This week, the Australian Clean Energy Summit 2019 was necessarily focused on changes to energy regulation, accelerating transmission build out and other ways of supporting faster integration of more renewables into Australia’s uniquely challenged grid. Held in Sydney, at the heart of the National Energy Market (NEM), the Summit sought to bring government, transmission providers and developers to bear on the problem that could spook investors and stall transition just as coal exits.

Industry confidence down

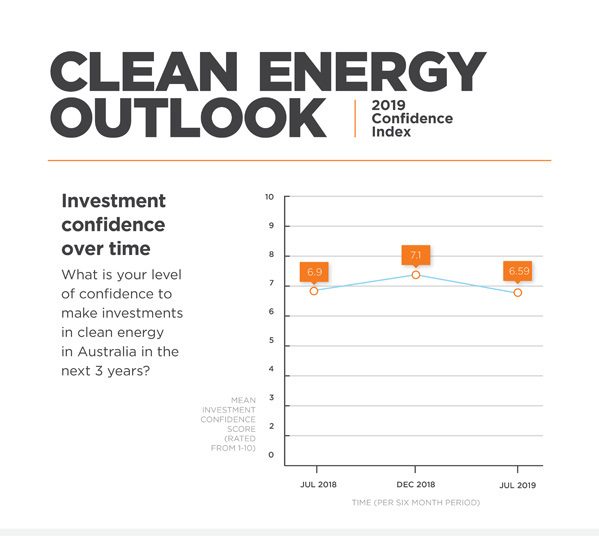

On Wednesday, the Clean Energy Council (CEC) released a pre-Summit thought provoker: its bi-annual Clean Energy Outlook — Confidence Index showed a decrease in industry confidence to invest in clean energy over the next three years. Asked to rate their level of confidence from one to ten, energy leaders’ average confidence levels have dropped from 6.9 points in July 2018 and 7.1 points in December 2018, to a one-year low of 6.59 in mid-2019.

Leaders gave the top two barriers to their intention to develop clean energy projects as “Concerns and challenges related to grid connection and network access”; and “Lack of strong federal energy and climate policy”.

In many ways, state governments have already stepped up to the yawning gap in Federal energy policy and commitment to energy infrastructure, and they continue to build bridges.

Among the opening speakers at the Summit, NSW Government Minister for Energy and Environment, Matt Kean was applauded for linking climate action to energy policy: “The NSW Government still supports the National Energy Guarantee, and will continue to support a national mechanism that integrates climate and energy policy…” said Kean.

Best development environment in the OECD

He also underscored the NSW Government’s determination to enable private capital to build a grid fit for 21st-century needs, and said, “We want NSW to be the easiest jurisdiction in which to develop new energy infrastructure in the entire OECD.”

Keane acknowledged that more than 19,400MW of large-scale renewable-energy projects worth some $26 billion to the state economy were either approved or making their way through the NSW planning system, but that there “is simply not enough existing transmission capacity for these projects to connect”.

He cited the NSW Government’s Transmission Infrastructure Strategy, released by then Minister for Energy and Utilities Don Harwin, in December 2018, as the plan that will unlock the pipeline of projects by prioritising three key energy zones in the New England region, the Central West and the South West of the state.

The Strategy itself describes its aim as to “help facilitate new transmission that could support up to 17,700 MW of new electricity generation in Energy Zones by 2040”.

Kicking off the chicken-and-egg game

Cue Caroline Taylor, Head of Public Policy at TransGrid, which operates and manages the high-voltage electricity network in NSW and in the Australian Capital Territory (ACT).

“TransGrid’s network today is almost at full capacity,” she said in a Summit panel discussion titled Rethinking transmission: Building a better system for renewables.

Among Taylor’s subsequent, data- and experience-based points:

- Demand for energy in NSW has risen steadily since 2014.

- The Liddell coal-fired plant which currently supplies 1,680 MW capacity to the grid is scheduled to close in 2022-23.

- NSW peak demand is around 15,000 MW, and with the withdrawal of Liddell, dispatchable capacity will drop below peak demand.

It’s unlikely that new coal-fired capacity will be built to replace Liddell and other coal-fired retirees. Kean acknowledged at the Summit that, “A decade ago, the challenge was decarbonising a reliable grid, despite economics; today, the economics are decarbonising the grid.

