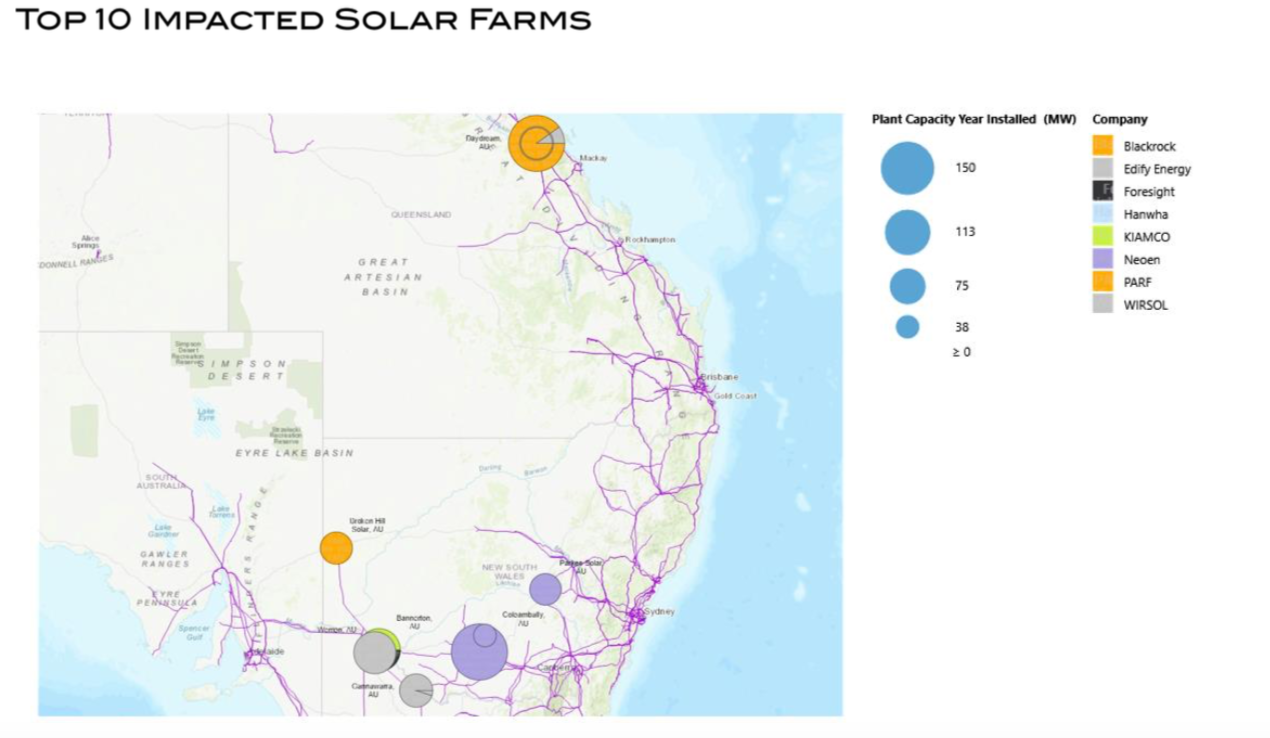

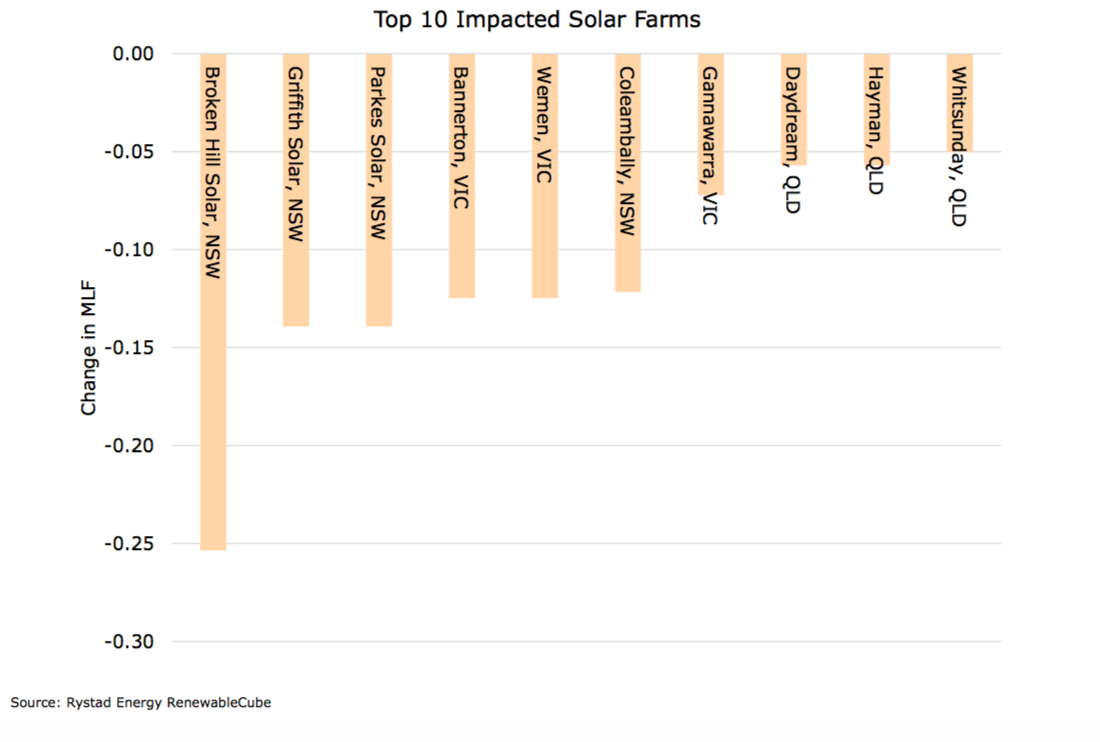

Analysis by Rystad Energy has revealed that proposed Marginal Loss Factors (MLFs) for 2019/2020 will make a major dent in utility scale PV project revenues. Six solar farms face a decline in revenues of 10% or more with MLFs particular adverse in Northern Queensland, north-west Victoria and Far West and Central New South Wales.

Looking to the future, connection requirements and grid bottlenecks is set to directly affect the financial viability of Australia’s large-scale solar fleet in the year to come. With over 4.5 GW of renewable energy projects queuing to be accommodated on the grid, delays are the only certainty and some projects being abandoned is looking increasingly likely.

The proposed MLFs released by the Australian Energy Market Operator (AEMO) earlier this month show a number of utility-scale solar projects are facing a higher transmission losses in the next financial year due to generation exceeding the carrying capacity of transmission lines and their location far from load centres.

MLF is of vital importance for project economics as it represents the loss of electricity as it flows through the transmission network from a power plant to load and determines how much of the output is credited for payments. Driven by new technology and a changing generation mix, the National Electricity Market (NEM) has been undergoing a transformation, which has led to large year-on-year changes in MLFs, as shown in the draft report.

“The large year-on-year changes in MLFs demonstrate the ongoing need for comprehensive planning of both generation and transmission to minimise costs to consumers,” AEMO said in statement.

The draft MLFs will most deleteriously impact four NSW and two Victorian solar projects. Rystad reports that all six projects will incur MLFs of more than 10%.

“A lot of solar farms, six, will see over 10% MLF reduction, so a significant hit to their revenue streams” said David Dixon, a senior analyst renewables for Rystad Energy. “You are essentially getting paid over 10% less, for the same generation, assuming the same price for generation. So, a pretty big hit to your revenue stream.”

MLF system design

While clean energy investment confidence has remained strong with tens of billions of dollars in the pipeline, the technical requirements for grid connection and network access for new wind, solar and storage projects have always been identified as the industry’s top concern. On top of that, deteriorating MLFs can deliver a double whammy – leading to calls for the mechanism to be re-examined.

