Major economies should divert fossil fuel Covid-recovery cash to clean energy before it’s too late

A report by Finnish company Wärtsilä has estimated the potential impact if every dollar committed to a non-renewables energy sector recovery was instead funnelled to clean power.

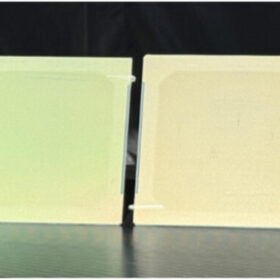

Hanwha Q-Cells moves to enforce recall of products found to infringe IP in Germany

The Korean manufacturer has announced that it wants to enforce the recall of products made by rivals Jinko Solar, Longi Solar and REC Group that were deemed by the regional court of Düsseldorf in June to have infringed a passivation technology patent. The recall applies to products sold since January last year in Germany.

‘Solar is the new king of energy markets’

The advance of PV has been lauded by the International Energy Agency as it launched the latest edition of a flagship World Energy Outlook 2020 report overshadowed by the Covid-19 crisis and uncertainty over how long the economic recovery could take.

Nobel Prize-winning auction geniuses want to apply their findings to renewables

Stanford professors Paul R. Milgrom and Robert B. Wilson were awarded the 2020 Nobel Prize in economics for developing a new auction theory and new auction formats for goods and services. Their findings were already successfully used in the electricity energy sector and may now meet the challenge on how to better shape clean energy procurements.

Trump pulls tariff exemption for bifacial panels – again

The U.S. president issued a proclamation on Oct. 10 that cites the impact of imported bifacial panels on U.S. solar manufacturing, while also raising the scheduled fourth-year tariff rate from 15% to 18%.

Islands on the horizon of hope: Canopy Power’s solar microgrid helps another island toward a sustainable future

Singapore-based solar plus storage microgrid expert Canopy Power has helped the Batu Batu resort on Malaysia’s Tengah Island reduce its dependence on diesel fuel through the installation of an integrated system which will cover a quarter of its energy needs.

Agrivoltaic project with vertically mounted bifacial panels goes online in Germany

German developer Next2Sun has completed a 4.1 MW solar plant built with roughly 11,000 bifacial panels provided by Chinese manufacturer Jolywood.

Another bumper year sees green bonds push through $1tn mark

Sustainability-linked debt financing is experiencing ever increasing popularity and the success of green bonds has driven other products linked to social performance and other sustainability criteria. The total volume of such investments to date passed the $2 trillion point this year.

World’s largest solar plant goes online in China

Huanghe Hydropower Development has connected a 2.2 GW solar plant to the grid in the desert in China’s remote Qinghai province. The project is backed by 202.8 MW/MWh of storage.

IRENA presents $2tn plan to drive 5.5m renewables jobs by 2023

Doubling down on renewable energy investment and energy transition spending is required to ensure a truly green global recovery from the Covid-19 crisis and its economic aftershock, claims the International Renewable Energy Agency.