Boulevard of broken plants: Can NSW reserves handle non-green days?

It’s been easy to get caught up in all the news from the Victoria and Queensland governments proposing record-setting funding and environmental targets by 2030 and 2035, along with the news of AGL bringing forward the closure of Loy Yang A.

Australia’s energy prices set to remain high until 2026

In a bit more bad news for everyone already struggling with the current energy crisis, modelling from Cornwall Insight Australia forecasts that prices will remain at increasingly high levels for the next three years, after which they will flatten but are not likely to lose their volatility in the longer term.

Recent events push NEM turnover to new heights

The story of recent times in Australia’s National Electricity Market has been the significant escalation of wholesale price outcomes in the market.

Do network operators dream of electric vehicles?

With more models entering the Australian car market and high prices at the bowser, electric vehicles are garnering more attention from both cost-aware and environmentally conscious consumers alike.

Queensland coal trips boosting solar’s sunset revenue

Increased demand and continual outages at gas and coal power plants in Queensland have seen a rise in the occurrence of extreme price spikes. The timing of these spikes, typically at peak hours between 5pm and 8pm, are seeing solar revenues soar just as the sun is setting.

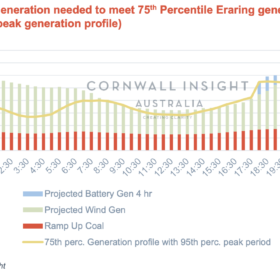

“I’m an All-Pro [coal plant]… You’ll never be more than a replacement player!”

The potential early retirement of Eraring has been the talk of the market the past week. Many of our customers have been asking what the impacts of the retirement might be on the acceleration or development of new renewable capacity in NSW and potential storage projects. In this Chart of the week, we look at the effect of the lost generation from Eraring and how that capacity might be filled.

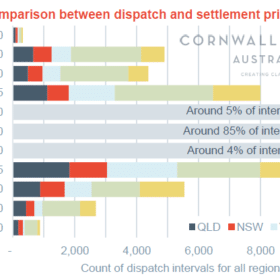

Don’t look back in anger: are peaking assets taking advantage of 5-minute price spikes?

Building on our previous Chart of the week in October, where we reviewed the first couple of weeks of 5-minute settlement, we wanted to revisit this topic. Now two months in, we take another look and see how well the fastest responding assets in the NEM are capturing the best prices in the 5-minute market.

Australia’s battery pipeline charges to over 26 GW, says new research

Less than a year ago and energy market analysts Cornwall Insight Australia projected a battery energy storage pipeline of 7 GW. This week the firm has updated its outlook and puts Australia’s current pipeline of proposed projects at over 26 GW. What is more, the technical lifetime of these assets is increasing too.

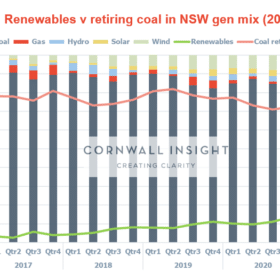

Energy is neither created nor destroyed; it just transitions

Last November, the NSW government announced its Electricity Infrastructure Roadmap which is expected to attract up to $32 billion in private investment for renewable energy infrastructure by 2030. The Roadmap aims to unlock 12GW of new renewable energy capacity from selected Renewable Energy Zones (REZs) with an additional 2GW in storage. Last month, the state government progressed its plans as it opened consultations on “specific urgent and mechanical policy details” on regulations needed to implement the Roadmap.

5MS is coming but it still remains a known unknown

The shift from 30-minute settlement to 5-minute settlement (5MS) is fast approaching – 162 days away but who’s counting.