Last week French renewable development giant Neoen announced plans for a massive hybrid power plant in South Australia (SA) featuring 1200 MW of wind, 600 MW of solar and 900 MW of battery storage. But how feasible is a potential project of this scale?

To answer this question, and a host of others relating to the project, pv magazine Australia spoke to David Dixon, Senior Analyst in Australian Renewables Research at Rystad Energy, and Tristan Edis, Director of Analysis and Advisory at Green Energy Markets.

The Goyder South Project was unveiled last week at an open day in the Mid-North town of Burra, SA, where Neoen proposes to build the potentially major renewable energy hub.

SA-NSW Interconnector Dependence

The feasibility of the project is entirely dependent on the successful construction and operation of Project EnergyConnect (PEC), the SA-NSW Interconnector. PEC, led by ElectraNet and TransGrid, is a 900km, 330kV above-ground interconnector proposed to run between Robertson, SA, and Wagga Wagga, NSW. TransGrid has been pushing strongly for this project for over three years as a way to provide “energy security to SA and unlock new renewables generation in south-west NSW.”

Construction on PEC is expected to begin by mid-2021, with the Environmental Impact Statement (EIS) to be up for display in the second half of 2020. If everything goes according to plan, the project could see completion by mid-2023.

We already know that the second and third phases of the Goyder South’s construction can only commence once the PEC is operational. Whether the timeline of PEC can be achieved introduces enormous risk to Goyder South. As David Dixon told pv magazine, “If the transmission line does not get built, it will be hard to justify such scale for the relatively small SA market (with limited export capacity to VIC).”

With more or less everything hinging on the Interconnector, the obvious question must be asked, is it going to happen?

PEC has a lot going for it. It has strong political support from both SA and NSW, in fact, NSW joined SA in giving “critical infrastructure status” to PEC late last month. TransGrid’s Chief Executive Paul Italiano says the CSSI classification means the planning approval process in NSW can be expedited to meet delivery deadlines.

Moreover, the need for transmission infrastructure was stressed by NSW Government Minister for Energy and Environment Matthew Kean at the opening of the Clean Energy Summit 2019. Kean noted that industry and investor confidence has lessened in recent years as the unique challenges of integrating the booming renewables industry into what has become an archaic grid system. The Clean Energy Council’s (CEC) Clean Energy Outlook – Confidence Index demonstrated this drop in confidence.

There is more than 19,400 MW of large-scale renewable-energy projects, worth approximately $26 billion to the NSW economy, currently either approved or in the approval process, but as Keane readily admitted, there “is simply not enough existing transmission capacity for these projects to connect.”

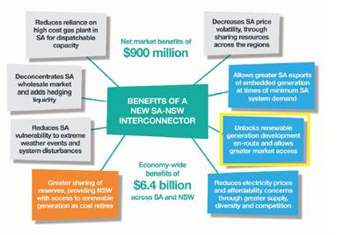

Tristan Edis points out that the PEC Interconnector has also been given a positive cost-benefit assessment from both the network operator and AEMO saying it delivers a net benefit.

However, PEC does have its opponents. There are some, Edis said, who point out that the cost-benefit assessment hinges largely on the doing away with the need for gas generation in SA. These opponents argue that it is simply unrealistic to imagine that SA can get away without at least some level of gas generation and capacity for its system stability and security.

These opponents, notably the South Australian Council of Social Service (SACOSS) raised their dispute with the Australian Energy Regulator (AER). SACOSS disputed whether ElectraNet was meeting the National Electricity Rules (NER) in terms of not adequately accounting for the risk of unintended consequences as a result of the potential retirement of three South Australian gas plants. However, the AER found that ElectraNet’s reports were in accordance with the NER.

As a result of the resolved dispute, PEC has now advanced into the latter stages of its Regulatory Investment Test for Transmission (RIT-T) with a final determination expected sometime before the end of the year.

Edis and Dixon both suggested that other opponents might include NSW communities that might not take too kindly land acquisition or to the building of new transmission towers that would most likely be necessary for the project’s completion.

Of course, it must also be noted that while the Goyder South project is entirely dependent on the SA-NSW Interconnector, the two are actually inter-dependent. It is projects of the scale of Goyder South that act as major drivers for PEC, as demonstrated by the Project Assessment Conclusions Report (PACR) published by ElectraNet for the SA Energy Transformation RIT-T.

Image: AEMO (Figure E.1)

Competition

If we assume the SA-NSW Interconnector goes ahead as planned, and that is an if 900km long, the Goyder South Project still faces the prospect of stiff competition along the proposed transmission line. Not to mention the necessity of the project to find significant source of financing in the form of PPAs in the regions the Interconnector will feed.

