Solar energy collectors… grown from seeds!

Rice University engineers produced “near-perfect” 2D perovskite crystals for photovoltaic applications, grown from seeds.

Roll-out solar arrays installed in successful NASA spacewalk

The first new ISS Roll-Out Solar Array (iROSA) has been installed on the International Space Station.

‘Agrivoltaics can certainly be a viable and meaningful alternative to large-scale solar’

US expert in environmental and energy policy Alexis Pascaris spoke with pv magazine about opportunities and barriers associated with agrivoltaics. Agrivoltaics are a very practical and advantageous alternative to large-scale solar, specifically in places where there are land-use constraints or needs for rural economic development, she explains. Differences in costs related to ground-mounted solar can typically be attributed to the raised racking systems or additional fencing, but these upfront investments in specialised hardware are eventually recovered as agrivoltaic systems produce dual-revenue streams.

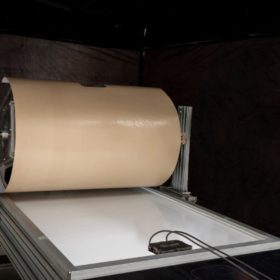

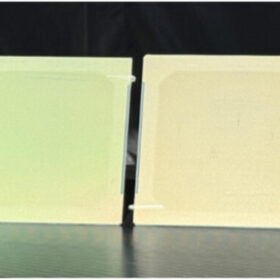

A repair tape for cracked backsheets

Backsheet failures have plagued the industry, causing hefty financial burdens to many asset owners. DuPont has launched a product it says allows for easy repair of modules.

Computational model for agrivoltaics

A U.S. scientist has developed a computational framework that assesses how well a hypothetical agrivoltaic project would perform in achieving desired outcomes such as the volume of PV electricity produced, and energy-to-agriculture. The method considers the high-frequency decomposition of solar irradiance into multiple rays and analyzes how these rays are propagated forward in time, to assess multiple reflections and absorption for various system configurations. It also takes into account panel inclination, panel refractive indices, sizes, shapes, heights, and albedo.

Cleaning solar modules with sand and wind, on Mars

NASA scientists have partially cleaned up the solar modules of the Insight lander operating on Mars, by using grain sands collected nearby and trickling them on the panels during the windiest time of the day. This handmade technique has made it possible, according to them, to increase the PV array’s yield of about 30 watt-hours of energy per ‘sol,’ or Martian day.

Software can reimagine breakthrough battery tech to power the electric future

By understanding the challenges that impacted the solar industry, battery material manufacturers will be better equipped to scale next-generation technologies from the lab to have a real-world impact.

Portable solar carport designed by student wins Genius award

Dubbed Gismo Power, the appliance is entirely mobile, can be grid-connected, and may be folded for storage.

Are oil and gas companies on the run?

Private sector fossil fuel spending on exploration is drying up just as modest rises in clean energy investments are being observed. With stock market investors increasingly embracing renewables, the IEA has observed positive signals in its latest energy investment report, but warned we are still doing far too little to keep global heating at bay.

5B’s modular expansion plans boosted by bigwig investment

5B, the Sydney-based modular solar manufacturer has successfully completed its most recent $12 million funding round, and along with the continued support of existing investors, the clean technology company also received investment support from former Australian Prime Minister Malcolm Turnbull and Smart Energy Council Director Simon Holmes à Court.