Analyst expects ‘unprecedented’ consolidation of Chinese solar industry

Private PV manufacturers and project developers alike are set to be squeezed out by the state in the world’s biggest solar market, according to Frank Haugwitz, who has compiled a wide-ranging report as preparations for the next five-year plan gather pace.

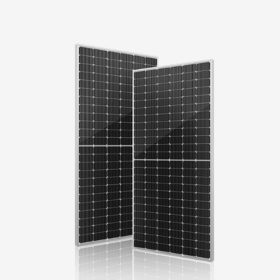

Seraphim signs module supply agreement in Australia

Chinese solar manufacturer Seraphim has strengthened its local distribution network in Australia on the back of a 50 MW high-efficiency solar modules supply deal with Raystech Group.

Solar could hold advantage in post-pandemic global energy sector

The International Energy Agency has acknowledged dramatic falls in energy investment caused by the Covid-19 crisis but said renewables, including PV, offered an attractive proposition to investors as the dust settled, given their enticing economics and short turnaround times.

Canadian Solar sees turnover and profits surge

The Chinese-Canadian solar manufacturer reported a 41% year-over-year increase in total module shipments to 2.2 GW in the first quarter. Revenue grew by 70% to $826 million, while net profit improved significantly from $17.2 million to $110.6 million.

FuturaSun enters Australian PV market

Italian-headquartered module manufacturer FuturaSun has completed accrediting its module range with the Clean Energy Council.

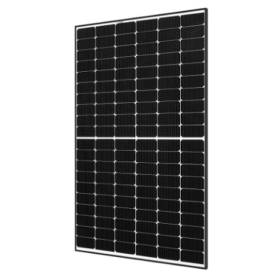

Jinko launches PV module with record output of 580 W

The panel is part of the company’s new Tiger Pro series, which includes two 530 W modules and a 430 W product for distributed-generation applications. It will begin production of the series in the fourth quarter, although it will start accepting first orders immediately.

REC Group confirms patent action against Hanwha in China

The solar manufacturer with manufacturing in Singapore has filed a claim against its Korean competitor relating to REC’s split-cell and junction box technology.

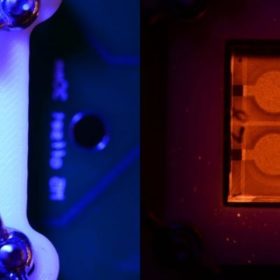

Shine! You’re on photoluminescence camera!

Researchers in Australia and China used intensity-modulated photoluminescence to map the series resistance of perovskite solar cells with a technique which could further understanding of the causes of instability issues in such devices.

Growatt awarded Top Brand PV Seal in Australia

Before Growatt won the Top Brand PV Seal award, back when “quarantine” was a foreign concept and foreign lands familiar, pv magazine took its annual China Road Trip to Shenzen to visit Growatt and learn about the company supplying solutions to 10% of Australian residential PV installs.

Covid-19 and dependence on China’s PV supply chain

The Asian Development Bank says developing countries in Asia and the Pacific should consider developing their own solar industry supply chains as the Covid-19 pandemic has exposed their over-reliance on China to carry through the energy transition.