“There are conflicting opinions about 2019, and that’s why we brought this panel in today,” said Gero Farruggio, head of Australian operations for Rystad Energy. The global market analysts track projects, project timelines and technical, commercial and economic information on each asset in the Australian renewable ecosystem.

“We speak to everyone across the sector,” said Farruggio at an event held in the afternoon light of a fiercely setting sun in Sydney’s Barangaroo quarter, “and we hear some people are really looking forward to 2019, while others are really concerned by the outlook”.

David Dixon covers the Australian renewables market for Rystad, working in tandem with his colleague Minh Khoi Le who tracks renewables activity in Southeast Asia.

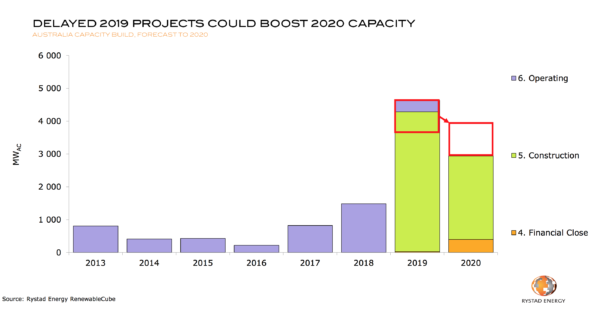

Says Dixon, “2019 is going to be a huge year for the renewable energy industry in Australia. We’re tracking approximately 4.5 GW of solar, wind and storage to come online in 2019. Half is wind, half solar and there’s a little bit of storage.”

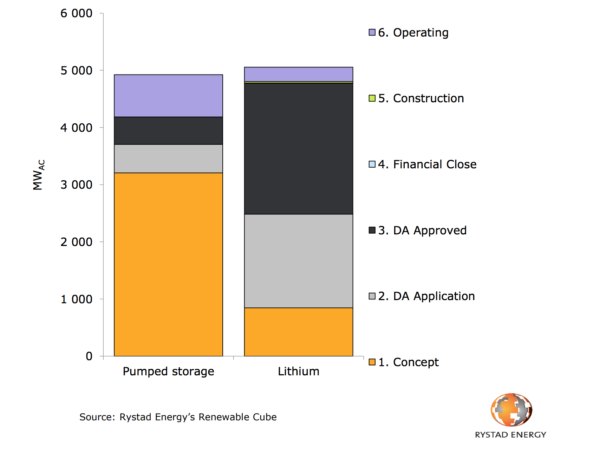

He anticipates what the company is calling the Storage Wars: “The battle for dispatchability to complement renewables.”

Graph: Rystad Energy

And Dixon points out that a significant part of the solar pipeline into 2019 will be comprised of “slippage” of projects scheduled for the previous year, but which did not reach completion as scheduled, whether they were temporarily suspended because of the collapse of engineering, procurement and construction (EPC) company RCR Tomlinson, or held up due to changes in grid-connection rules that forced the redesign of some projects.

In 2020, despite a forecast a dip in added capacity Rystad Energy is expecting a significant year: “We’re talking about 3 GW of potential PV, wind and storage coming online, again roughly 50:50, solar and wind.” 2020 will again ride on the back of slippage of some of the projects scheduled for the year before.

Graph: Rystad Energy

“What happens in the first half of 2019 is critical for determining what 2020 will look like. And unfortunately we are in the eye of the storm of the new grid-connection standards, political uncertainty particularly in NSW with two elections coming up, and whether or not we’ve seen the full extent of the fallout on some of the EPCs,” says Dixon.

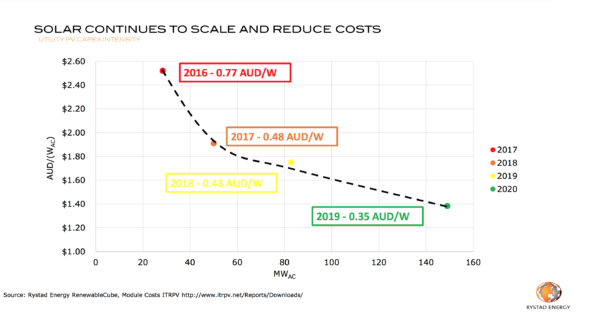

Some of the solar trends Rystad is tracking in its database include “a mammoth decline” in costs in the PV industry over a short period of time

Graph: Rystad Energy

“One aspect of this is panel cost,” says Dixon, “but that doesn’t fully explain the cost reductions you see here. Panel efficiencies are improving and this affects the whole value chain in terms of the amount of hardware that you need. Associated with this is also the amount of installation money required.”

When Farruggio handed over to the panel of solar market participants, he asked them to describe in a nutshell what they expect from the coming 12 months:

Wayne Gagel, Senior Analyst, Infrastructure & Utilities at Westpac Institutional Bank

“In 2018, changing rules meant that lots of projects were delayed. My impression is the engineering community knew very well how to build power projects. The rules changed, designs changed, and I think that’s the big thing we’ll probably take into 2019. Engineers are smart people, as soon as they have the rules that they need, they’ll make it happen. That’s going to be the biggest thing into 2019, is lots more people knowing how to design the connections, and maybe a little bit less stress from AEMO and the transmission companies about how these connections happen.