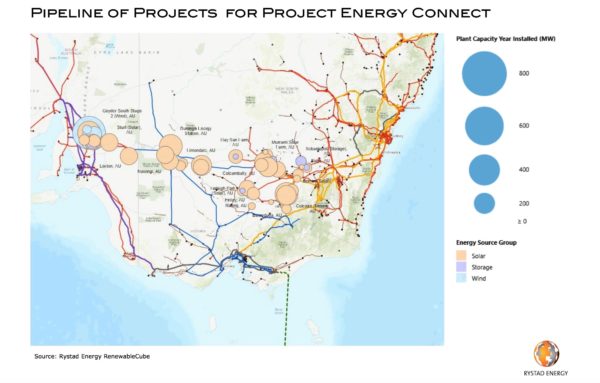

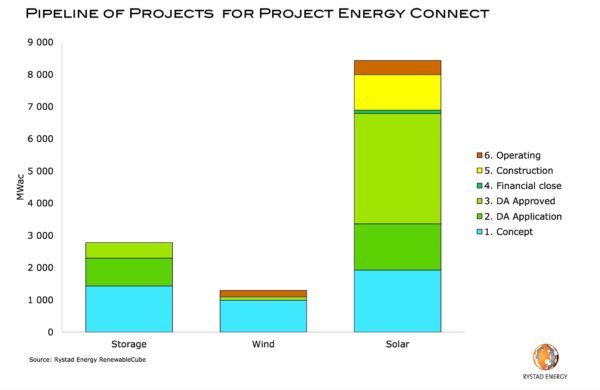

David Dixon of Rystad Energy has supplied these graphs to show the amount of competition presented by proposed projects along the along the potential transmission line.

Image: Rystad Energy/David Dixon

Image: Rystad Energy/David Dixon

Decarbonisation

The Interconnector is not the only hinge upon which the project is depending, Tristan Edis makes the point that a project of this size, in order to be financially viable, would also probably require a coal generator to shut down and for the federal government to introduce new policy “to drive further decarbonisation of the Australian electricity sector.”

While a handful coal generators are nearing retirement and facing shut down over the next decade, the introduction of new federal policy is a far less certain prospect. We can only hope the federal government realises that the now growing opportunity for projects of the scale of Goyder South and the Sun Cable project in the NT means that the renewable energy industry is simply too powerful for the government to lack clear policy.

Storage Wars

The Goyder South Project proposes a massive 900 MW of storage. But Edis raises concern as to whether there will be enough arbitrage opportunity to support such a storage amount in the mid 2020s considering Snowy 2.0 is expected to be completed by 2025-26. Edis points out that Snowy 2.0 could soak up a large proportion of the revenue case for a battery of the scale proposed by Neoen.

However, considering the success of Neoen’s Hornsdale Battery, the French developer is clearly confident that there is enough revenue for another large-scale storage project.

Conclusion

Of course, everything depends on PEC going ahead without any hiccups. And even if PEC is constructed on time, there are still relatively significant obstacles in the road. However, the benefits a project of this scale are enormous especially considering the necessity for renewable generation in both NSW and SA. Given the sheer ability of dispatch the renewable energy hub would have with interconnected transmission, we can only hope that Neoen’s project is simply, too big to fail.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

While SA might be one of the few states where electricity demand from the grid might actually rise over the next few years, if they electrify the mining industry, it is becoming increasingly difficult to see the sense in PEC. Even if Snowy II is not built, transmission beyond Wagga will be constrained at times while competing projects from Riverina solar will take up much of the available capacity east of about Deniliquin.

Net NSW power imports have already fallen from 9.1 TWh in 2014 to 4.1 TWh in the last 12 months. The currently financed build out of 2.7 GW of large scale wind and solar and the ongoing 50 MW/month of behind the meter generation will be supplying another 10-11 TWh before the link can be built. Thus all of Liddell and another 1-2 TWh of imports will be displaced by local renewables.

Then as demand declines in eastern NSW, because of increasing energy efficiency, increasing behind the meter solar and competition from other large scale solar and wind plants close to the load, the need for imports from 1,100 km away will dwindle to almost nothing.

In the meantime,a much cheaper and faster to build upgrade to the NSW/Queensland link will allow a significant increase in capacity from Queensland again depressing potential demand from SA.

On the other hand, with the apparently already financed Solar River project and the ongoing deployment of other smaller storage plants around SA, and an abundance of new solar, the chance that SA’s residual import needs cannot be supplied by the existing links is remote indeed.

“Last week French renewable development giant Neoen announced plans for a massive hybrid power plant in South Australia (SA) featuring 1200 MW of wind, 600 MW of solar and 900 MW of battery storage.”

About the size of a nuclear plant with 50% energy storage. The up side to this technique, is the ability to go from 10% of the stored power to over 100% output when wind and or solar PV is available. The speed which one can go from one extreme to another is milliseconds to seconds, something fueled generation can’t do.

Seems to be a ‘thing’ in Australia: “Construction on PEC is expected to begin by mid-2021, with the Environmental Impact Statement (EIS) to be up for display in the second half of 2020. If everything goes according to plan, the project could see completion by mid-2023.”

Usually prospective investors will gladly put their money in the pot when there is infrastructure available to sell the generated product. First the PEC is built, PPAs signed with Neoen so the Goyder South Project can move along as the PEC infrastructure is being built. This seems to by why there were at least three large alternative energy generation projects built, with no power infrastructure built to get the product to market.

With the impending Goyder South vs. Snowy 2.0 hydro power coming online a little later. One must keep in mind Energy storage has revenue streams above and beyond what a mechanical generation facility can provide. Yeah, Snowy 2.0 might be able to respond to conditions along the grid in 10 to 15 minutes, but can’t respond in 10 milliseconds to 15 seconds like energy storage can. With the properly designed inverters, the Goyder South system could react to conditions on the grid and with 18 pulse inverter technology, reduce harmonic distortion from switching spikes on the grid.

That implies a case for both, no? As massive as this battery is, it’s dwarfed by Snowy 2.0, and Snowy can’t respond quickly like a battery can. So, batteries are ideal for keeping the lights on until something larger and can kick in. They’ll work in tandem. Or do you think there isn’t enough demand for both projects?