Think tank Climate Energy Finance (CEF) says global energy markets are being reshaped by solar’s disruption, which is happening at speed, turbocharged by battery energy storage system firming.

A new CEF report, International Solar PV and BESS Manufacturing Trends, finds key market factors are triggering solar’s global chain reaction, which is dramatically reshaping the world’s energy landscape.

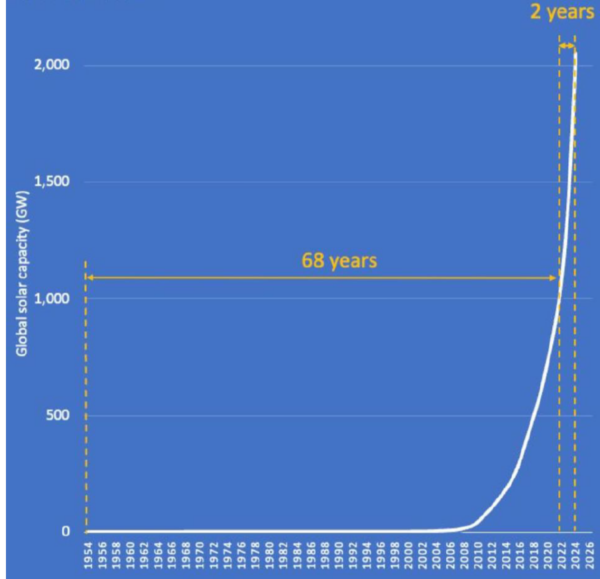

Price deflation, manufacturing capacity and record-breaking deployments have set solar installations on track globally toward 1,000 GW by 2030, bolstered by BESS deployments making solar competitive with fossil fuels.

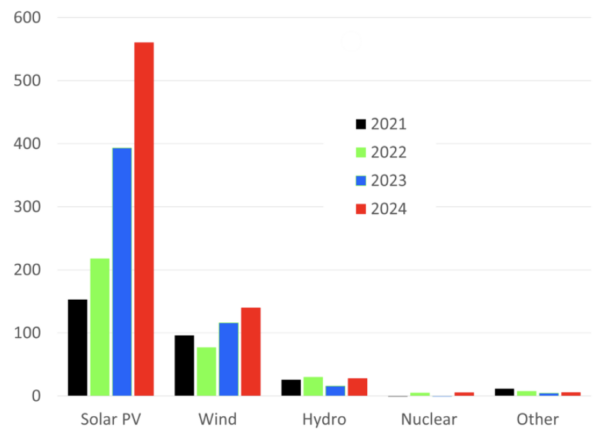

Image: Climate Energy Finance

The report says key drivers of solar’s rise include rates of unprecedented deployment of solar installations, which hit almost 600 GW or 100 times the rate of nuclear deployment in 2024, almost half of which was done in China, which installed 277 GW in 2024, five times more than the United States.

The global solar module supply chain manufacturing capacity has expanded over 2024 and into 2025, despite a 50% year-on-year (yoy) solar module price reduction, and global manufacturing capacity will exit 2025 at triple the 2024 solar install rates, the report says.

A third key driver is polysilicon prices dropping by almost 50% in China (falling to around $8 (USD 5)/ kg), and 20% globally, which helped lower solar module prices by 37 to 46% yoy, while reduced component costs reduced by oversupply and technological acceleration are expected to halve solar capex costs by 2030 to $636 / kW (USD 400).

Perovskite tandem solar cells potentially moving from about 25% to 35% efficiency within a decade will further reduce the cost per watt, combined with the potential of BESS at utility scale and in electric vehicles (EV), solar value will further unlock.

Image: Gavin Mooney, EMBER, Global Solar Council, February 2025

The report highlights EVs as a source of future storage capacity, with up to 2,359 GWh of capacity across the fleet by 2050, citing an Australia Renewable Energy Agency (ARENA) study, which found an average EV in New South Wales (NSW) could earn up to $12,000 per annum by providing frequency control ancillary services (FACS) to the grid.

The drop in lithium-ion battery prices fell 20% in 2024 into 2025, with further declines predicted, while BESS capacity globally reflects a yoy growth of 103% on the back of 70% of the world’s BESS deployments being done in China (78 GW / 184 GWh) and 93.6% of installed BESS globally, originating from Chinese companies.

Of those BESS, the report says, 30% were co-deployed with solar, with 350 GWh or BESS expected in 2025, and a projected 1 TWh projected for the global project pipeline in 2025-2030.

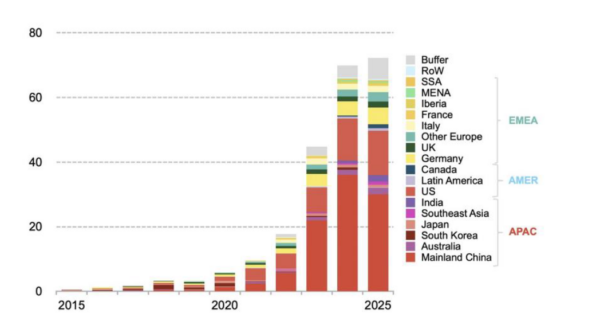

Image: Volta Foundation

A final key driver for solar’s transformation of the global energy market is the accelerated manufacturing in China of solar and BESS technologies, which though in overcapacity, positions China as the dominant market player, having control over 80%-95% of both supply chains.

China’s module production capacity stands at almost 1.2 TW out of a global total of 1.5 TW, the CEF says.

“Most future capacity is expected to be built in China, and despite likely industry consolidation of lower-tier manufacturers, Chinese companies have announced plans for 163GW of further manufacturing capacity across the supply chain, signalling no price recovery on the horizon and the continuing relentless erosion of the economics of fossil fuel generation,” the report says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.