Taylor confirms that NSW has abundant solar and wind resources, currently the cheapest and fastest-to-market alternatives to coal, and some of those resources overlap in the three key energy zones mentioned above, but she says grid augmentation is needed to ensure that the pipeline of renewable developments are able to export into the grid and that NSW is able to meet its growing demand (even as increasing distributed energy resources, such as rooftop solar are helping to meet that demand).

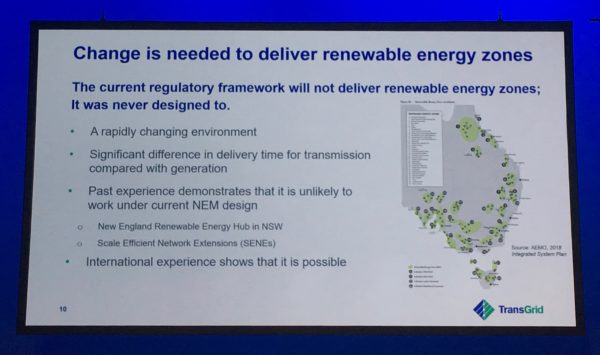

Australia’s existing energy market was developed at a time when transmission and generation were co-ordinated and well established and as such, says Taylor, “the regulatory framework was established to support incremental investment.” A critical emerging factor however is that, “the transmission that we are experiencing now needs something greater than incremental investment”, she says.

The mismatch in timeframes of Liddell closure in 2022 and transmission build out to support “new electricity generation in Energy Zones by 2040” was narrowed a little yesterday when AGL announced it would delay Liddell closure by four months, to help cover the peak-demand summer months of late 2022 and early 2023.

But the regulatory framework itself, the proposal, consultation and validation of rule changes through Australian Energy Market Commission (AEMC) and bodies with oversight such as the Energy Security Board, combine in a painstaking process.

The three Potential Priority Energy Zones identified by the NSW Government substantially correlate with potential Renewable Energy Zones (REZs) identified in the first phase of the Integrated System Plan which was published by the Australian Energy Market Operator in 2018, and is widely hailed and accepted by the energy industry as a way forward. So there is agreement between national co-ordinating bodies, and the State of NSW on where a first tranche of transmission upgrades is needed.

But “While the Integrated System Plan gives us a map of the future system plan, it remains unclear how it will actually be delivered,” said CEC Chief Executive Kane Thornton in outlining the challenges to transition.

Slide: TransGrid

The hub of the matter

One confounding factor in current plans to augment grid transmission is that in 2016 TransGrid, in partnership with the Australian Renewable Energy Agency (ARENA), undertook a feasibility study to investigate the technical and commercial aspects of a proposed New England Renewable Energy Hub.

The study showed that there were limitations to the Scale Efficient Network Extension Rule, as enacted by the AEMC in 2011, which would govern development of such a hub. The rule is designed to allow connection of multiple generators to the shared network over time, in order to prevent inefficient duplication of connection assets.

The study into the New England Hub was the first time the rule had been applied, even in theory, and Taylor told Clean Energy Summit attendees, “Despite cost efficiencies of approximately 18% through the shared connection, a number of commercial challenges prevented the project from being successfully delivered.”

These included a lack of incentives for developers and investors that were commensurate with the risks of the project; a disadvantage for first-mover generators; and a timing mismatch between delivery of transmission and generation.

The study of the New England Renewable Energy Hub shows a mere microcosm of the difficulties regulators and developers are encountering on the path to delivering coordinated transmission and renewable-generation projects in a timely manner to take over from the inevitable retirement of coal-fired capacity.

Currently the 4GW Walcha Energy Project, the largest single renewable energy project in the NEM, is further testing the resolve of all regulators, developers and transmission service providers to co-ordinate in the New England Renewable Energy Zone. In June, partners in the project Energy Estate and Mirus Wind submitted a scoping report to NSW Department of Planning & Environment for the 700 MW Salisbury Solar Farm and 100 MW/150 MWh battery storage system components of the massive project which is also planned to include pumped hydro energy storage and up to 700 MW of wind generation.

