Highly ambitious private infrastructure developer Lyon Group has appointed Deloitte as voluntary administrator to one of its entities Lyon Infrastructure Investments 1 Pty Ltd, and two of that entity’s subsidiaries Lyon Solar Pty Ltd and Lyon Battery Storage Pty Ltd. The company says it has made the move in order to facilitate a recapitalization.

Noting that its other entities are unaffected, Lyon Group expects its large-scale “dispatchable solar peaker” projects to proceed unchanged. “The appointment of the voluntary administrators allows a pathway for development of Lyon’s tranche 1 fully integrated large dispatchable solar peaker projects to proceed to financial close,” Lyon said in a statement.

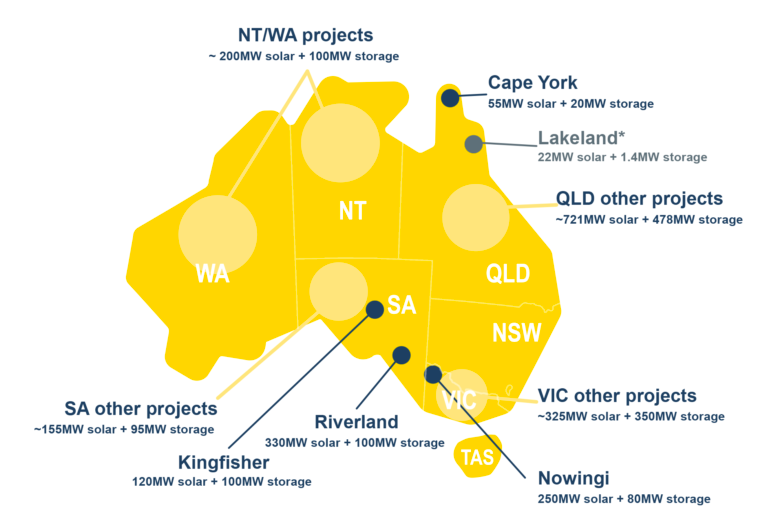

Originally slated to break ground in 2017, Lyon’s tranche 1 projects include: Cape York Solar Storage in Queensland with a solar PV capacity of 55 MW and 20 MW/80 MWh of battery storage; Nowingi Solar Storage in Victoria with a solar capacity of 250 MW and 80 MW/320 MWh; and Riverland Solar Storage with up to 330 MW of solar and 100 MW/400 MWh storage in South Australia – which, once constructed, could claim the title of the world’s largest solar+battery plant. To deliver the tranche 1 of its solar+storage projects, Lyon has partnered with Japanese energy giant JERA and battery technology provider Fluence.

Describing the $150 million Cape York Battery Power Plant as the first fully integrated grid-connected large dispatchable solar peaker in Australia boasting four hours of storage, the company reported in December the project had secured its generator performance standard, clearing the way for construction to begin in early 2019. In February, Lyon said its other two major projects (Riverland and Nowingi) are now progressing toward that milestone.

“Lyon’s tranche 1 projects have taken significant steps toward financial close over the past six months – in particular their connection and offtake arrangements – and continue to have the strong support of the project stakeholders including Lyon’s co-development partner JERA,” the company spokesperson told pv magazine, noting that the appointment of administrators is related to resolving the exit of one of Lyon’s investors – U.S.-based hedge fund Magnetar Capital.

In February, Magnetar Capital, a 25% investor in a Lyon subsidiary brought in two years earlier to support the developer’s ambitious plans, sought to wind up the group’s solar and storage units in a case before the Supreme Court of New South Wales. At the time, Lyon said it was negotiating the exit of Magnetar and looking to buy out the investor’s stake.

With the goal to roll out 1 GW of solar + 500 MWh of battery storage by 2020, Lyon entered into a partnership with Japan’s Mitsubishi Corp in 2016, a year before it welcomed Magnetar among its investors. Announcing the hedge fund’s first investment in the Australian solar sector, Lyon lauded Magnetar’s expertise in energy investment, noting that it had previously invested in 32 solar projects in the U.K. representing 344 MW.

The court case against Magnetar is the second legal battle for Lyon, after U.S. solar giant First Solar sought the winding up a Lyon Group unit over an unpaid loan in 2017. That dispute is now in confidential arbitration.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.