Before the the green “horsepower” bolts as falling battery prices put electric vehicles within reach of more Australians, Infrastructure Partnerships Australia (IPA) is advocating for a road-use charge on EVs to help maintain funding for road network build-out and maintenance in Australia.

Road User Charging for Electric Vehicles, a report published by IPA last week, warns that fuel excise, which represents 37% of the total funds raised from road users in the financial year 2017-18, “is in terminal decline” and that the costs of road infrastructure will increasingly be borne, by drivers who can least afford it — those, such as tradespeople driving internal-combustion-engine (ICE) cars who require their vehicles for work, those who can’t afford electric cars or newer, fuel-efficient vehicles, and those who live in areas with poor public transport alternatives to driving.

The trend toward revenue decline writes Adrian Dwyer, CEO of IPA in the introduction to the report, “started many years ago as vehicles became more fuel efficient and is set to fall off a cliff as a wave of electrification hits.”

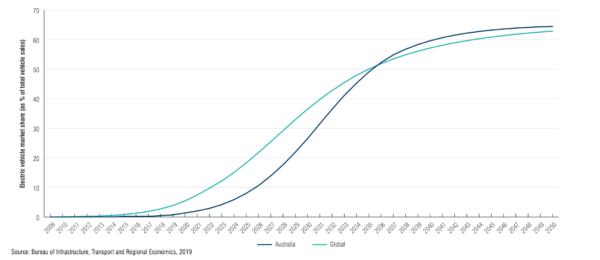

The wave, or the S-curve of electric vehicle adoption has not yet hit Australia, but the Australian Electric Vehicle Market Study Report jointly produced last year by the Australian Renewable Energy Agency and the Clean Energy Finance Corporation, estimated EVs would achieve price parity with internal-combustion-engine vehicles in the mid 2020s, at which point sales would take off.

Graph: Infrastructure Partnerships Australia

One of the drivers of consumer purchase of EVs is the reduced running cost of vehicles that have fewer moving parts, and that can draw on home solar systems to recharge: the Queensland Government’s Compare electric vehicle costs guideline released this year, estimates that electric vehicle charging costs are $3.75 to $50 per 100 kilometres traveled, which is 60% to 90% cheaper than fossil fuel from the bowser.

IPA has modelled a 4 cents per kilometre charge on electric vehicle drivers, calculating that the cost of running that vehicle over eight years will still be at least $3,600 less than the cost of running an equivalent ICE vehicle.

The 4 cents/km levy was formulated to equalise the tax contributions of EVs and their petrol-fueled counterparts, and the report claims such an impost will not disincentivise the uptake of EVs.

“On the contrary, a road user charge could provide the catalyst for strong growth in the electrified fleet by providing potential electric vehicle buyers with certainty about the future road funding arrangements,” it says.

Dwyer acknowledges the lack of appetite for reform of funding for roads, with a 2016 Federal Coalition agreement to advance reform now languishing.

That said, Dwyer suggests that,“Treasurers around the country are looking for ways to boost the productivity of their economies, and they need look no further than levelling the playing field on how we pay for roads.”

He adds that there will be “a large first-mover advantage in claiming an ongoing revenue stream that is stable, reliable and immune to inflation or economic downturns.”

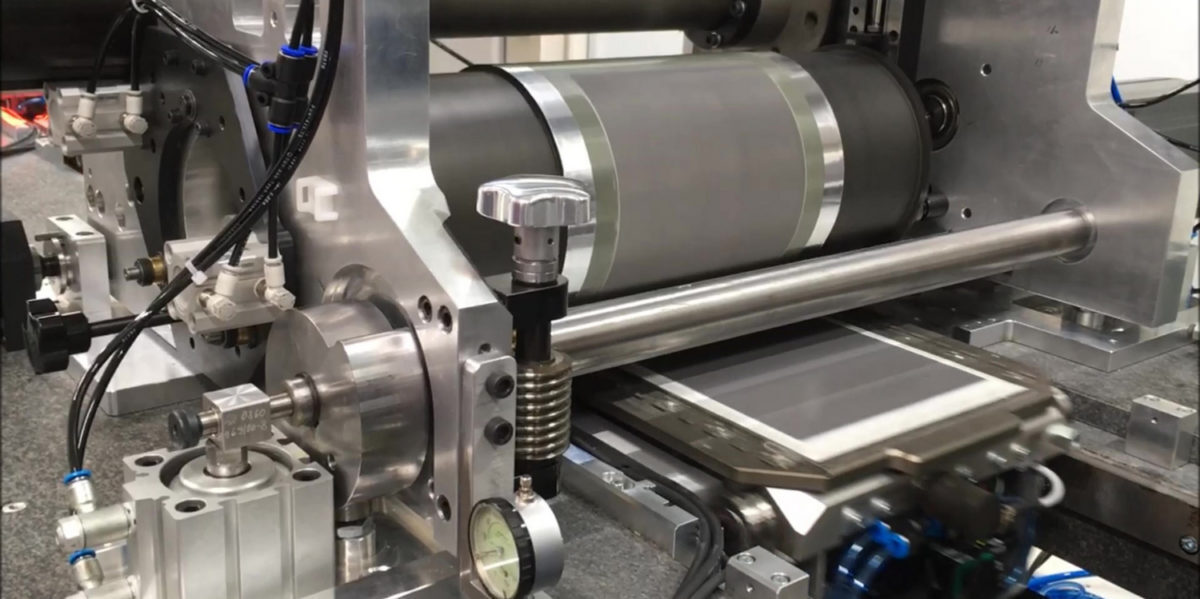

Image: Infrastructure Partnerships Australia

EV benefits worth incentivising

Transport is one of the fastest growing emissions sectors in Australia, having almost doubled its output over the past almost 30 years: from 62 Mt CO2-e in 1990 to 102 Mt CO2-e in mid-2018.

Accelerating the transition to electric vehicles represents an enormous opportunity to slash emissions, and improve air quality and therefore health outcomes for Australians.

The Australian Vehicle Council this year released a report, Cleaner and Safer Roads for NSW, that found vehicle emissions are responsible for 60% more deaths than motor vehicle crashes, and it estimated that every fossil-fuel-powered vehicle creates an average health cost to society of $7,110 over a ten-year period.

Australia’s Federal and state governments are currently doing nothing or next to nothing to incentivise electric vehicle uptake, despite calls to at least exempt EVs from the Luxury Vehicle Tax which applies to vehicles of $66,331 or more … when the on-road cost of an EVs typically ranges from just under $60,000 to $100,000.

The Electric Vehicle Council’s August 2019 report on the State of Electric Vehicles in Australia, highlighted that with significant mineral resources and a highly skilled workforce, Australia could benefit economically at every stage of the electric vehicle supply chain.”

It cited Australian innovators such as SEA Electric, which is winning more orders for its medium weight commercial electric vehicles overseas than on its home turf, and said, “Increasing the domestic electric vehicle market has the potential to reinvigorate automotive manufacturing in Australia and create tens of thousands of jobs in new adjacent industries.”

In recognition of the environmental and economic benefits of rolling the country’s car fleet over to EVs, the IPA report says, “Depending on their policy agenda, a government may also choose to provide a discount on a road user charge or registration fees for a number of years,” to ensure electric vehicles will pay less road tax than their petrol or diesel equivalents.

Whether tax revenues, emissions reductions, health benefits or sheer economics can drive governments to act remains to be seen.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

And let’s apply a carbon tax to engines above 2 litres. Too many people driving cars that are oversized