“Predicting MLFs into the future is something no-one has been able to do with any accuracy,” said Clean Energy Council (CEC) Chief Executive Kane Thornton, noting the MLF methodology was established over 20 years ago and is no longer fit for purpose. “A comprehensive and holistic review of MLFs by the AEMC is imperative, along with considerations of how this volatility could be controlled in the short term. The industry is calling on the AEMC to complete this review as soon as possible.”

A move to dynamic MLFs has been mooted as an improvement to the market, as the system was developed before large volumes of variable, renewable capacity was added to the network and market. However, The Australian Energy Council’s Ben Skinner has cautioned that while it may more accurately reflect the changing shape of electricity generation, it will not be a silver bullet for project developers.

“The possibility of moving to more dynamic intra-regional loss factors was once reviewed by AEMO’s predecessor, NEMMCO, who concluded the dispatch accuracy was not worth the additional complexity. This was however before the emergence of variable generation,” Skinner wrote in an article setting out the MLF system design.

“The regional market design, combined with static yearly loss factors is the result of an initial simplification decision that, as a trade-off, introduced some inaccuracy. It would be worthwhile re-assessing whether, given the changes in the power system, the trade-off continues to represent the correct balance.

“However it should also be noted that greater accuracy is unlikely to bring much joy to those parties who have been affected by adverse MLFs, as there is no reason to expect that greater accuracy would significantly improve their circumstance. The only way to reduce exposure to adverse MLFs is to very carefully assess the likely losses prior to investment. In fact this is exactly what the design of MLFs seeks to encourage.”

Last year, AEMO warned against significant curtailment for projects located in an area with not enough grid strength. In order to improve this, developers were faced with a choice of installing additional components, such as costly synchronous condensers, as done by Total Eren on the 256.5 MWp Kiamal Solar Farm in Victoria, or simply waiting for a network upgrade, which could take years.

AEMO is expected to publish the final MLFs that will apply for the 2019/20 financial year on 1 April.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.