Two worlds collided in a frisson of excitement at the Perth offices of Power Ledger late last week as its large-scale peer-to-peer energy-trading trial in India was set to expand; and the Australian Energy Market Commission released its information paper, How digitalisation is changing the NEM — the potential to move to a two-sided market.

“It’s a very exciting announcement,” Dr Jemma Green, co-founder and Executive Chair of Power Ledger said of the AEMC paper.

“There’s not a lot of competition in the peaking energy market — it’s really only for three or four players, and because there’s not a lot of supply, the prices are very high,” Green told pv magazine.

But the AEMC paper opens the door to a future in which Australian consumers will add supply to the NEM from their home solar and/or battery systems, controlling their devices to use electricity at times of low price, and selling energy into the market at times of favourable pricing.

“It’s heralding a new era of energy in Australia,” said Green.

Energy trading for a burgeoning economy

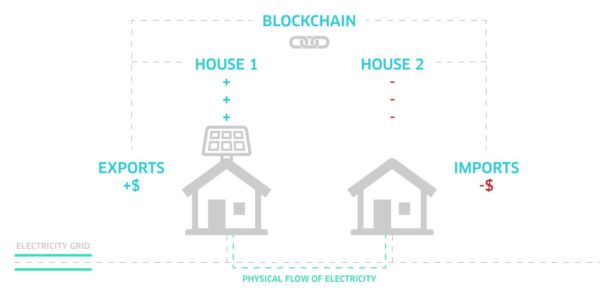

India is also on the cusp of enabling energy trading between inter-connected residents and distributed generators, using digital technologies such as Power Ledger’s blockchain-enabled energy trading and investment platforms.

“There’s a large-scale smart-meter rollout going on in India, which means you can create a very agile and dynamic trading environment with the feeds from those smart meters,” says Green.

For the past three months a group of gated communities in the Dwarka region, served by electricity distributor BSES Rajdhani Power Limited (BRPL), have been trading energy peer to peer on the Power Ledger platform.

That is, residents with rooftop solar — totalling 5-6 MW of collective infrastructure — have been selling excess energy to their neighbours, who may or may not have solar on their roofs, rather than letting it spill to the grid.

Image: Power Ledger

The win-win-win was demonstrated for prosumers who were able to monetise their investment in solar; for other participants who gained access to cheaper-than-grid renewable energy; and for BRPL, which was able to access a cost-effective energy alternative during times of peak demand.

In a country where it’s not yet possible for consumers to purchase renewable energy through the retail system, and the market mechanisms don’t yet exist to support the installation of solar by property owners and commercial entities … the Power Ledger trial was demonstrating the benefits of renewable energy to participants.

“With the exponential growth in our economy and production, the ability to generate clean energy and utilise it across India without the need for a fully centralised grid is critical,” said BRPL CEO, Amal Sinha.

“Realising the importance of distributed generation, we have already built an extensive renewables infrastructure, and this trial with Power Ledger will help us fully utilise that energy,” Sinha said last Thursday when announcing the expansion of the trial.

The ongoing trial will include solutions for group net metering, virtual net metering, EV charging and the exploration of virtual power plant applications among BRPL’s 2.5 million customers in the National Capital Territory of Delhi.

“Since our inception, the aim for our P2P platform has been to support energy retailers in better managing their demand and supply, and encourage renewable energy adoption,” said Power Ledger’s Head of Business Development and sales, Vinod Tiwari. “This project will be a working example of these concepts in action.”

Australian software-as-a-service export starts to scale

Green describes peer-to-peer energy trading as Power Ledger’s signature product.

Already a recognised Australian digital export, it has been used in projects as varied as a residential trading scheme between 10 households in the Austrian city of Graz; and a commercial project trading about 1 MW capacity between six commercial buildings in Bangkok.

“We see quite a strong growth trajectory for the Thai market,” Green told pv magazine, “because the government there has also signalled its intention to digitalise the energy market.”

Power Ledger last week also signed with an energy retailer in France whose customers want to be able to track the provenance of their energy — to specify which solar or wind farm their electricity is sourced from.

In future, such a project might progress towards another Power Ledger enabler — the proposed renewable-asset ownership product, which will help people who can’t afford to install solar on their own rooftop to own a fraction of a renewable energy asset.

Power Ledger “fractionalises the asset on the blockchain”, says Green, “so that the blockchain is the asset register; that asset then generates electricity, and that electricity is eligible for credit.”

Securing environmental commodities trading

Green sees great potential in the trading of environmental commodities on the C6 platform, Power Ledger’s second most advanced product, which is gaining traction in Renewable Energy Certificate (REC) trading in the United States.

“REC trading in the US is a very large market,” says Green, “with about $3 billion issued each year. We have a partnership with Clearway Energy, which is NASDAQ listed and has 6 GW of renewables in its portfolio, to roll out blockchain-powered certificate trading.” Power Ledger will also soon announce a REC trading project in Japan.

The evolving market for trading digital energy commodities is “often criticised for being opaque, but blockchain technology will make it more efficient, secure, and provide greater transparency”, Green said in a statement when the Clearway partnership was announced in late June.

“We will be able to track RECs on a blockchain ledger system from the point of creation, sale and transfer to the buyer, through to the point of retirement of the certificate and the annual sustainability audit.”

Applying a verified technology to Australia’s two-way energy street

Green, who co-founded Power Ledger “by accident”, in response to a series of life events and fortuitous meetings, is looking forward to expanding the company’s Australian base, which currently includes a 40-customer peer-to-peer trial in Fremantle, WA; and a large-scale virtual power plant in partnership with electricity wholesaler Powerclub, in South Australia, announced on November 7.

She says the AEMC move to facilitate a true two-sided national energy market, in which consumers are rewarded for buying and selling their energy “is pretty exciting”.

AEMC Chairman John Pierce agrees. Accompanying the release of the information paper, he said, “We are starting a new conversation to capture and extend the benefits of digitisation for all energy consumers into the future.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.