Room size says it all: from one year to the next, the emphasis of Informa’s February renewable-energy festival has flipped to give the Pumped Hydro and Battery Storage Conference the bigger venue, and the Large-Scale Solar Conference the smaller space — symbolic recognition that the opportunities for large-scale renewables will be cramped without the commercialisation and upscaling of firming, flexible storage.

Perhaps that’s too glib, perhaps the big room was just to accommodate keynote speaker, former Prime Minister Malcolm Turnbull, who as father of the future incredible bulk known as Snowy 2.0, would be talking under water.

But consider this from Dan Sturrock, Director of Business Development and Transactions at the Australian Renewable Energy Agency (ARENA), which is charged with investing to accelerate the national shift to affordable, reliable renewable energy: “We’ve really moved from that focus on the generation side into the flexibility side — pumped hydro, batteries, distributed energy, demand management and hydrogen.”

And this from Dr Alex Wonhas, Chief System Design and Engineering Officer at the Australian Electricity Market Operator (AEMO), “Renewables are coming at a rapid pace. We need firming of those renewables…

“Let’s utilise all the opportunities we have,” said Wonhas, referring to pumped hydro, distributed energy resources and behind-the-meter storage. “Let’s utilise large-scale storage, and maybe let’s also utilise gas,” he added in rapid succession as if he were about to be engulfed by an infirmary of renewables. “The important thing is we need to get on with it because it’s coming at us hard and fast.”

In Wonhas’ estimation, which referred to AEMO’s Draft 2020 Integrated System Plan, and in particular its Central Scenario (one of five possible energy-transition scenarios mapped out in detail, the Central Scenario is determined by market forces and current federal and state government policies) Australia needs around 16 GW of dispatchable resources to firm the pipeline of variable renewable generation.

Rush of renewables unabated

His fellow panellist, in the big room at Informa this week, Mark Williamson, Executive General Manager of the Clean Energy Regulator (CER), begged to adjust; Williamson said the Australian energy landscape is already well ahead of the Central Scenario and may even be outpacing the Step-Change Scenario, the most fast-moving of the five possible system evolutions, and characterised by simultaneous consumer-led and technology-led transitions.

According to Williamson, the whole of Australia posted a record level of renewables in 2019, totalling 6.3 GW of combined rooftop solar and utility scale renewables; and he predicted the country would see more than 6 GW delivered again in 2020.

He quipped that for utility-scale renewable assets, “delivered renewables” referred to those that the CER has accredited for entry into the renewable energy target, “but typically, with a few minor grid issues we’re having, there’s a bit of a delay between when we accredit and when AEMO allows connection and ramping up in a staged way.”

As a result of these “minor” issues of delayed connection and curtailment, he said, much of the capacity accredited in late 2019 would only reach full generation capacity in mid-2020. Add in off-grid resources projects, and “a lot of sub-30 MW solar power stations just under the AEMO radar” and 2020 will see “the biggest ever step up in total renewables generation we’ve seen, and 2021 will again be around those record levels,” said Williamson.

For Williamson, too, the need was rampant for a quantum leap in flexible capacity, such as pumped hydro storage, big batteries, and DER, enabled and exchangeable via improved grid interconnection.

The big room then, should have been buoyant, and some winning battery-storage projects were showcased: Hornsdale Power Reserve, Infigen’s Tesla-battery-based Lake Bonney project; and ElectraNet’s substation-connected, grid-strengthening, reliability-enhancing Dalrymple ESCRI project were among them.

Image: ARENAWire

Large-scale energy storage on the commercial verge

However, none of these demonstrator projects would have broken ground without millions of dollars worth of subsidy, and the commercial viability of most large-scale storage, both pumped hydro and large-scale batteries, is still less than marginal.

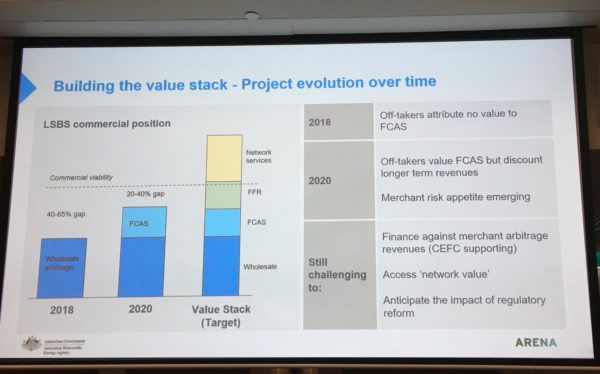

As Sturrock put it, in a session titled Large-scale battery storage — the road to commercial viability, “It does feel like we’re on the cusp, but it’s always quite hard to know where you are on the cusp.”

He said the battery projects assisted by ARENA were developed to demonstrate the different capabilities of batteries and their potential contributions to the NEM and renewable-project viability, and had boosted in-country expertise in battery deployment and grid connection.

“It’s been pretty tough to date,” he said, referring to the travails of retrofitting a 25 MW/50 MWh Energy Storage system to Edify’s Gannawarra Solar Farm, and other projects that faced location-specific hurdles. “Every project has been a first of its kind, but hopefully that becomes a smoother path so we can get these projects built quickly and increasingly cost effectively.”

