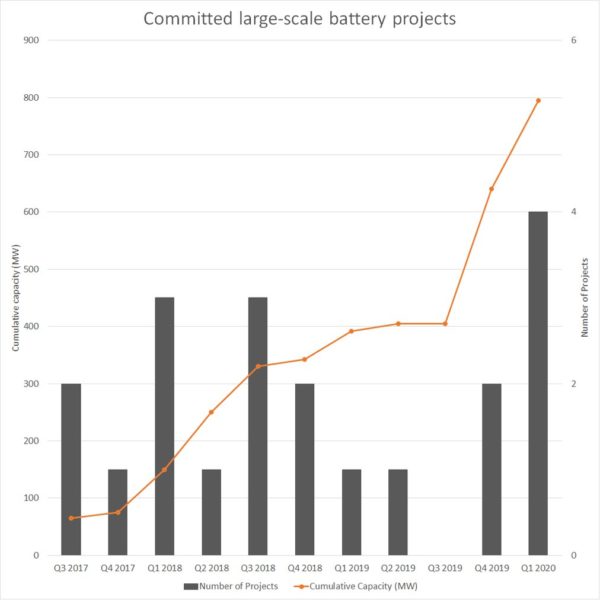

Big batteries are becoming increasingly attractive for investors as Australia’s transition to a renewables-dominated grid continues to accelerate. In the last six months alone, the level of investment in large-scale battery storage in Australia has doubled on the back of rapidly falling costs, according to an analysis by the Clean Energy Council.

From the end of Q3 2019 to the end of Q1 2020, the cumulative capacity of utility-scale battery projects has risen from 400 MW to 800 MW. This increased investment includes a 50% expansion to Neoen’s Hornsdale Power Reserve, also known as the Tesla Big Battery, which has significantly raised the profile of energy storage across Australia and demonstrated its unique capabilities. The world’s largest operating battery started testing its increased 50 MW storage capacity last week as it readies to provide a range of new grid support services, such as digital inertia.

“Battery technology is now proven and scalable, and the costs have plummeted rapidly,” said Clean Energy Council Chief Executive, Kane Thornton. “This has resulted in new investor commitments to new batteries, growing interest in battery development, and a clear recognition of the role of batteries to complement and support wind and solar and provide essential grid services.”

While they help smooth the output of wind and solar, utility-scale batteries also provide critical system services, including swift response to frequency changes on the energy system. “There is no other technology that can respond as quickly as batteries to changing frequency on the energy system,” said Thornton.

The contribution of big batteries was particularly prominent in Q4 2019 when extreme weather, interconnector failures, risk of islanding, changing nature of load and coal-fired generator outages have all combined to contribute to increased Frequency Control Ancillary Services (FCAS) requirements. As a result, the quarter saw total battery revenue of $20 million.

The new projects committed in the last six months are expected to create 3,800 jobs in their construction and translate into a big gain for the sector. As revealed in the CEC’s recent report Clean Energy At Work, energy storage currently accounts for around 6% of Australia’s renewable energy workforce (excluding Western Australia and Northern Territory), with just 1 to 2% employed in large-scale battery construction.

Need for regulatory change

Despite the value that big batteries have demonstrated both for the grid and system owners, further investment is likely to require significant reforms. According to the CEC, the incentives for battery projects to provide grid support services remain “immature and poorly defined”.

One of the most important reforms that would support the further deployment of big batteries is the shift to five-minute settlement, which would reward fast-response energy generation in the NEM like batteries, demand response providers and new generation gas peaking plants if they can quickly deliver electricity (or switch off) when the power system needs them to. However, the new rule that was due to come into force on 1 July 2021 has been put on the back burner.

Some regulatory progress has been seen on a state level. Most recently, New South Wales has changed its legislation to support big batteries installed as stand-alone projects, rather than next to existing wind and solar farms. The changes are likely to pave the way to the state’s first big battery and support new projects funded through the NSW government’s $75 million Emerging Energy Program. Under the program, the state government is looking at 14 big batteries out of 31 dispatchable electricity projects that have been awarded funding.

However, the CEC underlines that there is still a lot to be done as market arrangements need to be changed to value the grid services provided by batteries and improve how batteries are integrated into the National Electricity Market. “Batteries, along with extended duration storage solutions such as hydro and pumped hydro, will play a critical role in supporting the generation of wind and solar as the lowest cost forms of generation in Australia,” Thornton said. “Investors are clear that these are the energy technologies of the future.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.