While the unknowns far outweigh the knowns, the renewables sector in WA has been left high and dry under the Turnbull government’s NEG. Explicitly excluded from the NEG, the WA Labor Government may introduce a state-based RET or tender program, to incentivize large scale renewable deployment in the state.

Some WA industry participants are beginning to fret. Perth-based solar distributor Baywa r.e. Australia Managing Director Durmus Yildiz has told the ABC solar is not at the level of competitiveness that the government has assumed when it designed the NEG policy.

“[There is] uncertainty for us as an industry to get the renewable energy subsidies or support systems cut in such a quick fashion,” Yildiz told the ABC.

“We might actually see that it gets even harder for Western Australians on the solar side,” Yildiz added.

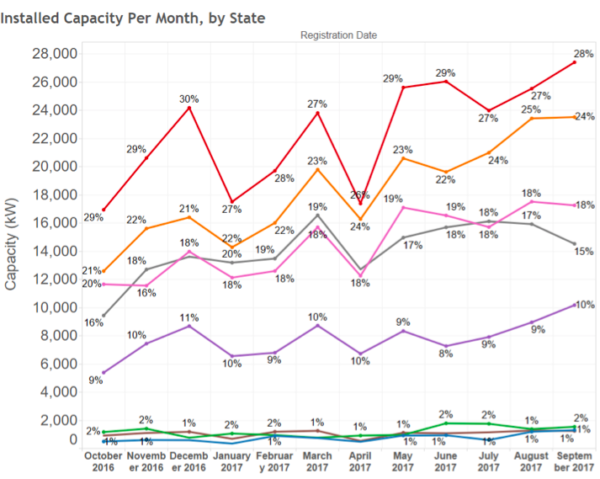

Market data appears to confirm that the WA PV market may not be as rosy as the strongly performing east coast. Data compiled by SunWiz reveals that while WA (indicated below in grey) accounted for as much as 20% of national rooftop demand, based on REC registrations, in January 2017, by September that had fallen to 15%. The leading states are Queensland (in red), New South Wales (in yellow), and Victoria (in pink).

The share of the commercial (C&I) market segment is also falling in WA, while on the east coast the market segment is one of the outstanding good news stories from PV in 2017. C&I market share has increased in Australia overall from 10% to 25% in the last 12 – 18 months.

In terms of large scale solar in WA, there are a number of developments underway. While not coming close to approaching the scale of the development in Queensland, momentum had been beginning to build in the WA large scale marketplace.

The 20 MW Emu Downs project is set to be completed by January 2018, and has signed a PPA with WA utility Synergy. The state-owned utility has also unveiled plans to expand Australia’s first PV power plant in Greenough River in WA’s mid-west from 10 MW up to 40 MW. WA wave power developer Carnegie is working on its 10 MW Northam project. And the 39 MW Byford Solar on Perth’s outskirts is set to be complete in early 2018, and has signed a PPA with gas provider Kleenheat.

However, with no RET beyond 2020 and excluded from the NEG, the WA government may choose to take the initiative in fostering the continued rollout of solar and wind in the state.

WA State Treasurer and Energy Minister Ben Wyatt has indicated that he would prefer the state being a part of a national program, but he has not ruled out taking action rather than standing by to see projects get off the ground ‘over east.’

“Ultimately my preference is always to break to a national model, I don’t think individual state models are as efficient and as effective for private sector investment as a national model,” Wyatt told the ABC.

WA’s South West Interconnected Network is supplied by a significant amount of power from the coal-fired Muja facility in the coal mining town of Collie. However, there is gas-fired generation also in place, and with WA maintaining a reservation policy for some of its natural gas reserves, the state has not seen some of the price spikes experienced on the National Energy Market.

The life of Muja itself cannot be extended indefinitely, however. In September, the government announced that the 52-year old Muja AB plant would be closed, after a $300 million attempt to revive the facility finally failed.

“The $300 million of taxpayers money was wasted on this project,” said Wyatt when announcing the decision to close Muja AB in the face of safety concerns. “Muja AB will be remembered as the embodiment of the previous government’s lack of respect for the taxpayers of WA.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.