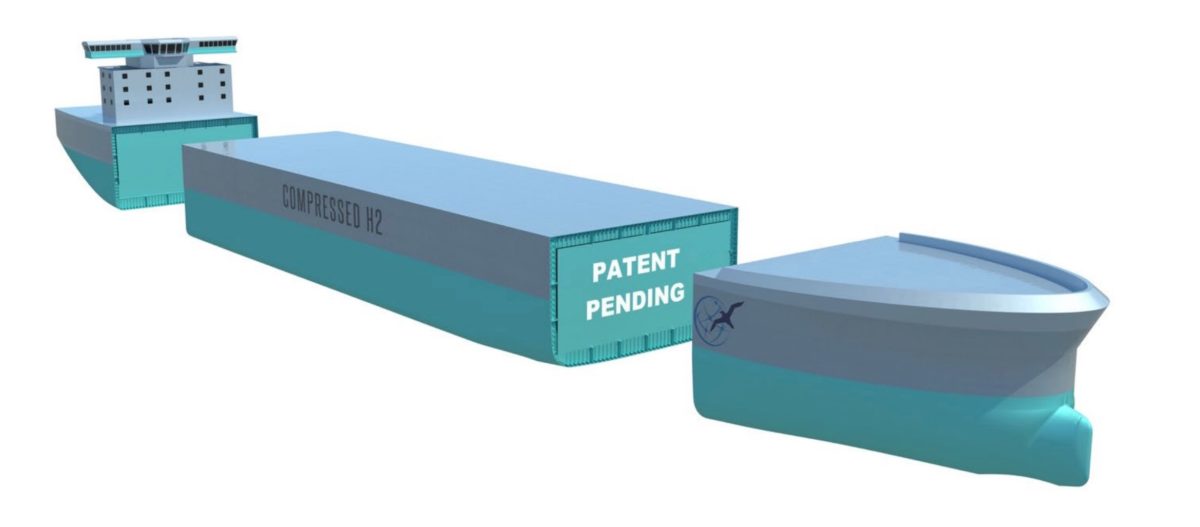

With a global hydrogen economy on the horizon, Australia is looking to get a swift start in order to get past the breakers and streak away into the lead. Hence the National Hydrogen Strategy and the H2 under $2 target. Seeing this ambition, Global Energy Ventures (GEV) is released details of its plans to develop a new compressed Hydrogen ship (H2 Ship) to transport the energy.

Of course, some may already be disappointed that H2 Ship hasn’t been named ‘H2 Mc2face’, but that disappointment will be short-lived once one starts to consider the manner of figures at play. GEV’s H2 Ship design has a storage capacity of up to 2,000 tonnes of compressed hydrogen, and the company seems to be focusing on green hydrogen produced by renewable energies like solar rather than browner versions.

“GEV sees Australia as the global leader for establishing a national hydrogen strategy and industry with major funding programs in place,” said GEV’s CEO Maurice Brand. “Australia has also established future hydrogen export agreements with regional customers in Japan, Korea, Singapore, and most recently Germany.”

Image: Global Energy Ventures

“To be focused on a new class of vessel to transport hydrogen is now timely given the global push by governments and major corporates to focus on ‘net-zero carbon’ policies,” continued Brand, “with hydrogen as a pillar for decarbonising heavy carbon emission industries.”

However, Brand was quick to assure any particularly gassy shareholders that the H2 ship will “not detract from our focus on the commercialisation of the CNG Optimum”, a GEV ship for transporting compressed natural gas. Of course, GEV is welcome to whatever short-term gains CNG Optimum provides, but should also realise that GEV will most likely watch the CNG Optimum receding into the past like the wake left by the H2 Ship into the global energy future.

After all, a 2018 report prepared for the Australian Renewable Energy Agency (ARENA) estimated Australia could earn up to $1.59b from the export of up to 344,800 tonnes of hydrogen in 2025 rising to 3.18 million tonnes worth $13.4 billion by 2040. And, the National Hydrogen Strategy itself estimates an industry worth about $11 billion in GDP by 2050.

Whether Australia’s hydrogen industry has the export potential suggested is another story. The Australia Institute (TAI) and the consulting firm ACIL Allen have both questioned the government’s figures, and moreover have questioned just how much of a export market there is for Australian hydrogen. Some have even suggested inflated figures are being used to rush a hydrogen market that could be built gradually using entirely renewable energy sources.

“Prematurely establishing a hydrogen export industry based on highly inflated demand figures may lock out the cleanest form of hydrogen, using renewable energy and electrolysis, because the technology isn’t cost competitive at this stage,” said Richie Merzian, Climate & Energy Program Director at TAI.“If hydrogen development is rushed in Australia it could see fossil fuels locked in as a global energy source for decades to come. The emissions will make it impossible to comply with Australia’s obligations under the Paris Agreement.”

Many, including Australia’s Chief Scientist Alan Finkel and the Australian Renewable Energy Agency (ARENA) believe hydrogen’s export potential is significant. “Australia has a golden opportunity to become a major exporter of hydrogen, as other countries look to transition to low carbon energy sources,” said former ARENA CEO Ivor Frischknecht.

However, Australian National University (ANU) professor Andrew Blakers disagrees. While hydrogen may furnish domestic energy supplies, and potentially power the shipping of the nation’s exports, as an export in itself, Blakers argues that hydrogen’s “woeful round-trip efficiency” renders it unviable. Of course, HVDC cable transmission of energy does not suffer the same loss, but the distances between Australia and potential buyers, such as Japan and South Korea, are simply unfeasible, especially with China better positioned.

On the other hand, Australian Hydrogen Council (AHC) CEO Fiona Simon says that our global trading partners are already “hungry for clean hydrogen and are currently shopping around for reliable, high volume suppliers.”

As for the powering of shipping part, Blakers and GEV are together, with the H2 Ship to include engines that burn pure hydrogen, a ‘zero-carbon’ shipping solution.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

All hype and little substance. 2,000 ton for a ship is nothing.