The energy transition is gathering pace faster than ever, according to an update from professional services firm Ernst & Young (EY) which cited the influence of the three Ds: decarbonization, decentralization and digitization.

In a blogpost aimed squarely at persuading energy utilities to embrace the switch to renewable energy and storage if they wish to survive the energy transition, EY’s global energy leader Benoit Laclau also cited the transformative nature of EVs, artificial intelligence, machine learning and the cross-sectoral push for electrification.

Last year, accountancy ‘Big Four’ member EY produced a report which examined three tipping points of the energy transition as it predicted off-grid energy would reach price and performance parity with grid power as early as 2021 in Oceania; EVs would reach parity globally with conventional vehicles in 2025; and the cost of transporting energy would be more expensive than generating and storing it locally as early as 2039 in the northeast U.S.

Those tipping points have likely got even nearer now, thanks to better, cheaper technology; climate policy ambition; corporate renewable energy deals; and stakeholder pressure, wrote Laclau yesterday.

Disruptive technology

Citing new analysis of energy markets in Europe, Oceania, Gulf Cooperation Council nations, China, India, Latin America and the United States, the EY energy specialist said new renewable energy capacity had outpaced conventional power asset additions for the seventh year in a row in 2018 thanks to battery storage, EVs, artificial intelligence (AI) and machine learning.

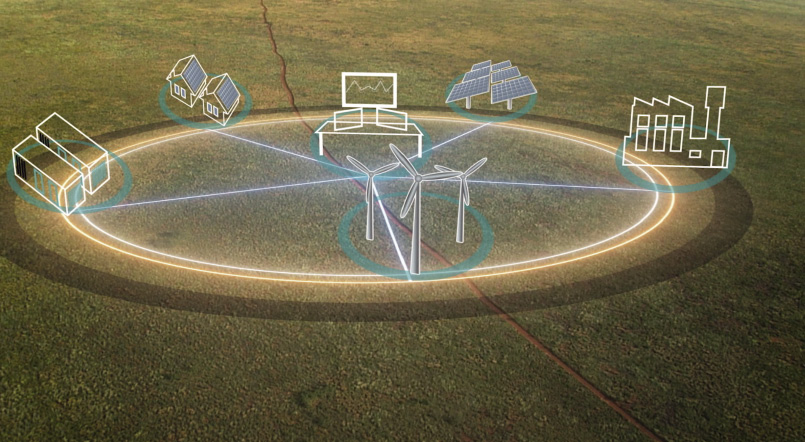

Utility scale storage was a prime factor, said Laclau, with the U.S. leading the way as 40 GW of energy storage are set to be added worldwide by 2022 and with the technology already beating natural gas on price in some markets. The role played by AI and machine learning in enabling peer-to-peer energy trading would transform life for surviving power companies, warned the EY expert.

On the subject of policy support for the energy transition, Laclau noted more than 60 nations had already declared plans to totally decarbonize electricity generation as governments raised their climate change ambitions. China, for example has increased its renewable energy target to a goal of securing 35% of its energy from renewable sources by 2030, up from the previous 20%. India is gunning for 275 GW of clean energy generation capacity by 2027 – and 227 GW by 2022 – and the governments of Argentina, Egypt and Saudi Arabia have announced an intent to reduce electricity price subsidies which largely benefit fossil fuel generation.

Clean corporates

Although Laclau cited figures demonstrating ever accelerating take-up of residential solar – more than 2 million PV rooftops in Australia, 8 million California residents participating in community solar schemes – the EY blogger stressed corporate renewable energy procurement would transform the way power companies operate much faster than individual households.

Citing a survey of 2,400 large global companies carried out by the International Renewable Energy Agency last year, Laclau said 50 businesses had committed to powering their operations entirely from renewable energy and more than 200 had pledged to source at least half their power from green sources as private power purchase agreements (PPAs) signed direct with generators and on-site installations proliferated.

As well as responding to the demands of activist investors and the public – another of Laclau’s pillars driving the switch to clean energy – rising costs for the transmission of energy contributed to corporate deals that could cut out power network operators entirely, helping the approach of the third of the tipping points highlighted by EY a year ago.

Grid-related transmission costs are expected to rise 7% per year in the northeast United States, Laclau noted, with an annual rise of 3.9% anticipated in China, Latin America and “other emerging markets” and a similar rise of 3.6% predicted in Oceania and Europe. PPAs lasting ten years or more offer “a great hedge” against such developments, added the EY energy leader.

Electrify everything

Electrification would add further momentum to the new energy landscape, wrote Laclau, who added that by 2050 half of total fine energy consumption would be electric as space heating and cooling, industry, data centers and transport embraced electrification as part of a wave of cleaner cities – an important development as ever more people gravitate towards urban centers. A significant proportion of those urbanites will be driving EVs – around 57% of them measured by new vehicle purchase expectations in 2040 as Laclau noted around a third of the global car fleet will be electric by the middle of the next decade.

The only option for energy companies – generators and distribution network operators – is to embrace the change and get ahead of the game by investing in the electrification of transport, energy storage and microgrids and changing the services they offer increasingly grid-independent customers, said Laclau, who noted many of the fossil fuel majors are already making big strides along that path.

“The clock is ticking”, Laclau concluded.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.