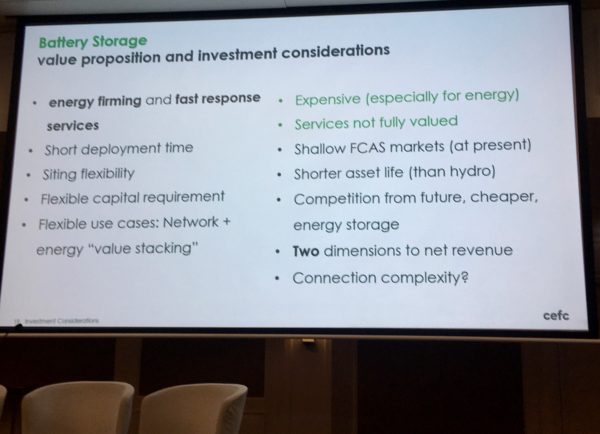

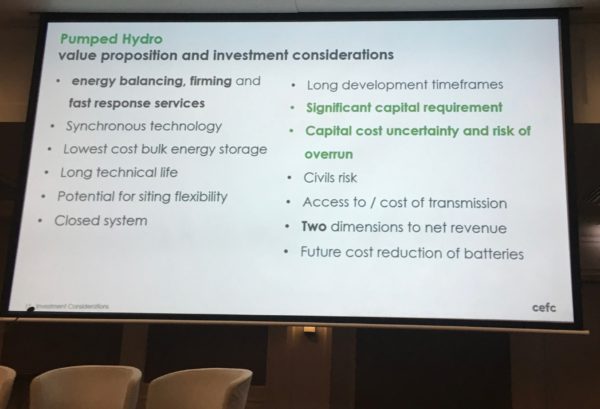

Both pumped hydro and batteries remain risk-riddled propositions for investors, said Simon Brooker, Executive Director of the Clean Energy Finance Corporation, who listed the pros and cons of each technology (see slides below).

Image: CEFC

Image: CEFC

Said Brooker, “It’s really hard to finance large-scale investment in a merchant price environment where the underlying market is transitioning rapidly to an unknown future state.”

A battery of vital capabilities

Sturrock at ARENA, which frequently works in tandem with the CEFC to finance projects, says installations such as Hornsdale have shown that batteries can deliver fast response and that they can succeed in arbitrage trading and trading in FCAS markets; Dalrymple ESCRI has demonstrated grid-forming capability and its ability to support “islanding” or self sufficiency during outages elsewhere in the grid …

And yet, these case studies are mere precursors to regulatory changes required in order for battery developers to access revenue streams that will continue to fill the value stack, that could make them bankable in their own right and freestanding of subsidies.

He says a number of projects now have a 50% value gap to fund, but ARENA is seeing quite a few projects in the range of 20% to 40% gap, and it has some in its portfolio at 20%, but these, said Sturrock, “haven’t reached financial close yet — watch this space as to whether some take another step towards that commercial line”.

Divining new revenue streams

“I think the big question,” said Sturrock, “is are there some new revenue streams that can be unlocked at scale?”

Energy and FCAS are the only price signals currently provided by the market, but, said Ali Asghar, Senior Associate in Power, Energy Storage and Electric Vehicles at BNEF in Australia, and on the panel with Wonhas and Williamson, “We know we need capacity to meet peak demand, we know we need inertia response, we know we need reactive power.”

Such qualities were undervalued when they were inherent in conventional generation, argues Asghar, but if the market could recognise them as services that variable renewables cannot provide … “That’s where firming or flexible technologies come in. They could participate in the market where conventional renewables cannot,” providing those services that are essential to the functioning of the grid.

Nothing other than the Federal Government stands still in the transition to renewable energy. Through its Clean Energy Innovation Fund, the CEFC is funding new technologies, such as Relectrify’s large-scale battery packs made up of masses of still high-capacity discarded electric-vehicle batteries — a growing, ready-made storage resource that will change the game for some projects.

Build it fast or fail

Overall, Wonhas poses that Australian government and regulators need a change of mindset to bring gigawatts of enabling infrastructure, such as interconnectors and dispatchable storage options forward in the transition timeline.

He says that historically, the mindset has been, “Let’s build something when we definitely know we need it.” But, “We need to acknowledge that the energy sector is going through a massive and rapid transition, and we need to build those assets ahead of those events occurring.”

As Prime Minister, Turnbull may not have managed to bring the National Energy Guarantee to fruition, but he was prophetic in taking full government ownership of Snowy Hydro Limited and getting the ball rolling on Snowy 2.0, which comes with its own difficulties and a long timeframe to delivery, but did anticipate large-scale storage demand.

A multitrack train is hard to gauge

Asghar said at Informa, “We often get the pace of change of what’s happening in the NEM quite wrong.”

For example, he said, “The market will tell you right now there’s no point building more renewables.”

And yet the progress of independent chains of events — energy consumers deciding to install rooftop solar, states building renewables to fulfil their own population needs and decarbonisation goals, businesses demanding a sustainable source of electricity and sourcing/building their own — drives in more renewables than market signals themselves would encourage.

The resulting effect on energy-prices, says Asghar will likely drive coal-fired operators to retire plants before their expected end of life.

At that point, from a renewables perspective, there might be even be an oversupply of renewable megawatt hours to serve consumers, but “we may not have that dispatchable capacity when we need it”, and at the moment, he says, there aren’t enough signals in place to ensure that we will have enough capacity in the NEM.”

Australia needs to increase the size of its energy-storage room.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.