While former energy and environment minister and current treasurer Josh Frydenberg was no dreamboat when it came to supporting renewables, Angus Taylor is being viewed unfavourably by observers far and wide. In its latest Renewable energy country attractiveness index (RECAI), Ernst & Young (EY) notes that Taylor has attracted the label as being “the most anti-renewables politician yet” as Australia slipped one place in the index.

EY notes that Taylor has taken control of the national energy portfolio, “amid political upheaval and an uncertain renewables environment in the country.” And while he has committed to the Small-scale Renewables Scheme (SRES) as it stands, his efforts thus far in the portfolio have done little to encourage investors.

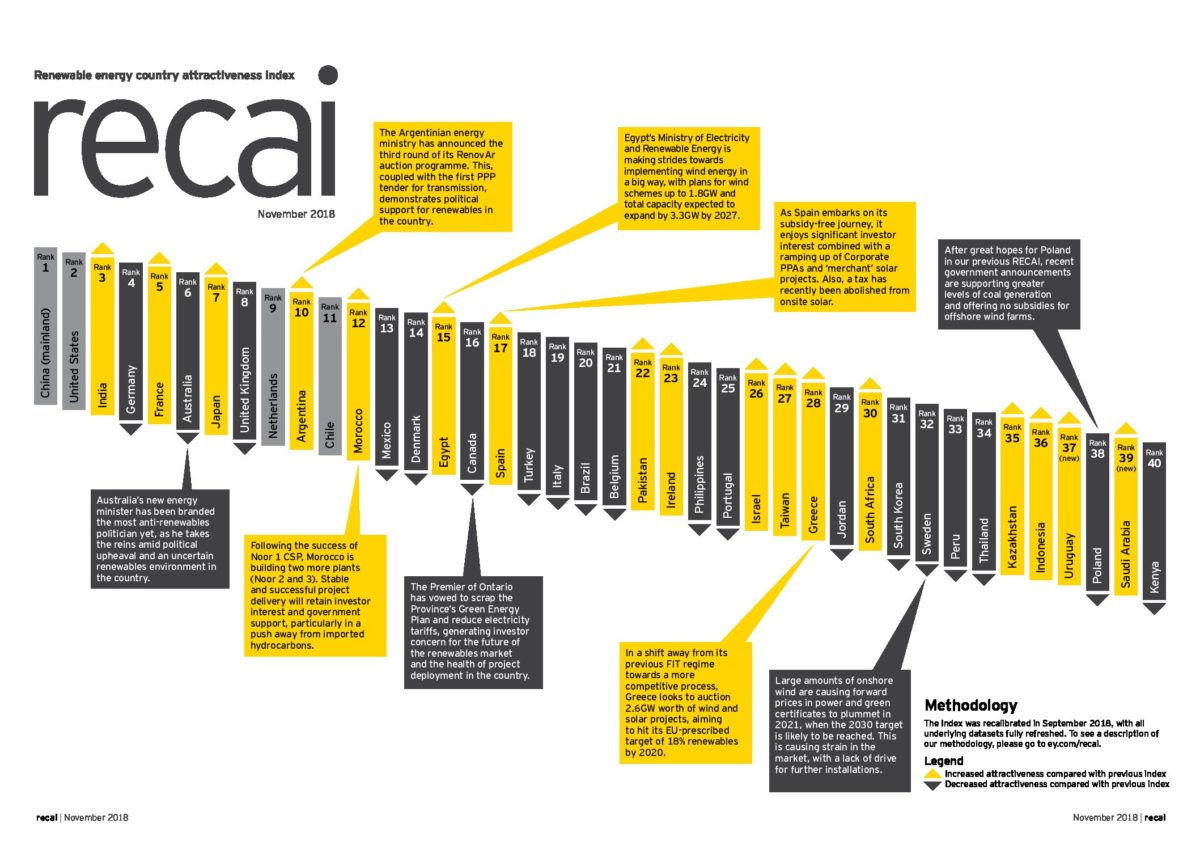

Australia’s sixth place ranking on the index, with a RECAI score of 62.3, comes behind China with 65.7, the United States (63.8), India (63.8), Germany (62.7) and France (62.5). Rounding out the top 10 were Japan (59.2), the United Kingdom (58.6) and the Netherlands (58.6).

“An uncertain political climate – particularly the continuing trade disputes between the U.S. and China, among others – compounded by the increasing scarcity of subsidies, presents a challenging backdrop to the maturity of the renewables sector,” said EY’s Ben Warren, RECAI chief editor in a statement. “However, oversupply will provide a short- to medium-term boost to the price competitiveness of renewables, and is also likely to drive some consolidation upstream.”

While Australia’s ongoing support for solar PV, presumably driven by legacy Renewable Energy Target projects and the SRES, came in at 54 – behind only India in the among the top 10 – its support of offshore wind registered a score of only 30, although onshore faired a little better with 47.

EY sees increasing electricity demand in mature renewables markets, as electric mobility grows, as a pull factor for investment, it notes that the transformation of the transportation sector also brings with it “considerable uncertainty”.

“The promise of an all-electric future presents new opportunities and challenges, particularly in relation to charging infrastructure,” added Warren – who also heads up EY’s Global Power & Utilities Corporate Finance unit. “Investors are responding to the risk that over-investment could lead to heavy losses if utilization falls short of expectations – or if the market changes direction, leaving investments stranded. Those players who take steps to mitigate the risks and test the value hypothesis of new business models, will gain a competitive edge.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.