The lithium industry has been riding on a rollercoaster in recent years, experiencing rapid demand growth, supply bottlenecks and oversupply of mined products. The oversupply, caused largely by the opening of lithium mineral operations in Australia, outpaced the EV boom and mineral conversion capacity in China and led to tumbling lithium prices.

Six lithium mines have opened in Australia since 2017 while sales growth has slowed down in China, the largest market, according to Bloomberg NEF. As prices for lithium almost tripled between mid-2015 and mid-2018 with the world’s EV fleet hitting the 5 million mark, the lithium-ion battery manufacturers began to fret over the supply of raw materials. In the first quarter of 2019, sales of electric vehicles in China grew by about 90% year-on-year. While that sounds impressive, it’s half the growth seen between 2017 and 2018, according to Nikolas Soulopoulos at BNEF in London.

The present lithium oversupply is a side effect of miners attempting to position output to meet an expected rapid rise in future demand, which has been exacerbated by a slowdown in the ability to convert mined ore into lithium materials. As a result, monthly average lithium carbonate spot prices fell from a peak of US$ 22.89/kg in February 2018 to US$11.28/kg by October that year, a fall of 51% largely because of supply side pressures, finds London-based consultant Roskill. Prices have continued to fall into 2019, reaching US$ 9.56/kg in June.

According to Morgan Stanley, lithium prices will stay on the downward trajectory in the years ahead. The investment bank said it expects lithium prices to experience a 30% fall over the next six years, as new technologies lower the cost of production and keep the market oversupplied.

Australian miners suffer a blow

This has come as somewhat of a surprise for bullish lithium miners and producers. According to an index compiled by Benchmark Mineral Intelligence, lithium prices have fallen by 9% this year, hitting share prices of the largest producers. Shares in U.S. producer Albemarle are down by 10% this year, while those of Chile’s SQM have fallen by 23%.

Australian exporters are also struggling with the new market reality. ASX-listed mining company Galaxy Resources confirmed that its export volumes for the six months to June 30 would be just half that shipped in the respective period of last year. According to the company, extremely weak exports in the first three months of 2019 were on its customers having high inventory levels.

Lithium exporter Pilbara Minerals said it was reducing production from its Pilgangoora mine in response to reduced demand from Asian customers. The company explained the Chinese utilities that convert Australia’s lithium-rich spodumene concentrate into battery-grade lithium had been slow to construct and commission new conversion capacity, and therefore were not ready to take the volumes they had ordered.

On Monday Mineral Resources said in an ASX statement it would drop the price of its 6% spodumene concentrate for this quarter by 11% – almost US$80 a tonne. The concentrate, from the company’s Mt Marion mine in WA’s Goldfields region, will be sold for US$608.95 per dry metric tonne compared to US$682.38 for the previous quarter.

For miners and producers in Australia and elsewhere, the situation is expected to remain unchanged until the EV uptake kicks into gear. BloombergNEF forecasts the supply of lithium-ion batteries will need to increase by more than 10-fold by 2030, with electric vehicles accounting for more than 70% of that demand.

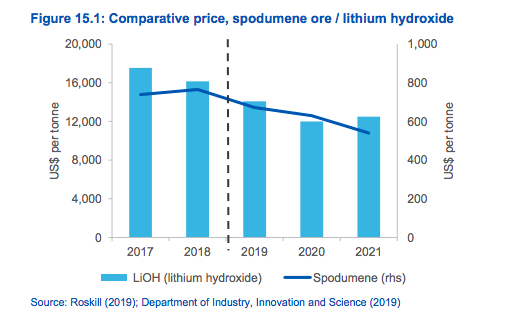

In the meantime, spodumene ore — the precursor material for lithium hydroxide — is expected to face a longer period of oversupply, with prices remaining soft. According to the Australian federal government’s most recent Resources and Energy Quarterly, lithium hydroxide prices are projected to fall by around 15% in 2019, as oversupply persists and inventories grow. The supply surplus is projected to gradually close, with the price expected to start turning around after 2020.

“The fact that supply is being triangulated against future demand makes it somewhat unlikely that oversupply will correct in the very near future. However, demand growth is likely to outstrip supply by around 2023,” the report states.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“The lithium industry has been riding on a rollercoaster in recent years, experiencing rapid demand growth, supply bottlenecks and oversupply of mined products. The oversupply, caused largely by the opening of lithium mineral operations in Australia, outpaced the EV boom and mineral conversion capacity in China and led to tumbling lithium prices.”

This with the recent announcement of TESLA’s claim of the MegaPack which is supposed to be a 250MW/1GW energy storage system that can be installed on three acres in three months. I’m thinking maybe Australia needs its own Giga-Factory. Raw materials in one door, finished battery pack out the other door.

Which means lower battery and EV prices, right?

There is more than having the Giga-factory, one needs to go the extra mile and power the Giga-factory with solar PV, wind generation and yes, its own energy product, the energy storage system.

As for EV prices, it is still early on in the march of new technology. I read an article today about a company Linear Labs and their HET electric motor which is supposed to be (more) efficient than current electric motors on the market. The ‘claim’, more power output, more efficient, cheaper to manufacture in quantities. These are the kinds of things that will decrease the price of EVs. Right now even TESLA is using a ‘repurposed’ Toyota factory in California to build its TESLA stable of electric vehicles. The industry will have to ‘flesh out’ an all EV manufacturing line instead of a “repurposed, reprogrammed” standard ICE manufacturing line. For one, getting rid of multiple power supplies and controllers in the vehicle would bring costs down. Going to a 48VDC internal battery buss would allow two wires running down the vehicle from front to back, with controllers like, lights, gauges, door lock, windows, mirrors, cameras, sensors, steering, braking to be powered by the buss and redundant fiber optic for communications and control of all vehicle devices. When you redefine the production line for the actual product you are building, then it becomes more efficient and more cost effective.