At 9:45am on Tuesday 13th October 2020 Queensland (QLD) electricity spiked from approximately $25/MWh to $15,000/MWh (the current market price cap) in response to a tripping incident principally involving nine solar farms in northern QLD and one in the Sunshine State’s south. The price soon dived back to $17/MWh and then proceeded to hit bedrock – the market price floor of -$1000/MWh. What a ride! Who knew QLD dispatch intervals could give the Gold Coast’s theme parks a run for their money?

The following day’s publication of the Tuesday Market Day by the Australian Energy Market Operator (AEMO) showed that the nine northern solar farms were ‘constrained down’, realising a Cassandran warning issued by AEMO in March about the region’s grid system strength vulnerability. The event has been closely scrutinised by Paul McArdle of Watt Clarity, who penned a five-part case study in an effort to work out just what in the name of Wally Lewis happened in QLD.

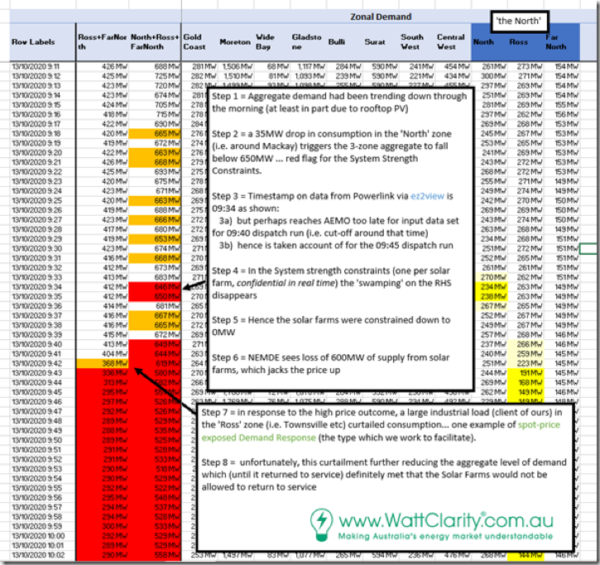

With great debt to McArdle’s case study, this article looks to tell the story of the below table of data representing 1-minute snapshots of consumption across Powerlink’s 11 QLD zones. The three highlighted zones represent North QLD and show the aggregate consumption dropping below the 650MW mark in three zones and/or 350MW for the northernmost two. These fallouts, says McArdle, “triggers the bite in the System Strength constraint”.

McArdle hypothesised that an outage of line 821 (the 275 kV feeder from H10 Bouldercombe near Rockhampton, to H11 Nebo near Mackay) meant that stronger constraint equations were in place to limit the input of solar farms. These constraints were activated when aggregate demand fell below 650 MW across the three zones (at least partly due to rooftop PV) but eventually tripped by a single 35MW drop in the North Zone. Somehow this even was not forecasted, but now these farms were constrained to 0 MW in the 09:45 dispatch interval, sending the price rocketing up to the Market Price Cap.

According to Andrew Wilson, Project Director of the Warwick Solar Farm and Manager of Energy & Sustainability for the University of Queensland (UQ), “the challenge with the event on 13 October was how suddenly it occurred – this will present both risks and opportunities depending on your position in the market, both overall as well as from interval to interval.” To borrow McArdle’s analogy, the constraints pulled the handbrake when the grid was coasting downhill.

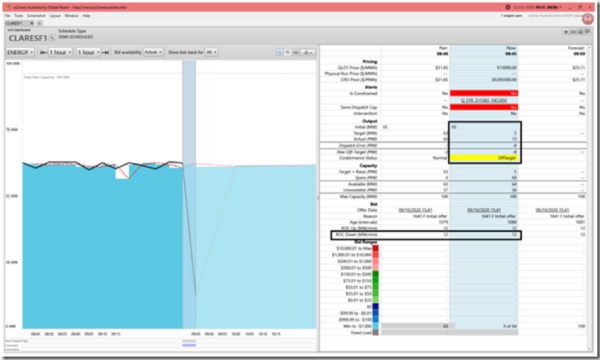

In all, 11 large scale solar farms were impacted by the reaction of this single constraint in northern QLD, as well as the Mount Emerald Wind Farm (the reason more wind farms weren’t impacted is due to the fact that they’re aren’t any). Among the impacted lot include: Rugby Run Solar Farm, Clare Solar Farm, Hamilton Solar Farm, Daydream Solar Farm, Kidston Solar Farm, Whitsunday Solar Farm, Hayman Solar Farm, and Collinsville Solar Farm. Take, for instance, this drop off at Clare Solar Farm between Townsville and Bowen, shown in the bellow data set:

