As markets around the world brace for the economic impact of the COVID-19 pandemic, PV manufacturing operations are reportedly beginning to return to normal in China. On the demand side, many questions remain unanswered and dependent on the way in which individual countries respond to the outbreak.

Analysts at BloombergNEF and PV InfoLink say significant contraction is likely this year, but some companies, as Byron Bay-based solar retailer Smart Energy, are reporting record sales with consumers panic buying solar and storage to shore themselves up in uncertain times. In its latest webinar, the Smart Energy Council (SEC) is looking into the impact COVID-19 could have on the supply and demand in the residential and commercial solar and battery storage market.

“I don’t want to pretend that this a trivial disruption, this is a very significant disruption,” John Grimes, SEC Chief Executive, Smart Energy Council said in its opening remark, inviting participants to discuss the potential impact and the measures to help protect business over the next six month.

Weaker dollar

The COVID-19 outbreak coincides with the slide of the Australian dollar, which plunged to as low as US55.10¢ on Thursday, its lowest level since 2002. While depreciation could be good for certain sectors, such as tourism, under normal, non-COVID 19 circumstances, imported goods are likely to experience a price hike. In the case of solar panels, the impacts could be big, according to Lliam Ricketts, Director of Supply Partners. “Most of the products come in US dollars so the base price will be affected,” he said.

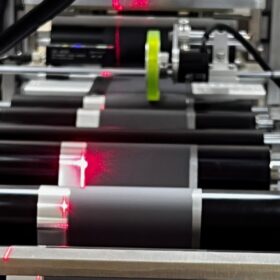

From a distributor’s perspective, Ricketts said consumer demand is definitely still there in the residential PV arena, but so is limited supply. “We are seeing a normalization in supply and many panel manufacturers returning to 60% or more of their manufacturing capacity,” he told the SEC webinar. “Unfortunately, some factories which are running at say 60% are allocating products to other countries that pay a higher premium, and since Australia is a discount market, we are still seeing some limited supply.”

While an economic downturn can make life really difficult for businesses offering nonessential services, solar PV provides electricity, a commodity that everyone needs. Therefore, according to Ricketts, it is crucially important to continue to market through this period.”As a wholesaler, we are in the best industry you can be in at these times. Energy is an essential service and those power bills are not gonna stop coming to households and businesses,” he said, adding that marketing efforts are essential right now.

Unprecedented disruption

Commenting on the situation from a retailer’s perspective, Sam Craft, Operations Manager at NRG Solar, said industry players had been talking about a two to eight-week delay in the panel, inverter and battery supply. “As an industry, we’ve seen it all but this is a new type of disruption,” she said, adding that the industry may be facing consolidation and “unfortunately, some business may not survive”.

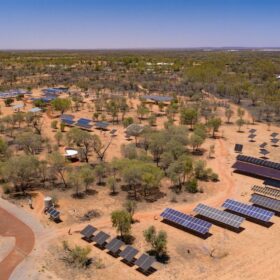

The Adelaide-based company saw a dive in inquiries and sales as the coronavirus hit Western countries in early March, which actually according to Craft, is not unusual at that time of the year. However, she said that there has been an increase in demand for batteries and blackout protection in South Australia, which could also be explained by the decreasing subsidies offered under the Home Battery Scheme. Simultaneously, a similar increase in demand for home batteries has been reported in New South Wales, particularly in regional areas where people are keen to shift to self-reliance.

“Some companies have reported their leads are down but in fact, the quality of those leads is better. So people who are now inquiring for solar are more serious about making that shift,” Craft said.

Geoff Bragg, Solar Energy Industries Association (SEIA) Vice-Chairman and SEC Secretary, confirmed that there are mixed reports from the Australian solar market, but that the industry is well-positioned to thrive under these conditions compared to other sectors of the economy. “There are very few products that save people money, remember you are selling such a product and keep marketing – we are in a pretty unique position in that regard,” he said.

While he suspects that the residential demand will drop off in pessimistic market conditions, Bragg believes there is no reason installations should not proceed. “Assuming there are no full lockdowns, good communication to the customers about safety and social distancing during installation are really important. But installations can proceed with crews keeping distance from homeowners and business owners – there is no need for personal contact,” he said.

According to Bragg, solar installers in Australia are still quite busy. “A lot of installers I have talked to are still very busy with the work coming through the pipeline and they are focused on actually delivering for customers and maintaining their reputation,” he said, adding that demand may be further bolstered by the existing government rebate programs.

This week, the Australian federal government’s “Economic Response to the Coronavirus” introduced new incentives for commercial and industrial solar PV uptake. The government has increased the instant asset write-off threshold from $30,000 to $150,000 and expanding access to include businesses with aggregated annual turnover of less than $500 million (up from $50 million) until 30 June 2020. The SEC webinar participants expect this to translate into a surge in sales and inquiries.

“I think there is a big opportunity for the 30-100 kW commercial PV space and that this area will thrive during this period with that generous federal government incentive,” Ricketts said. He went on to advise retailers who are seeing low PV sales numbers, to simply add storage to their offer.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.