The Australian Energy Market Commission (AEMC) has released its annual report on electricity price trends this morning. The report predicts that the trend of dropping energy prices is set to continue through to 2022 across most states. The trend’s continuance is due to more generational capacity, of which that provided by large-scale renewable projects is particularly responsible.

Over the three years modelled by the report, consumers are expected to save somewhere in the range of $97 on their electricity bills. AEMC Chairman, John Pierce, said the 10th price trends report shows costs falling across the three critical drivers of consumers’ bills.

Generation costs are falling due to the new generation entering into the grid, particularly large-scale renewable projects which are more than making up for the ongoing retirement of coal-fired power stations. AEMC made specific reference to the total capacity of omitted projects including 2,338 MW of solar, 2,566 MW of wind and 210 MW of OCGT.

Similarly, the cost to the consumer brought about by “green schemes” is set to fall in tandem with the fall in Large-Scale Generation Certificates. Now that investment in renewable energy is not only standing on its own two feet but veritably sprinting past its dirty rivals, the cost of “green schemes” is necessarily falling. Additionally, regulated network prices are lowering in response to falling distribution costs.

- Wholesale costs are estimated to fall by around $62 from FY19 to FY22 for the representative consumer as more supply comes into the market and demand remains flat.

- Network costs are estimated to decrease by $11 over this period.

- Environmental costs are estimated to fall by $21 over this period.

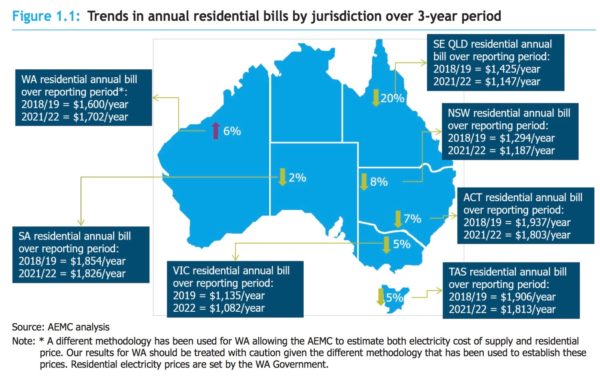

“While the overall national trend is down across the supply chain there are regional differences across states and territories that will affect price outcomes depending on where you live and how much electricity you use,” noted Pierce. “Overall, a representative consumer will pay around $97 less than today by June 2022.”

From FY19 to FY22:

- Southeast Queensland electricity prices estimated to fall overall by 20% or $278 (an annual average drop of 7.0%).

- South Australia electricity prices estimated to fall overall by 2% or $27 (an annual average drop of 0.5%).

- Victoria electricity prices estimated to fall overall by 5% or $53 (an annual average drop of 1.6%).

- NSW electricity prices estimated to fall overall by 8% or $107 (an annual average drop of 2.8%).

- ACT electricity prices estimated to fall overall by 7% or $134 (an annual average drop of 2.4%).

- Tasmania electricity prices estimated to fall overall by 5% or $93 (an annual average drop of 1.7%).

- Western Australia electricity costs are projected to rise by 6% or $102. However, actual price outcomes may be different due to different regulatory arrangements in Western Australia.

The Northern Territory (NT) was excluded from the report as the data previously supplied by the Department of Treasury and Finance (DTF) is no longer an accurate representation of wholesale costs after the entry of independent generators in the Darwin-Katherine Interconnected System (DKIS).

South-East Queensland is set to see the biggest price fall, driven by the influx of committed renewable generation including 595 MW of solar and 496 MW of wind. “New renewable generation mean that prices of electricity are lower during peak renewable production periods,” said the report, “which may lead to lower wholesale electricity purchase costs depending on the hedging profiles of retailers.”

The report found a similar trend across the states, such as New South Wales, which has a new committed generation capacity of 1,171 MW of solar.

The only state AEMC predicts to see its prices increase in the next period is Western Australia (WA), a prediction based on the continued increase in gas prices. Gas generation supplies around 60% of WA’s electricity.

Of course, the AEMC is quick to note that despite the in-depth analysis involved in the production of this report, the energy market is a living network, liable to sudden shifts in mood and temperament. “More supply puts downward pressure on prices,” said Pierce, “but it’s important to note that over a decade of analysis we have seen trends change sharply in response to factors such as sudden generator closures and implementation of new policies. As such, all price projections should be seen as just that, projections.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.