Factoring in the rapidly falling cost of batteries, which are getting much cheaper than it forecast last year, Bloomberg New Energy Finance (BNEF) has revised its outlook of the global energy storage uptake over the coming decades.

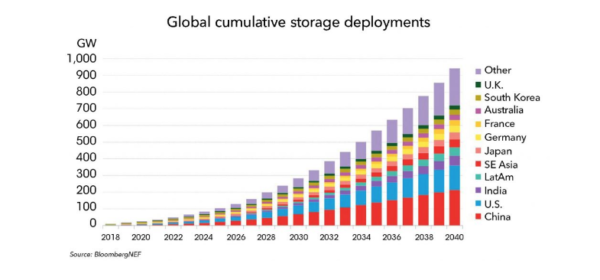

In its latest Long-Term Energy Storage Outlook, BNEF forecasts the global energy storage market will grow to a cumulative 942GW/2,857GWh by 2040, attracting $1.66 trillion in investment over the next 22 years.

On top of steep decline in battery prices seen earlier this decade, BNEF sees the capital cost of a utility-scale lithium-ion battery storage system sliding another 52% between 2018 and 2030.

“We have become much more bullish about storage deployments since our last forecast a year ago. This is partly due to faster-than-expected falls in storage system costs, and partly to a greater focus on two emerging applications for the technology – electric vehicle charging, and energy access in remote regions,” said Yayoi Sekine, energy storage analyst for BloombergNEF and co-author of the report.

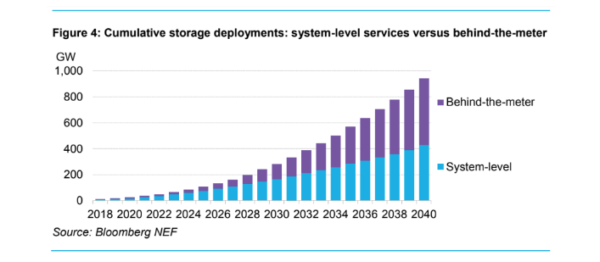

The case for behind-the meter batteries is forecast to grow from strength to strength, with a variety of benefits they bring, such as shifting grid demand in order to reduce electricity costs, storing excess rooftop solar output, improving power quality and reliability, and earning fees for helping to smooth voltage on the grid.

But, all until the mid-2030s, the energy storage market will be dominated by big batteries.

“We see energy storage growing to a point where it is equivalent to 7% of the total installed power capacity globally in 2040. The majority of storage capacity will be utility-scale until the mid-2030s, when behind the meter applications overtake,” said Logan Goldie-Scot, head of energy storage at BNEF.

Leading markets

Nine markets will account for two thirds of the installed capacity by 2040, BNEF says. These are: China, the U.S., India, Japan, Germany, France, Australia, South Korea and the U.K

“In the near-term, South Korea will dominate the market, the U.S. will take over in the early 2020s, but will be overtaken by China in the 2020s. China will then lead throughout to 2040,” BNEF says.

Developing countries in Africa are also forecast to see rapid growth in battery storage driven by off-grid applications. Utilities are likely to “recognize increasingly that isolated assets combining solar, diesel and batteries are cheaper in far flung sites than either an extension of the main grid or a fossil-only generator,” the report says.

Overall, demand for batteries for stationary storage will account for 7% of total battery demand in 2040 and be dwarfed by the growth of batteries in powering electric vehicles.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.