Labor pledges $22m to establish Northern Australia’s first eco-industrial precinct

Federal Labor has promised to allocate $22 million to help establish the Lansdown Eco-Industrial Precinct being developed in northern Queensland if it wins the election in May.

World’s biggest solar-plus-battery project gets $210m funding boost

Sun Cable’s ambitious plans to build the world’s largest solar PV and battery energy storage project in Australia’s remote far north are a step closer to fruition after two of the nation’s richest men provided their backing for a $210 million capital raise.

Behind Taylor’s ‘weird’ decision that sparked Australia’s carbon credit drama

Over the weekend, Angus Taylor effectively handed over billions to carbon credit aggregation companies born of the increased price of Australia’s carbon credits – without any clear reasoning. This “weird” decision, as Bruce Mountain called it, stumped many but the Australia Institute told pv magazine Australia it’s just one of many moves the Morrison government has made to increase the supply of carbon credits and depress their price – a strategy which seems curiously misaligned with the scheme’s stated purpose of reducing emissions.

Battery prices won’t fall until 2024: IHS Markit

The London-based analyst has published a series of clean tech predictions for the year which also highlighted the rising proportion of sub-5MW solar projects in the global market, and cheaper clean energy financing costs even as panel prices continue to rise.

$125 million fund for innovative Australian–German green hydrogen projects opens

A joint fund with roughly $125 million from both the Australian and German governments has opened today and is seeking applications from projects across the value chain of renewable green hydrogen.

Floating solar, battery manufacturing co-op among nine projects funded in coal country Victoria

The Victorian government will fund a floating solar project, an initiative to locally manufacture solar batteries, and install a portable renewable energy system for community services during emergencies as part of its Latrobe Valley program.

Australian-led consortium acquires French solar company with 15GW under development

A consortium led by Australian financial group Macquarie Asset Management will acquire French solar developer Reden Solar. The $3.7 billion (€2.5 billion) transaction is expected to be finalised in the third quarter of this year.

EV battery manufacturer demonstrates 1200km range, raises $88 million

The US battery manufacturer Our Next Energy (ONE) has said it will use the funding led by BMW to accelerate its R&D and build a US manufacturing facility.

Cannon-Brooks puts ‘pens down’ after AGL shuns revised takeover bid

Australian energy major AGL has rejected a second buyout offer from a consortium including software billionaire Mike Cannon-Brookes and Canada’s Brookfield Asset Management, saying it continued to undervalue the power producer.

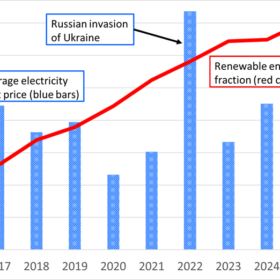

Solving the EPC equation for utility-scale solar developments

We are living through uncertain times. Despite the urgency of the energy transition and the substantial and growing opportunities for new utility-scale (and larger) renewables developments, risks arise for owners, developers, lenders, investors and contractors.