One of the striking trends in Australian energy markets in the past two years has been the emergence of corporate renewable power purchase agreements (PPAs). According to the Business Renewables Centre of Australia (BRC-A), a total of 58 corporate PPAs have been negotiated for 2.3 GW of capacity since 2017 with over 60% of the investment made with new wind and solar farms.

With a number of drivers behind the trend, including sustainability targets, improving budget certainty in volatile markets, the potential for cost savings and improving their brand or social licence by supporting new renewable energy, Australian commercial and industrial energy customers have jumped on the energy transition bandwagon. To meet the growing demand, innovative PPAs and services for C&I customers have emerged at pace with a number of flexible new solar PV contract models and services on offer, including BRC-A.

BRC-A was launched in March as an independent platform for connecting commercial and industrial energy consumers with proposed renewable projects totalling 7 GW. Additionally, the online portal offers simplified guides and templates for a well-negotiated PPA and mentorship by businesses that have successfully negotiated the hurdles to the renewable energy market and provides the opportunity to join buyers’ groups that share administrative costs and multi-megawatt contracts.

New market force

In its first report released on Tuesday, BRC-A finds a total of 58 corporate PPAs involving 70 organisations has been negotiated by Australian energy buyers since 2017, becoming an important vehicle for financing new renewable energy projects, primarily wind and solar farms. “Now that the Renewable Energy Target has been fully subscribed sustained corporate leadership is as important as ever,” the report says, adding that over 40,000 MW of solar, wind and battery storage projects are also looking for a buyer, but government policy uncertainty is proving to be a barrier.

“Until recently, solar and wind farms needed a power purchase agreement with a retailer to get built, but the growth of corporate renewable PPAs has opened up a vital new source of investment in renewable energy,” said Christopher Briggs, Technical Director, BRC-A and Research Principal, UTS Institute for Sustainable Futures. “The emergence of corporate PPAs is proving crucial in driving the energy transition in Australia and helping to realise the nation’s climate change targets.”

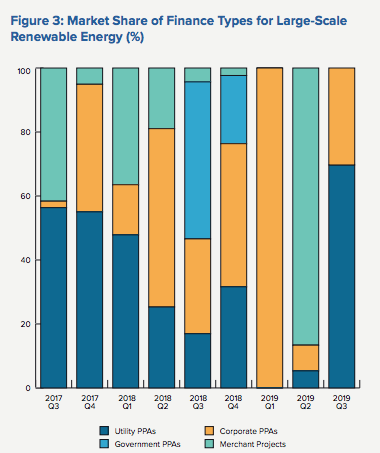

As can be seen in Figure 3, until recently, a utility PPA was the most dominant option for project developers – but the market has diversified. Since it is a new market segment, much of the activity is not public with procurement processes and negotiations undertaken privately. While it might be challenging to forecast the growth of corporate PPAs, energy consultant Energetics estimated in August 2019, there was around 500 MW of corporate PPA deals in the pipeline.

Over 40,000 MW of solar, wind and battery storage projects are also looking for a buyer, but government policy uncertainty is proving to be a barrier, BRC-A estimates based on AEMO’s generator information.

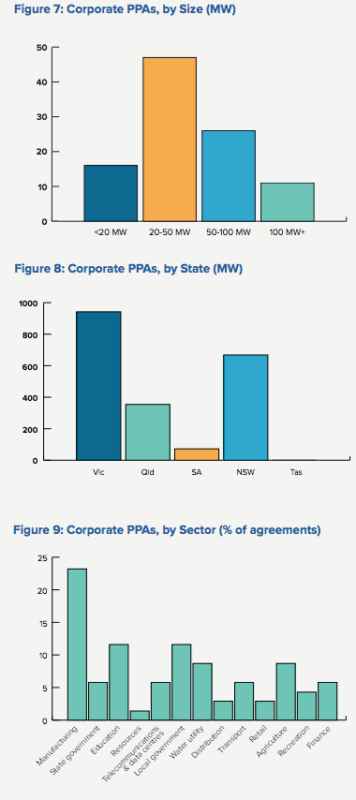

The average size of a corporate PPA is just under 44 MW, which has fallen from around 65 MW over the past 12 months as the market has diversified beyond big corporates, the report finds. Around one-third of deals are greater than 50 MW, almost half are 20-50 MW and around 10 per cent are smaller than 10 MW.

Figure 8 shows that Victoria is the leading state for corporate PPAs with the highest number of deals and installed capacity. During 2018-19, PPAs accelerated in NSW. Only a handful of PPAs have been signed in South Australia and Queensland notwithstanding the large volumes of utility-scale solar under development.

The leading sectors for corporate PPAs are manufacturing, education, utilities and governments. Strikingly, there is a wide diversity of sectors now with a PPA – encompassing most sectors of the Australian economy.

“While large corporate buyers led the way in the early deals, there has also been a series of deals with smaller and mid-sized buyers – like schools, vineyards and even the Sydney Opera House,” said Briggs.

World Wide Fund for Nature-Australia’s CEO, Dermot O’Gorman said the “explosion of interest” in corporate PPAs was reflected in the more than 240 member organisations joining BCR-A in its first year. “Corporate buyers are putting their money where their mouth is and it’s time for our governments to step up and provide strong renewable energy policies to match the corporate interest,” O’Gorman said.

Unstoppable tide

BRC-A, a collaboration between the WWF Australia, Climate-KIC Australia and the Institute for Sustainable Futures at the University of Technology Sydney, expects the market interest and activity in corporate PPAs remains very strong.

After a rush of corporate PPAs in 2018, there was a slowdown in the number of finalised agreements during the first half of 2019, the report states. Almost 25 agreements were announced in 2018, but there was just five new PPAs in the first half of 2019 – mostly small retail PPAs, but activity has picked up again recently with five PPAs announced in the third quarter. The interest in BRC-A services is also growing strong.

“In just one year, we have grown to support over 240 member organisations, including about 80 buyers members, 90 developers, 60 professional service providers and 16 industry partners. This year we’ve held sold-out PPA training bootcamps in Sydney and Melbourne, and will deliver more training in 2020,” said Monica Richter, WWF-Australia’s Senior Manager, Low Carbon Futures, and Project Director, BRC-A.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.