Investment is a lot like going for a swim, in that investors like a clear strategy as a swimmer likes clear waters. The veracity of such an analogy can be found in the Clean Energy Council’s (CEC) most recent Clean Energy Outlook – Confidence Index. The survey of industry executives shows that despite the continuance of federal policy ambiguity, and the economic impact of the Covid-19 pandemic, investor confidence is up across both small and large-scale renewables thanks mainly to state governments’ positive statements and clear strategy for the energy transition, particularly New South Wales (NSW).

Investor Confidence

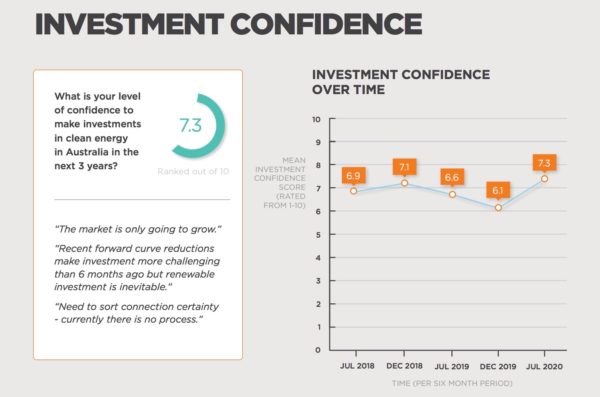

Back in December 2019, investor confidence was at its lowest in recent memory. After a year punctuated by grid congestion, curtailment, transmission losses, negative power prices and the petering out of the federal 2020 Renewable Energy Target policy, investors reported a confidence level of only 6.8 out of 10. Indeed, according to data compiled by Bloomberg New Energy Finance (BNEF), investment in Australian renewable energy capacity fell 40% in 2019.

However, by June 2020, the CEC’s survey reports a rise in investor confidence from 6.8 to 7.3 out of 10. Though investors remain timorous in the face of connection uncertainty, confidence is gradually growing back in the knowledge that renewable energy is, quite simply, “inevitable.”

NSW – State of Grace

Much of the regained confidence in renewable investment, says the CEC, is thanks to the clear strategies set out at the state level. “State-based targets remain supportive of investment,” said one executive, “despite lack of clarity around emissions or energy policy at a national level.”

The CEC singled out NSW for particular praise, praise founded upon the nation’s highest level of investor confidence: 7.5 out of 10. NSW’s growing attractiveness for investors is owed partly to amended laws allowing large-scale battery storage systems and partly to do with the state’s three pending renewable energy zones (REZs).

Late last month, the NSW Government’s plan to deliver a 3 GW REZ in the state’s Central-West was met with overwhelming investor interest and project proposals valued at $38 billion. The original plan was to deliver 3 GW of firmed renewable energy to the region, but the expressions of interest totalled 27 GW, prompting NSW Energy Minister Matt Kean to commit a further $31.6 million to the REZ.

“The NSW Government’s strong and positive statements and clear strategy for the transition of the state from one that is highly dependent on coal-fired power to one that is an energy and economic superpower in a low-carbon economy was a key factor in increased investor confidence,” says the CEC.

Other states also saw increases in investor confidence, including Victoria (VIC) and Queensland (QLD). CEC Chief Executive Kane Thornton said that while challenges related to the grid and a lack of federal energy policy remain a concern, business is willing to make the most of the opportunities presented. “State governments are leaning in, and it’s working,” declared Thornton.

Employment

Every crisis is a crossroads, and Australia is certainly at a crossroads. An already looming economic downturn exacerbated and emphasised by the economic impact of Covid-19 has many thinking Australia should embrace its clean energy future today, banking on its sure approach as the basis for a wide array of renewable jobs to kickstart the economy.

Early this month, Aussie think-tank Beyond Zero Emissions (BZE) published its Million Jobs Report, a green scaffold plan backed by a host of climate, development and investment leaders to create 1.8 million new jobs through renewables and low emissions projects over the next five years.

Growing investor confidence further supports the notion that the green path of economic recovery is the right path for Australia. Indeed, the CEC’s survey found that 56% of employers would be increasing their workforce over the next year thanks to the large number of shovel-ready renewable projects.

“This is great news coming out of Covid-19, but we also know from our recent Clean Energy At Work report that the industry could lose up to 11,000 jobs unless a strong policy landscape is developed that supports renewables,” said Thornton. “It’s vital that the investment pipeline can give the renewables business the confidence to invest in the development of solid workforce and training practices.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.