I think in Australia we landed on a formula early on that seemed to work very well in terms of getting bankable projects. To a certain degree, and this is a sign of immaturity, developers then thought, “OK, this is the formula, this is what works.” In 2018 we saw some of the flaws of fixed-time, fixed-cost contracts that put a lot of stress on the EPC contractor.

There is a lot of scope in Australia to look at different forms of EPC — things like different risk-sharing mechanisms — and I think they’ll come with maturity.”

Michael Corio, Sales Leader International Markets, Array Technologies, one of the leading manufacturers of single axis trackers

“2018 was a banner year from an equipment-supply perspective. We reached a milestone of about 1.7 GW deployed and a lot of that occurred in 2018. We continue to think that the next few years in Australia will be fantastic, due to the declining cost of solar.

2019 will be an exciting year. While we’ve seen the pace of projects getting to financial close has maybe slowed from the early days in this market, more larger scale projects are being proposed, so I think economies of scale are ramping up and could have an offsetting effect on the rate at which these projects take off.

From a technology tracking supply perspective, we’re looking at a lot more optimisation of designs on solar farms. We’re also seeing new module technologies; for example, bifacial modules are a big topic in the industry.

Currently Array Technologies is conducting a study with the National Renewable Energy Lab in the United States, to measure the real production gains of bifacial modules with different tracker configurations, heights off the ground and other variables. So we will continue to innovate.”

Robbin Russell, General Manager, Signal Energy, EPC provider

“2018 has been just a wild, exciting ride for us. It was quite a welcome to Australia. We found that our value proposition, to try to think like an owner, and to build a project the way the owner of the project would want it built and come alongside them, made for successful projects.

For 2019, we’re seeing more requests for bifacial technology, and obviously developers trying to drive EPC prices down lower and lower and lower, partly because when the developer gets hit with needing synchronous condensers or harmonic filters, it further drives that pressure to get EPC costs down as low as possible

We believe there are some opportunities to drive down prices. Part of that is helping the workforce to understand what it takes to build a solar farm. It’s also getting investors and equity comfortable with what we’re able to deliver on the back end, so that plants produce for a long time and they meet the requirements of the contract.”

Ryan Hauville, Regional Director, Phillip Riley, recruitment and executive search firm specialising in the renewable-energy industry

“2018 was dynamic, fast-moving, turbulent and exciting. From a recruitment and hiring point of view we saw a couple of major skill sets come into demand: grid connection/commissioning and PPA focused roles. These positions had really low candidate pools, so it was challenging to find those skills in the market.

The second thing I noted in comparison to 2016-17 was that salaries calmed a little bit. In early to mid 2017, there were only 10 operating solar farms in Australia. So, there was a really small pool of candidates to choose from and probably 20-30 solar construction projects on the way, and a lot of wind as well. The supply and demand there saw a huge spike in salaries. But those projects have created a critical mass of candidates and people who’ve seen projects through construction, so there’s probably a larger talent pool now to select from, and that salary spike, luckily for employers, has started to cool down a bit.

I think 2019 could see the entry of a few emerging pockets. We think hydrogen is getting a lot of attention at the moment. The off-grid market is getting close to being viable in Australia and has huge potential. And the utility-scale battery market is getting pretty exciting. Talking to the companies involved in that, they’re forecasting a big few years ahead, and 2019 will be the year that really starts to kick off.

The second major trend this year will be the emergence of asset-management roles, both financial and technical. There’s a lot of construction activity, a lot of projects are coming online and into operation. Again, Australia is a very new emerging market, and the talent pool that can point to real-life experience with operating assets is quite limited. That’s the first area where we expect a big influx of people from offshore and some visa sponsorships, to bridge the gap in local talent.”

Chris Wilson, Co-founder and Managing Director, Terrain Solar, solar farm developers

“I don’t remember getting much sleep in 2018. It was a hell of a year here in Australia for the market, particularly for developers, dominated by this three-letter acronym — NEG. Certainly that played its ups and downs in the market. But the silver lining was that we saw the corporate PPA space start to gain a lot of momentum

2019 is definitely shaping up to be a very big year. The big-ticket items are the election coming up and what that means for the market. And the biggest challenge coming through is very much grid connection. It used to be that offtake and PPAs were the number one constraint in the development space, but now it’s very much shifting into understanding grid connection and risks and the risk of delays and the costs associated with grid connection.

The Australian grid is unique, and Australia is world leading in the rules that are being introduced, the skill sets that are being developed to deal with constraints in the grid, and the modelling we’re doing. It’s certainly a big challenge, but there’s a lot of opportunity.

I think a lot of people when they hear the word AEMO, and they hear the words synchronous condenser, they think, ‘Here’s another added expense that we never really had to consider.’ But it’s about the laws of physics. There is only so much that a group of generators can generate at the same time when you have a limited resource like the grid. What more people are now starting to understand is that the nature of the constraints is not about who got there first. The nature of the constraints is that if there’s a fault, or if a tree blows over a line, it’s about who has the most influence on the constraint that is caused — it doesn’t matter if you are the first guy there or the last guy there.

In Australia we’ve kind of been a victim of our own success. We have been upsizing our projects significantly — 100 MW, 200 MW, 300 MW. We’re getting bigger because we’ve got the land, but we don’t necessarily have the grid to support all of that. It’s going to take a lot of smart engineers to come through and find intelligent ways to manage that. Putting in 50-year-old technology synchronous condensers is not the most economic or efficient way to do it, in my opinion.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.