There are a few ways to examine the lost capacity. The most interesting is not that the market will lose ~2GW of generation capacity over the evening peak, but that NSW is going to lose ~848MW of ramping capacity from Eraring (Liddell runs mostly flat, so its ramping loss is only ~88MW). Currently, NSW coal generators ramp up ~2GW of generation from their midday lows at ~12/1pm to the evening peak at ~6/7pm.

Eraring currently accounts for 42% of this ramp. If the other coal generators – Bayswater, Vales Point, and Mount Piper – take on most, if not all, of the ramping responsibility, this will push these units above 87% capacity on average over the evening peak (where they are currently only averaging ~68%) pushing these units close to the edge of their operational limits. Assuming each of those would be available for up to 90% of their nameplate during the evening peak, there is enough spare coal capacity to cover Eraring’s average generation loss. But to cover Eraring’s 95th percentile of generation over the evening peak (over the 5:30pm-11pm period), coal alone would be insufficient where an additional 122-513MW of capacity would be needed. Tallawarra and Tumut are the only dispatchable units that could shoulder this ramping responsibility but need to see higher prices over the should periods to incentivise additional generation. The squeeze over the ramping period is not only going to put a strain on coal generators to ramp more heavily, but it is likely to create a squeeze in raise regulation FCAS markets, which is heavily linked to energy prices and the availability of ramping capacity.

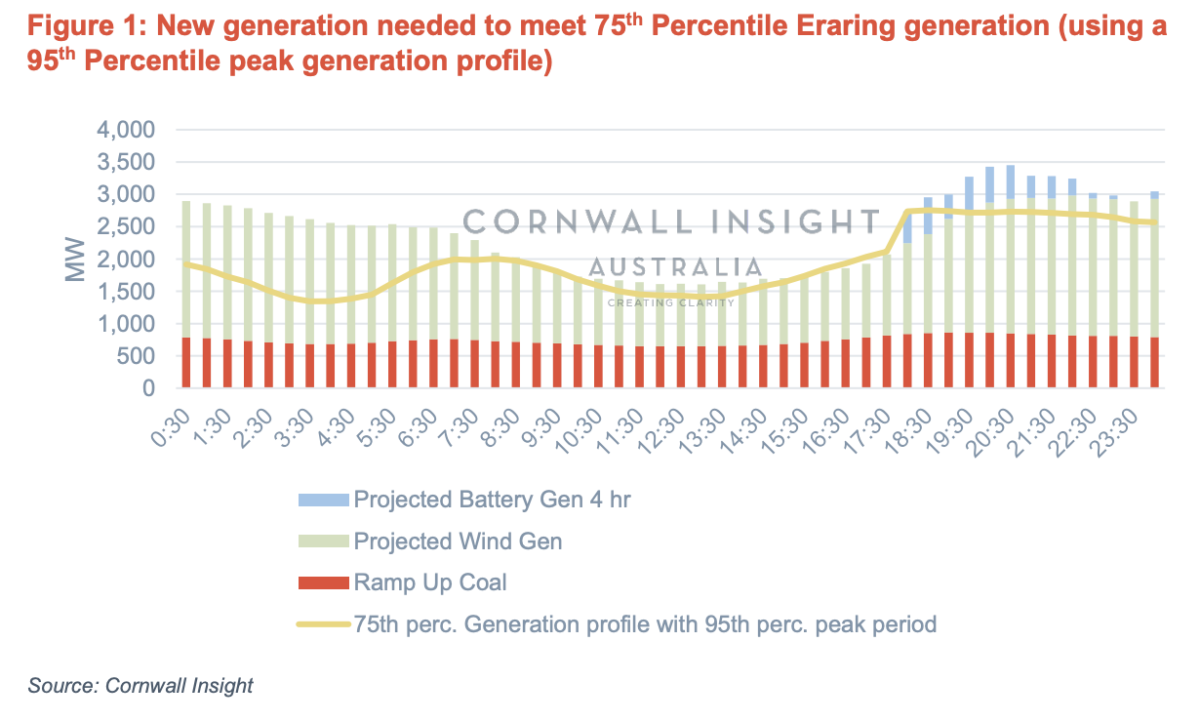

So, assuming that the whole generation loss is not covered by coal alone and that coal only ramps up an additional 20% of its current generation, new capacity will be needed to fill the generation gap. Interestingly, the wind profile in northern NSW Tablelands follows a very similar profile to the current Eraring coal generation profile. Admittedly the REZ is unlikely to have the needed increase in hosting capacity in time, but this may be the impetus needed to push this development more quickly, especially since this transmission augmentation is now an Actionable ISP Project.

Two different mechanisms could be used for estimating the required capacity buildout needed to cover Eraring’s exit: (1) pure least cost of technologies to satisfy the generation profile; or (2) the maximum profit (i.e. market efficient) of the technologies to satisfy the profile.

We would only need around 230MW of solar and 3,714MW of wind on a least-cost basis. Based on our current forecast build-out, this would mean no accelerated or additional development of solar (as the current forecast build is sufficient), but an additional (or accelerated development) of 2,850MW of wind would be needed. To satisfy a 75th of Eraring generation profile, it would require an additional 450MW of solar and 3,090MW of wind.

On a profit basis, to satisfy a 75th percentile Eraring profile, we wouldn’t need additional solar (as only 319MW would be required), but an additional ~3,196MW of wind would be needed. The need for storage is only seen when we need to cover a 95th percentile Eraring generation profile. In the 95th percentile case, we could expect an additional 4,055 of wind, which leaves us ~395MW short of the required capacity over the evening peak (If we assume a wind profile more akin to the Southern Tablelands rather than the Northern Tablelands, the wind needed is 3,897MW and short capacity is only 189MW). From our storage model, we have an indicative storage profile for the evening peaks, which suggests that if storage was used to satisfy those peaks, then an additional ~737MW of storage would be needed to cover that gap (which is not too far off the capacity of the 700MW battery proposed for the Eraring site) on the Southern Tablelands profile only 353MW of storage would be needed. However, given the commitment of the 660MW Kurri Kurri gas plant, this may easily be covered by this peaking asset in the future. In reality, these 95th percentile generation events are due to uncommon contingency events, so if we were only to plan for covering generation at a 75th percentile of Eraring generation but meeting a 95th percentile peak with storage, this number is far larger and closer to 1,112MW of storage.

Either way, it appears there is a significant need for further wind generation in the next few years and potentially some additional storage to assist in covering the evening peaks, however with the federal government stepping into the market with Kurri Kurri and the NSW proposing a 700MW battery the potential shortfall over the peak could be well and truly covered.

The full impacts of Eraring’s exit on pricing and the NEM’s capacity build-out will be outlined in our Benchmark Power Curve release in the coming months.

Author: Ben Cerini, Principal Consultant at Cornwall Insight Australia

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The problem is not peak demand, gas, coal, hydro, more wind and solar and batteries will handle that. The problem is two weeks in winter when wind and solar output is half the annual average