In a statement from creditors, it was revealed that three Lyon Solar companies (the Companies) have entered liquidation. The news comes after Lyon Group placed these Companies into administration in May.

The Companies in liquidation are Lyon Infrastructure Investments 1 Pty Ltd, Lyon Solar Pty Ltd and Lyon Battery Storage Pty Ltd. The liquidators are Richard Hughes and David Orr.

According to the requirements of the Deed of Company Arrangements (DOCAs), approved by a majority of the Companies creditors on 25 September 2019, the Companies had 15 days to execute the DOCAs or they would automatically be placed in liquidation. “The Companies’ directors failed to execute the DOCAs within the required timeframe,” said Joint and Several Liquidator David Orr. “Accordingly, the Companies are now in liquidation.”

According to a company spokesperson, Deloitte was made administrators of the Companies in May in an attempt to resolve the exit of one of Lyon’s investors – U.S.-based hedge fund Magnetar Capital. Lyon Group became embroiled in a legal battle with Magnetar as Lyon looked to buy out Magnetar’s 25% investment share in a Lyon subsidiary. The dispute remains in confidential arbitration.

Orr and Hughes will now seek to sell the Companies’ projects. “We will continue to liaise with interested parties of the projects” noted Orr, “with the aim to execute a sale agreement(s) in the coming months.”

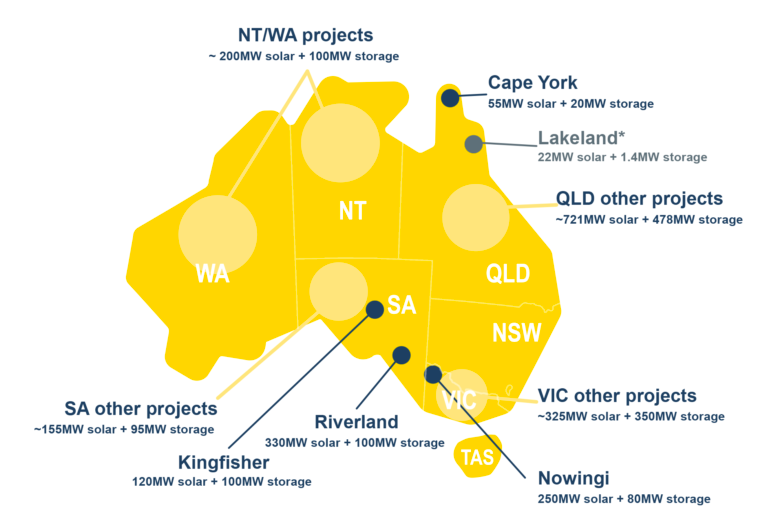

The most advanced of the projects to be sold off is the $150 million 55 MW Cape York Solar Storage project with its 20 MW/80 MWh of battery storage. The project, located outside Cooktown, was shortlisted by the Queensland Government in July as part of 10 renewable projects for CleanCo’s reverse auction.

Two other significant projects include Nowingi Solar Storage in Victoria with a solar capacity of 250 MW and 80 MW/320 MWh and Riverland Solar Storage in South Australia with up to 330 MW of solar and 100 MW/400 MWh of storage. If Riverland were to be constructed, it would be one of the world’s largest solar+battery storage plants.

At the time of administration Lyon maintained the situation would not leak out into Lyon Group’s other sectors, it is assumed the company is keeping the same line with reference to their liquidation, especially considering Lyon announced a significant joint-venture with two of Asia’s largest energy generators last week in an effort to curb the prevalence of curtailment.

However, considering the newly announced partnership with China Huadian and the fact that the agreement also brought in another Lyon partner, Japan’s Jera, it is becoming hard to imagine that the strain of the Companies’ legal battles has not leaked into the Group’s other limbs. After all, the liquidation of three of Lyon’s key assets can hardly be isolated.

Despite this apparent pressure, Lyon is singing a different song. Lyon claims “the voluntary administration process was highly successful in stopping the disruption.” Moreover, Lyon claims its recent deal with China Huadian was inclusive of China Huadian’s intention to purchase the three projects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.