Trafigura to develop 2 GW of renewables though partnership with Australian investment group IFM

Oil and metals trader will join forces with Australian investment group IFM to launch the new entity, which will develop solar, wind and energy storage projects – some of them supplying clean energy to Trafigura operations – as well as making acquisitions.

WoodMac: Tesla Battery Day 2020: Too good to be true?

Like most Tesla events, speculation and hype were at all-time highs after CEO Elon Musk hinted that something “very insane” would be revealed. He was not far off! Tesla detailed a completely new cell, along with plans to improve manufacturing, costs and shrink the battery supply chain. With such bold claims come many questions.

Chinese PV industry headed toward grid parity

Project delays and price changes due to fluctuating demand are disrupting the Chinese solar market. Researchers who have analysed the situation claim that the nation’s PV industry will be back on track toward grid parity by the end of the year.

‘Nuclear power is now the most expensive form of generation, except for gas peaking plants’

The latest edition of the World Nuclear Industry Status Report indicates the stagnation of the sector continues. Just 2.4 GW of new nuclear generation capacity came online last year, compared to 98 GW of solar. The world’s operational nuclear power capacity had declined by 2.1%, to 362 GW, at the end of June.

Best membrane for vanadium redox flow batteries

A new research paper looks at the membranes used for applications in vanadium redox flow batteries. It outlines various membrane technologies and the obstacles to bringing batteries to mass production.

SNEC 2020 CEO Series, Shanghai – Interview with CEO of Ginlong Solis

As one of the most rapidly growing inverter manufacturers, Ginlong Solis went public and became listed on the Shenzhen Stock Exchange (SZSE) early last year. With the support from the capital market, Ginlong Solis continued its rapid growth. According to Wood Mackenzie, the company ranked among the top ten inverter manufacturers in terms of global product shipments in 2019. How has Ginlong Solis developed its market strategy? What new products and solutions is Ginlong Solis showcasing at SNEC 2020 in Shanghai? And how is the company dealing with the impact from the COVID-19 pandemic? These issues are addressed in the following interview with Wang Yiming, the founder and CEO of Ginlong Solis.

Thin-film agrivoltaic solar tubes

German tech company Tube Solar AG has secured €10.8 million to develop its cylindrical agrivoltaic modules. The lightweight devices could also be used on roofs until now considered unsuitable for PV.

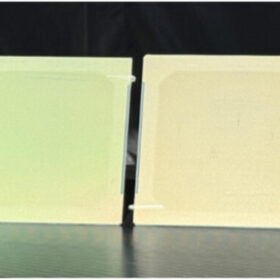

Long read: Time is now for HJT

There’s nothing new under the sun, and this is ever so in PV. So it should come as no surprise that the hottest new cell technology has actually been in mass production for decades. But is now the time for heterojunction to move into the mainstream? There are serious challenges to overcome if so, but momentum is undoubtedly building.

Tesla battery day bingo

Tesla battery day is next week. Earlier this year, Elon Musk told analysts that what he had to say “will blow your mind. It blows my mind.” Here’s a list of battery hyperbole and terms you’re bound to hear at the event.

Heating up the heterojunction-LID discussion

Scientists led by the University of New South Wales have looked into the long-term degradation of silicon-heterojunction. Their findings suggest that illumination at high temperatures could actually improve cell efficiency, but also risks activating multiple light-induced degradation mechanisms if not carefully controlled.