For the past five months, five solar farms in the south-west New South Wales and western Victorian region have been curtailed by 50% in their output to the National Electricity Market (NEM); these are joined by 45 renewable assets in the area with connection to the grid now contingent on novel solutions and future improved transmission capacity.

AEMO says five of those generators are at the point of commissioning but now on hold, 15 generators are committed to connect and 25 generators are at the point of applying for connection.

As the queue grows, solar developers are weighing their options; as causes are more clearly articulated, AEMO and the industry are focused on minimising impacts and inching forward in a literal one-at-a-time connection conga line that could stretch well into 2021 and beyond.

On the weekend, AGL Chief Executive, Brett Redman told the The Weekend Australian’s ‘Inquirer’ that, “The market is working out how to bring through the large amount of investment that is going on and will be needed”, but in the context of the coming decade it will be seen “as more of a blip than a catastrophe”.

The Victorian State Government’s move last week to sidestep some rules that govern operation of the NEM with legislation to fast-track priority projects such as transmission upgrades and supply-smoothing grid-scale batteries, is a sign that courageous actors can find ways to overcome the impasse.

French-based renewable energy developer Neoen’s decision last week to seek liquidated damages (damages pre-determined in a contract for delivery of services, usually providing for compensation for delayed completion) from EPC Siemens Gamesa, for delays in commissioning of its Bulgana Green Energy Hub due to connection challenges signals likely ripple effects from the West Murray bottleneck.

Image: AEMO

In an interview with pv magazine, the Clean Energy Council’s (CEC) Director of Energy Transformation, Lillian Patterson outlined current and future steps for members of the industry organisation.

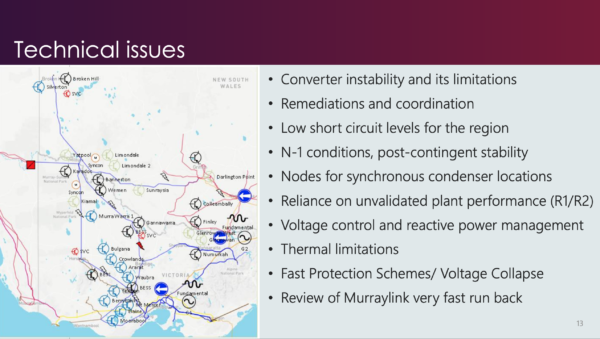

pv magazine: What do you understand to be the problem in south-west NSW and Victoria?

Lilian Patterson: It is a highly technical complex issue and it stems from the fact that it is a very weak part of the grid. My understanding is that they’ve observed some oscillation issues to do with the five existing solar farms there, which makes it a very difficult operational environment — a difficult environment in which to connect more generation while ensuring that we continue to maintain system stability in that area.

Image: AEMO

You recently chaired a meeting of CEC members. What were the feelings expressed?

We have a group of affected members and we’ve met twice now, once before AEMO’s big forum on 10 February, and we had another one last week.

There certainly is a feeling of frustration and a real concern that this will lead to delays for projects. [But] AEMO’s forum was really helpful in providing clarity. I think a lot of people may not have understood the problem, they may have felt they weren’t getting the same information as the next person. Having that forum helped to get everyone on the same page.

Is there acceptance that this may have been a genuinely unforeseeable problem?

I guess it’s hard to say whether it was fully foreseeable. I think there is recognition that there is a lot of inverter-connected generation going into the system, and that’s really changing the dynamics of the grid.

There was talk that inverters can be retuned to alleviate their effects on stability of the grid?

The five operational solar farms that are being curtailed 50% are going through a retuning process at the moment. My understanding is that it’s not simple, and it’s taking some time.

How can so many generators have progressed so far in the complex connection process, to now be delayed by a year or more in supplying their electricity to market?

What our members want now is to ensure that generators can still connect. While a sequencing process may lead to some slowdown in connections, if that is the only way forward, then they want to ensure that that sequencing process is as robust and transparent as it can be to ensure that it can be moved through as quickly as possible.

Which solar farms are affected?

One of the difficulties is that there is no public list of affected projects. AEMO only confirmed the sequencing approach at its forum and since then we’ve been gathering member feedback.

It’s not necessary to know who is in front of you or behind you, it’s more about where you are in the queue; people want to know that they are No. 5 and a timeframe around when their project might be addressed.

Some of these projects aren’t our members. I’ve accounted for I’d say around 80% of the affected projects, just from the conversations I’ve had with members. Some of them are also a little uncertain about whether they will be affected or not; they might be at the fringe of the issue and obviously they’re really hoping they will be ruled out as being affected and will be able to continue through the regular process.

