AGL has laid out plans for the deployment of around 1.2 GW of utility-scale batteries across multiple locations, including a massive 500 MW battery system at its Liddell coal-fired power plant, the oldest plant on Australia’s electricity market scheduled to close by April 2023. The energy giant on Friday announced it had lodged a scoping report with NSW’s planning department to install the storage system at the Hunter Valley site by June 2024.

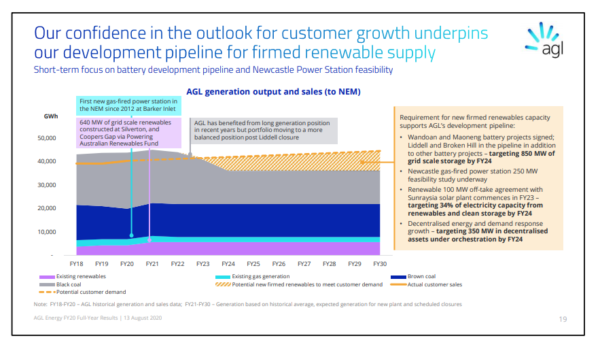

The Liddell Battery is part of the 850 MW multi-site integrated battery system AGL targets to develop within four years as announced in its FY20 Results and is in support of its Climate Statement commitments to support the transition from coal generation to renewables. AGL Chief Operating Officer, Markus Brokhof said over the past decade battery technology has evolved rapidly and is now at an investment level that allows AGL to lead the transition to decarbonization in Australia.

“Battery storage is critical to enhance the energy system’s flexibility and support the ongoing integration of renewable sources to the NEM,” Brokhof said. “It removes one of the biggest limiting factors of renewables, by providing electricity anytime but particularly during peak demand. As more renewables come into the energy system, we need to make sure we are supporting the development of storage and firming capacity, like grid-scale batteries.”

The plan represents a massive extension of AGL’s current supply portfolio. In addition to some 330 MW in batteries already announced, the company is targeting 850 MW of grid-scale batteries installed, managed or under development up from 30 MW today. The previously announced utility-scale battery projects include Wandoan (100 MW) in Queensland, Maoneng (4 x 50 MW) in NSW, and Dalrymple (30 MW) in South Australia.

Planning applications are also being developed for a battery connected to Torrens Island Power Station site in Adelaide with other sites under consideration, such as its Loy Yang coal-fired power station. “We believe battery technology is now at a level that allows AGL to lead in Australia’s transition to a smarter and more efficient energy future,” Brokhof said. To support the delivery of its grid-scale target, AGL has invited select suppliers to tender for the procurement of integrated battery systems.

DER fleet and demand response growth

The company’s development pipeline for firmed renewable energy also includes significant distributed and demand response capacity. As revealed in its annual report released on Thursday, AGL aims to deploy a further 350 MW of distributed and demand response assets under its orchestration by FY24, up from 72 MW today.

“We were the first to establish a retail-led virtual power plant and we launched a bring-your-own battery program last year. Our demand response program, Peak Energy Rewards, will have the capacity to scale from 20,000 customers to 1 million customers over the coming year,” said Christine Corbett, Chief Customer Officer at AGL Energy.

In line with its Climate Statement, AGL aspires to ensure that 34% of its electricity capacity comes from renewables and clean storage, compared with 22% today. Its goal is 20% of group revenue from clean energy or carbon-neutral products, compared with 11% today.

On Thursday, AGL also reported its underlying profit after tax was $816 million, down 22% due to a major unplanned outage at AGL Loy Yang, lower wholesale energy prices impacted by Covid-19 driven excess supply, and higher depreciation expense.

“The impact of Covid-19 has been to bring these headwinds forward a lot faster as wholesale prices have fallen, while also bringing new cost headwinds from credit losses associated with customer hardship,” AGL’s CEO Brett Redmann.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Favor nos informar o contato eletrônico dos senhores.:

– CEO da AGL, Brett Redmann. ou do Sr .: diretor de operações da AGL, Markus Brokhof o

Não conseguimos localizar, o referido contato dos mesmos pela internet ou seja atravéis do site da Agl.com .

muito obrigado.

Saudações.