Batteries vs. peaking plants

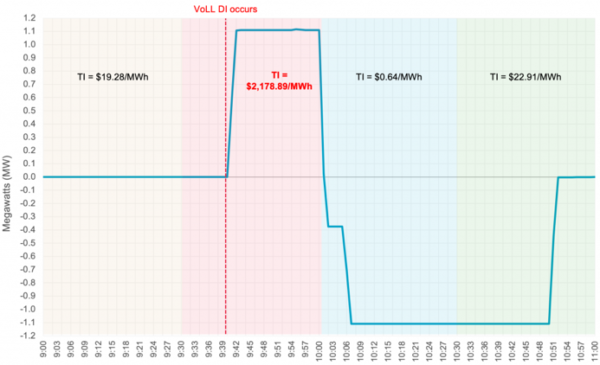

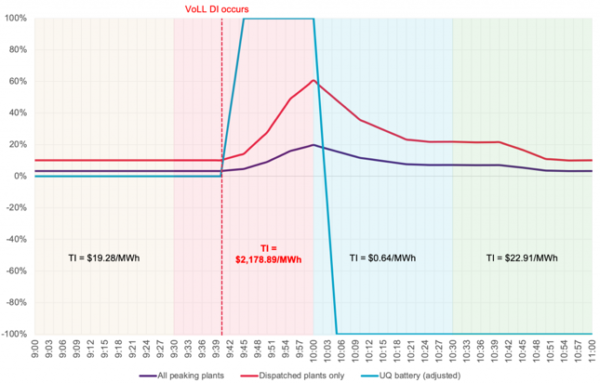

The QLD spike event may be, in the words of Wilson, “a harbinger of things to come”, an ongoing series of skirmishes between the growing extent of distributed storage, such as Wilson’s UQ 1.1MW/2.2MWh battery, and peaking plants. From Wilson’s perspective as a market participant: “Without any hedging (physical or financial), that single half-hour trading interval on 13 October would have cost us in the order of $22,000 – compared to around $400 for a typical trading interval at this time of year.” Thankfully the battery performed perfectly during the spike event; its Demand Response Engine (DRE) algorithm responded to the price spike and began discharging for the remainder of the interval, thereby minimising UQ’s exposure. A scheduled generating unit, says Wilson, “would have been required to bid capacity into the pool and then ramp linearly over five minutes towards a set target.”

“We openly acknowledge,” continued Wilson, “…that large behind-the-meter assets acting as price-takers like this isn’t sustainable. It’s not too much of a problem today (our battery is the biggest behind-the-meter battery in Queensland), but imagine a world where 1,000 x 1MW batteries responded in the same way!”

As Wilson points out, how various assets respond to such constraint equations and five-minute settlement becomes increasingly important the further we move into the energy transition. The peak output of peaking plants responding to the event occurred during the 10:05 interval – rather late in the trading game. Wilson argues the start-up time (unexpected in the mid-morning), and ramp rate constraints meant that peaking units could not respond in time to take advantage of high prices or fill the supply gap left by the sudden constraint of North QLD’s solar farms.

5-minute settlement

According to Wilson, the price spike event is a clear demonstration of the benefits of five-minute settlement for batteries which are best able to respond rapidly with full discharge or full charge. “Despite two intervals within the half-hour having negative pricing,” said Wilson, “the battery discharged the entire time to chase the overall average price for the half hour which still settled at around $2,200/MWh.” Of course, in turn, the event also demonstrates how the current 30-minute settlement rules put flexible distributed storage at a disadvantage.

“In a five-minute settlement world,” continued Wilson, “the battery would have doubled its revenue by more dynamically responding to changes in price between each five-minute interval. The commencement of five-minute settlement in October 2021 is going to create a lot of opportunities for fast response assets like batteries, but will also equally create challenges for other types of assets that may have flow on impacts to things like the market for cap contracts.” Such assets include peaking plants whose overall power is almost infinite but ramping speeds are too cumbersome for the evolving grid.

Powerlink and AEMO are pondering ways to transition the grid while maintaining system strength, such as Powerlink’s announcement on October 7th that it would become the first transmission company in Australia to deliver system strength services. Powerlink Queensland’s model is to install a large synchronous condenser and then on-sell its system strength capacity to multiple renewable energy projects, a way to increase renewable energy integration into congested parts of the grid.

In the end, the spike event of October 13th clearly demonstrates that constraint equations are too rigid to be efficient. Some suggest the implementation of easing constraints. As McArdle told pv magazine Australia: “This event illustrates that all aspects of the supply/demand balance, including what’s behind the meter (like rooftop PV and small batteries), needs to be to be rationally considered as part of designing an NEM 2.0 that will help the energy transition actually succeed.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

To get the fattest-possible premiums, you have to sell when volatility is at the higher end of that range and cash out when volatility contracts.