Could delays of nine months or more push some renewable developers to the brink?

No member has explicitly told us that, but people are really questioning what this means for their project. And it’s possible that projects that are further towards the back won’t proceed. What that means for any particular business is hard to say at this stage.

Were you talking about workarounds at the AEMO forum?

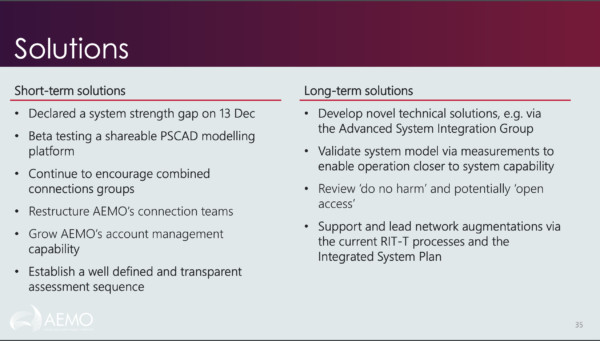

There were some ideas. I think AEMO is still keen to pursue looking at novel solutions. Sequencing is the first step, but they want to engage with industry and work collaboratively on what else can be done.

Image: AEMO

We talk a lot about interconnectors, but this is a problem of local transmission line isn’t it?

My understanding is that this is a local transmission issue. Interconnectors such as EnergyConnect coming on and the VNI upgrade will assist this issue, but AEMO is aware that those upgrades are a long way off still, so something needs to be done in the interim.

Oliver Yates went so far the other day as to suggest that there is a deliberate go-slow in terms of the Government’s directives to AEMO and the Australian Energy Regulator and the AEMC. Do we have reason to believe that this is some underlying reluctance to give renewable energy the infrastructure it needs to succeed?

We recognise that the transmission framework and the rules were set up at a time when the need to build a lot more transmission wasn’t foreseen. The regulatory investment test for transmission is supposed to allow for customer protection, to ensure that consumers don’t pay for transmission that isn’t needed. That has meant the process is really slow.

As to the extent to which governments could address that better … We’re seeing some movement in the actioning of the ISP rule changes; Victoria came out with its announcement for transmission; the NSW-Commonwealth Government agreement looked at underwriting a lot of transmission such as Hume Link and QNI, so I think governments are moving more on transmission.

What are next steps for the CEC on behalf of its members?

We have prepared feedback on the AEMO proposal at the moment, which is in the form of questions about the sequencing proposal. There’s a lot of detail that needs to be worked through. We’re also talking to AEMO about how we can facilitate conversations with our members, whether we can perhaps hold a series of workshops looking at other technical solutions. We’re looking at how OEMs can assist with the PS-CAD modelling side of things. The role that batteries could play is also on the list of things to work through with our members and AEMO.

What’s helpful in overcoming this significant bottleneck on the road to transition?

I think what’s helpful is to focus on looking forward. We can look back and ask who is potentially to blame, but from our perspective what’s helpful is we’ve acknowledged that this highly technical and complex issue has arisen, how do we work together to address it rather than finger pointing.

What’s really important about this piece of work is that it could set a precedent for when similar problems arise elsewhere in the network. It is highly likely that complex system-strength issues will arise throughout the network, so we’re keen to ensure that what happens here sets a good precedent for how these issues are managed in the future.

Part of that is a process: if it arises how do we deal with it? At the moment we have the “do no harm requirement”: every connecting generator has to complete an impact assessment to see whether they do harm to the system; if they do they have to go down the route of system-strength remediation, which in a lot of cases has meant adding a synchronous condenser. We are seeing a complete over build of synchronous condensers in the system and that doesn’t feel efficient. So I think through this process we’ll be considering how we’re going to fix that.

And part of it is addressing how the rules can be changed for this kind of issue. For example, who is best placed to be responsible for system strength?

What impact do you think the West Murray challenges will have on investor confidence?

We know there’s been a 50% drop in investment in the past year, which is really concerning. Investor confidence is at a low and it has reduced significantly for a number of different reasons. A lot of people are watching the West Murray issue. A lot of our members [outside the affected area] want to know what’s happening because they want to know what it could mean for them. For example international players need to report back to their head offices, and that goes to the investability of Australia in general. We are concerned about the sentiment in the industry at the moment, and that’s why it’s really important for us to address this as a priority.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.