Following 2018 final surrender, the Clean Energy Regulator (CER) has released data showing liable entities acquitted 24.3 million large-scale generation certificates (LGCs) for the 2018 assessment year against a total liability of 28.2 million LGCs, leaving a shortfall of 3.9 million LGCs or 13.9 per cent of total liability.

The 2018 surrender rate for LGCs of 86.1% represents a decrease on the 2017 rate of 93.3%, while the surrender rates for small-scale technology certificates remained unchanged at 99.9%.

Under the Renewable Energy Target (RET), liable entities – generally electricity retailers – are required to surrender a number of renewable energy certificates proportional to their energy acquisition for the calendar year.

However, with LGCs prices on a downward trajectory and the 33,000 GWh RET target at hand, some retailers are opting to pay a penalty and buy cheaper LGCs at a future date. While in 2017 ERM was harshly criticized for doing so, last October the CER approved carrying obligations forward as it became obvious that the RET would be clearly surpassed.

However, while carrying forward a shortfall of less than 10% does not result in a “penalty” charge, the energy retailers that do not surrender at least 90% of their liability are required to pay a $65 shortfall charge for each certificate not surrendered – a charge which is fully refundable.

With the LGCs prices on a steep downward trajectory, the deferral of liability has become increasingly popular among energy retailers. Being allowed to make up for the shortfall over the next three years, retailers are choosing to surrender LGCs at a later stage, which is likely to bring them fat profits.

The latest data show that some of the nation’s biggest retailers have chosen not to meet their renewable energy target obligations in 2018, including Alinta, which is carrying forward 100% of its obligations, Lumo Energy, Simply Energy – both of which with over 90% shortfall, and EnergyAustralia (37.74%), which sold its shortfall, about 700,000 LGCs, to other retailers.

LGCs prices

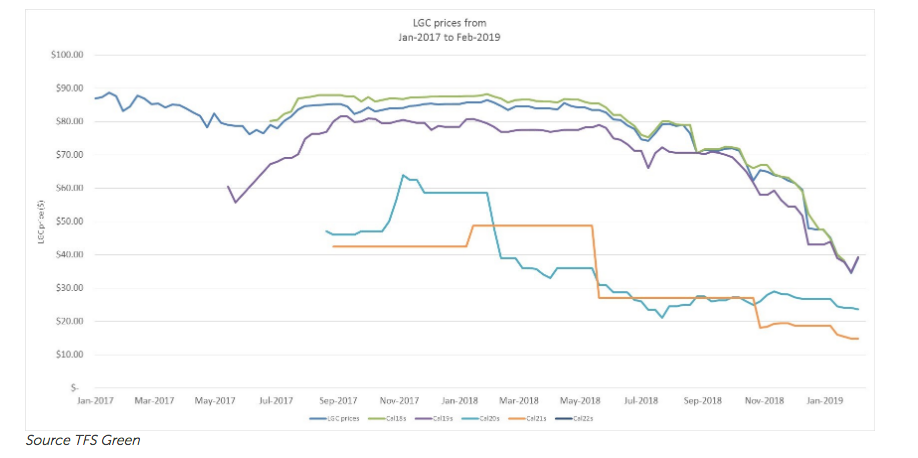

The latest data from CER shows that LGCs spot prices fell to $39 on 14 February 2019, while forward prices for 2020 and 2021 have also fallen and are at $23.60 and $14.75 respectively. This is a huge drop down from the LGC spot prices in the period from July 2016 to June 2018, when they consistently remained above $80.

As the pipeline of renewable energy projects continued to grow with a record 3455 MW accredited and switched on in 2018 placing a downward pressure on the prices, the LGCs value halved from June 2018 to December 2018 and reduced even further to $34.50 in early 2019 before rebounding slightly to $39 at the shortfall deadline.

While the drop in the LGCs value should be good news for consumers, major energy retailers have not passed this through to their customers, who are still paying the old RET costs through their electricity bills. But, according to the CER, this is expected to happen this year.

“Using the current spot price for LGCs and the Australian Energy Market Commission’s (AEMC) methodology on household pass-through costs, costs to electricity users should fall from an expected $44 to $33 in 2019,” the CER says.

According to the CER, 7.1 million LGCs remained in the market at the date of the final surrender, down from 9.4 million in 2017, while total consolidated revenue for paid shortfall stood at $458 million.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.