Following a year marked by grid challenges that took a toll on the renewable energy industry in Australia, Covid-19 is threatening to grind to a halt a host of solar and wind projects this year and beyond. According to Norwegian consultancy Rystad Energy, the pandemic will hit the industry hard, postponing or canceling the financial close of up to 3 GW of projects.

The delays and cancellations are largely the result of the falling Australian dollar, which has hit a 17-year low and plummeted 20% relative to the US dollar since the beginning of January. Given that key components are typically procured in US dollars, this has resulted in capex increases for both utility-scale PV and wind developments, making once viable projects no longer economical.

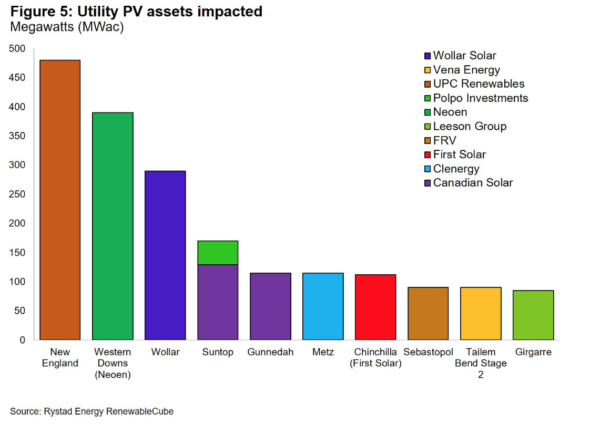

According to Rystad Energy, New South Wales looks set to take the hardest hit since 65% of solar PV and 67% of wind projects that are expected to, but have not yet reached financial close in 2020, are located in the state. Utility PV companies most impacted include UPC, Neoen, Wollar Solar and Canadian Solar, while Tilt and Goldwind will be most impacted in the utility wind segment.

Construction slowdown

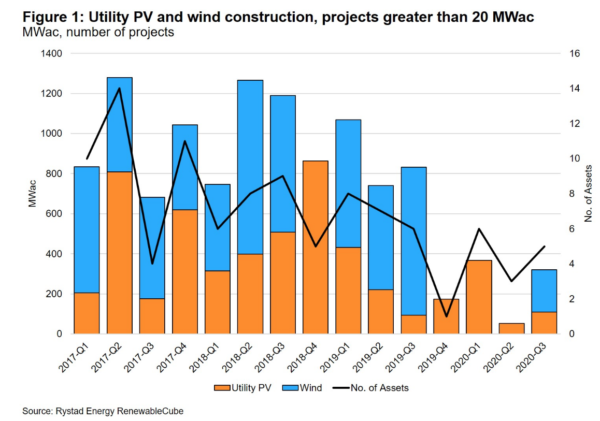

Things were far from ideal in 2019 as grid challenges, including network capacity availability, commissioning issues, Marginal Loss Factors (MLF) and system strength variability, took center stage. Coupled with already challenging project economics, these issues slowed the number of projects and associated capacity to break ground at the end of 2019, Rystad finds (Figure 1). In the last quarter of 2019, less than 200 MW of PV and no wind capacity entered the construction phase.

The trend continued into 2020 with less than 400 MW breaking ground in Q1. “With the additional challenge of Covid-19, the pace of construction has only slowed further since the end of the first quarter and developers now face a quagmire of infrastructural and economic obstacles,” the consultancy said.

The trend continued into 2020 with less than 400 MW breaking ground in Q1. “With the additional challenge of Covid-19, the pace of construction has only slowed further since the end of the first quarter and developers now face a quagmire of infrastructural and economic obstacles,” the consultancy said.

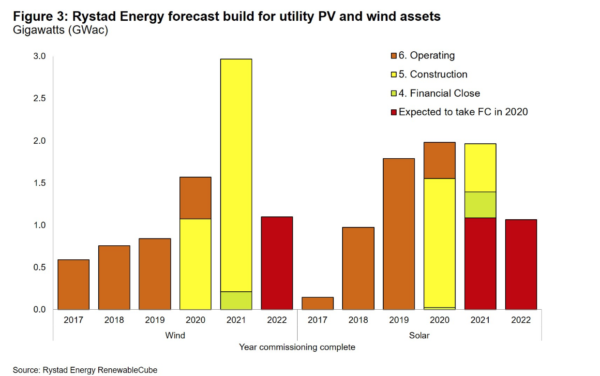

Australia was poised for a record rollout of big PV this year with up to 2 GW of projects expected to join the grid. At present, 530 MW of PV capacity has reached financial close and has either already begun construction or will do so in 2020. However, the consultancy expects that the impact of Covid-19 on project economics will likely delay or cancel the financial close of the remaining projects.

The list of impacted solar farms with financial close in question is long (Figure 5) and includes some of the most significant developments on the grid. These projects are expected to constitute a significant part of the PV pipeline in 2021 and 2022 (Figure 3).

PPA market turmoil

The majority of capital expenditures for utility PV and wind assets are for hardware, comprising about 60% of expenses for PV and 75% for wind. As hardware is typically priced in foreign currency, mostly in US dollars, the depreciation of the Australian dollar has had a substantial impact on project economics already resulting in a slowdown of orders that were otherwise imminent.

While predictable cash flows under long-term contracts make a perfect bedfellow for solar as a resource, the length of power purchase agreements (PPAs) in Australia has been shortening and is now typically between seven and 10 years. As contract lengths continue to decrease, particularly among corporate offtakers, projects are scrambling for second or even third PPAs. Driven by heavy build-out, PPA prices have plummeted, ensuring that only the lowest-cost projects come forward.

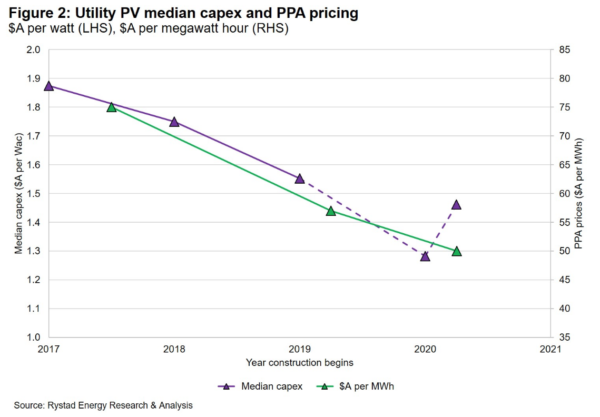

As shown in Figure 2, PPA pricing has expectedly followed PV capex down the cost curve over the years. However, as capex has increased in recent months with rising hardware costs, developers will now face even greater challenges to profitably meet PPA pricing, Rystad Energy finds. “Furthermore, securing debt will be an obstacle in the short term, given that cash is now a scarce commodity; financiers are unlikely to lend cheaply,” the consultancy says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.