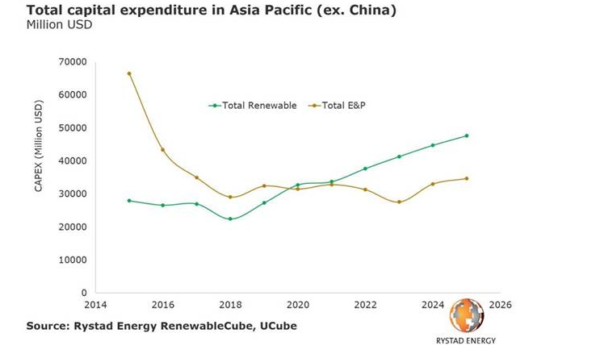

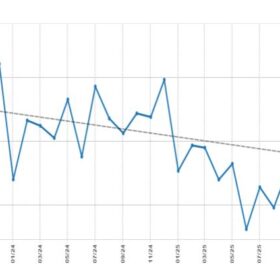

Oil and gas majors are increasingly investing in renewables in the face of mounting pressure from consumers, investors and regulators pushing for an energy transition. In the Asia-Pacific region outside China, renewable energy investment will overtake spending on upstream oil and gas projects as soon as next year, according to a report from Norwegian consultancy Rystad Energy.

By 2020, capital expenditure on renewables will surpass US$30 billion and leave fossil fuel exploration and production spending in its wake for the first time.

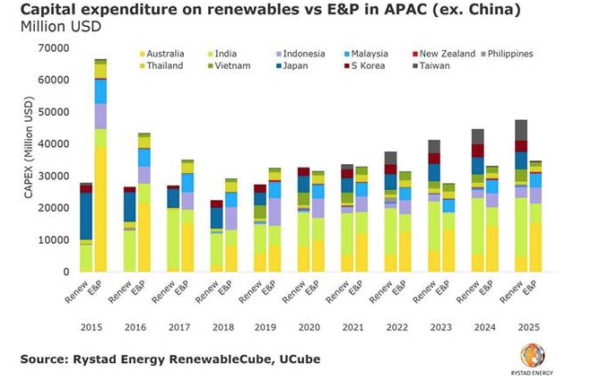

The trend will be driven by contributions from Australia and Asian countries, including India, Vietnam, Taiwan and South Korea.

“These countries each have strong pipelines for renewable energy developments of all types, including offshore wind,” says Gero Farruggio, Head of Renewables at Rystad Energy. “And, importantly, most have large targets outlining the inclusion of renewable power sources within their respective energy mixes, with corresponding support policies.”

Australian pipeline

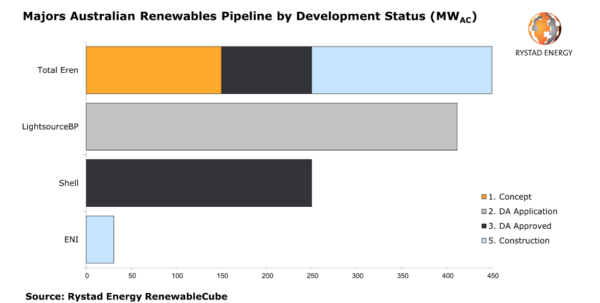

According to Rystad, the step change came with the emergence of oil and gas majors as investors. “By 2020 it is feasible that the majors will be the dominant renewable developers in Australia as they pursue ‘oil and gas’ scale opportunities. Commercial drivers are increasing the desire to ride the ‘solar-coaster’,” Farruggio said.

Although only 1% of the country’s solar, wind and utility storage projects is currently owned by oil majors, the consultancy forecasts upstream companies will be the dominant renewable developers in the year ahead.

“Upstream companies will lead the charge, building sizeable utility storage, solar and – ultimately – offshore wind portfolios. Solar panels, lithium ion batteries and turbines will soon be conventional segments of Australia’s oilfield services,” Farruggio added.

The pipeline is already taking shape across the country. For instance, Total Eren has launched construction on Victoria’s biggest solar farm, the 256.5 MW Kiamal Solar Farm and is looking to add a second stage with a generation capacity of up to 194 MW. On top of that, the renewables developer – which is 23% owned by French oil and gas major Total – is exploring commercial options for an approved 380 MWh of energy storage.

Multinational oil company Shell has secured approval for a 250 MW solar power plant in the Western Downs region of Queensland, and recently unveiled plans for a 120 MW utility scale PV array to supply its QGC onshore gas operations in the north of the state.

Enel Green Power Australia, a subsidiary of Italy’s energy giant, owns the 275 MW Bungala Solar Farm in joint venture with Dutch Infrastructure Fund. The project located near Port Augusta, South Australia, is one of the largest solar facilities in the country. Recently, Enel launched construction of the 34.2 MW Cohuna Solar Farm, one of the three solar projects allocated in the first Victorian renewable energy auction.

Diversifying its gas-focused portfolio Down Under, Italian oil group Eni entered the Australian renewables market earlier this year by acquiring the Northern Territory’s largest solar project – the 33.7 MWp Katherine Solar Farm, and the list goes on.

Rystad noted that Woodside and Santos were absent from the chart above – released in April – but both are making strides in the sector. While Woodside is focusing on battery storage replacing spinning reserves and more recently on the export of solar-powered hydrogen, Santos is forging ahead on two fronts. The latter company is focused on replacing oil driven generators on beam pumps and a 2 MW behind-the-meter solar PV development at their Port Bonython facility in South Australia, with the upgrade realized through a joint venture with ZEN Energy.

Overall, renewables in Australia are expected to continue the strong growth seen in 2018 through 2020, despite challenges, such as local transmission losses, also known as Marginal Loss Factors (MLFs). “Investor confidence is high in Australia, and the country currently has a development pipeline of over 105 GW of solar, wind and storage projects, as well as a fleet of ageing coal-fired power stations which will require replacement,” the Rystad report added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I see renewable energy is going gangbusters (with a current focus on batteries).

My question is how many PV solar panels are being manufactured in Australia and when is this activity to grow (or start)?