NSW wants to connect with you

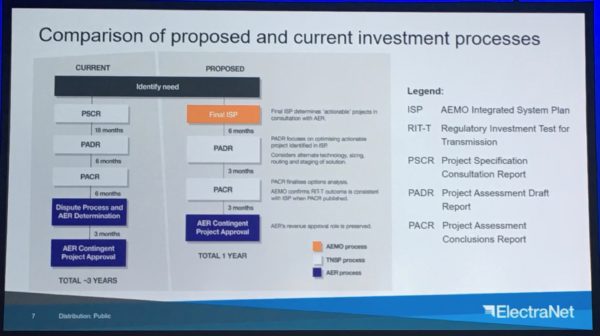

Also on the Rethinking Transmission panel at the Australian Clean Energy Summit was Rainer Korte, Group Executive Asset Manager at ElectraNet, South Australia’s transmission-network operator. Korte updated the industry on Project InterConnect, which is progressing through validation and approval systems for delivery in 2022-23, and the effect that reforms encompassed by the ISP would have on reducing transmission time to delivery.

A combined initiative of ElectraNet and TransGrid, Project InterConnect is a 900 km, 330 kV above-ground transmission line connecting Robertstown in South Australia with Wagga Wagga in New South Wales, with added connection to Red Cliffs in Victoria along the way. It will facilitate connection to the grid by new renewable generators at strategic points in its pathway, and will enable interstate distribution of current oversupply of South Australian renewable energy at certain times.

The process towards approval of the project has so far taken three years; further approvals, and time to build and commissioning are anticipated to take a further three years. Korte says that the process undertaken to date could be reduced to just 12 months under reforms proposed in the Integrated System Plan. Essentially, he says that inclusion of a project in the ISP (the next version of which will be published in mid-2020) will assume a level of approval to allow that project to move directly into its second approval phase.

NSW and South Australian Governments have in the case of Project InterConnect provided support for ElectraNet and TransGrid to progress state planning and environmental assessments in parallel with the Regulatory Investment Test for Transmission (RIT-T), so that actual build can proceed more quickly if the project passes the test.

Slide: ElectraNet

Fast change + slow reform = shy investors.

While all parties to the regulatory and planning processes that will facilitate delivery of renewable energy are working to accelerate approvals and building of strategic transmission, Simon Corbell, Chief Adviser at Energy Estate and a transition enabler as former ACT Minister for The Environment said that “one of the key challenges for government and for AEMO is in determining whether or not we are really going to get the investment and the timely delivery of transmission upgrade we need.”

Thornton says that the change being enacted in every aspect of regulation and supply is, ironically, both too much and not enough: “Too much change spooks investors, makes it even harder to forecast the future wholesale energy price or adds unnecessary regulatory burden and cost on project development. At the same time there isn’t enough change that brings the regulatory and market environment into the 21st century,” he said.

At the heart of regulation of the NEM and the rhetoric of the Federal Government is that decisions, upgrades, changes and developments all be undertaken in the interests of delivering lowest-cost electricity to consumers.

Back on the Rethinking transmission panel, Tom Geiser, Senior Market Manager at Neoen, volunteered an analysis he’d conducted, using historical data, on the benefits of a 200 MW SA-NSW interconnector. In 2018 alone, he said, such a transmission investment “would have saved consumers about half a billion dollars”. Most of the savings would have been on the NSW side of the border, he says, since the interconnector, “was taking the spilled energy from South Australia and cutting NSW rates, but it also cut some peaks in South Australia.”

Extrapolating from this modest assumption, Geiser estimated that the actual 800 MW Project InterConnect would pay back its $1.52 billion investment within three years.

“How many opportunities do we have like that,” asked Geiser, “for incredibly short payback on an asset that’s going to last for 50 years?” Presumably more than one.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“It’s unlikely that new coal-fired capacity will be built to replace Liddell and other coal-fired retirees. Kean acknowledged at the Summit that, “A decade ago, the challenge was decarbonising a reliable grid, despite economics; today, the economics are decarbonising the grid.”

This is World wide, electric utilities have found that commodity fueled centralized generation is inefficient, costly to run and destructive to the environment to operate. Alternative, non-fueled distributed generation resources that have energy storage as part of the project cost less, are much easier to amortize over the life of the asset. The accepted life of a coal fired plant seems to be in the 40 to 50 year span. The amortization is also ‘spread’ over that 40 to 50 years. Solar PV and wind generation have at least a 20 year life span, yet many of these projects have amortized over a 10 to 15 year span. That gives the utility 5 to 10 years to create a CIP money pool to replace the solar or wind assets with the latest greatest technology at less capital cost for another 20 to (? years) life span.