The new-era medium-scale utility solar sector is not about starting small, but about building fast, about easy connections to the grid, stable solar farm-to-substation marginal loss factors and rapid, reliable returns on investment. Enter the sector’s first dedicated investment vehicle — Solarion Renewable Fund — which invites wholesale and sophisticated investors to pick a farm from its portfolio and reap five-year average net yields of 4-6% per annum.

“Our aim is to fill the gap in medium-scale solar assets in Australia, and grow the portfolio to over 200 MW in the next few years,” said Solarion CEO, Lasman Citra, in a statement.

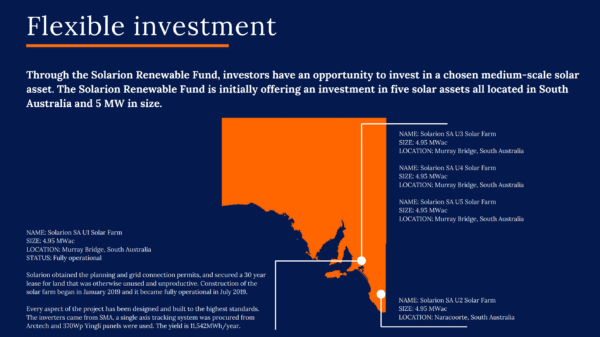

Solarion Renewable Fund’s generating portfolio currently consists of SA U1 Solar Farm (formerly known as Mobilong Solar Farm), which was commissioned in mid 2019, but it has four other 5 MW assets at various stages of development in South Australia.

Once a Solarion investor makes their choice of asset, full capital calls will only be made when their chosen solar farm is fully operational, substantially eliminating the risks that have become associated with investing in large-scale projects, and with projects in development or build phases.

Out of Terregra, comes Solarion

Executive Director of Solarion Renewable Fund, Graham Pearson, explained to pv magazine that Solarion grew out of Indonesian-based firm Terregra Renewables, which identified and began developing its five-by-5 MW Australian portfolio in 2018.

“Around the middle of this year, Terregra was renamed Solarion, the ownership structure changed, and our full focus became creating this renewable fund,” he says.

In Indonesia, Terregra is involved in developing hydropower projects and solar systems in the commercial rooftop and utility solar sectors. Here on the ground in Australia it recognised the potential for medium-scale solar.

“Even when we started these projects in 2018,” says Pearson, “larger projects faced challenges to get grid connection, along with capacity constraints, long commissioning delays, and we’ve seen a bunch of solar farms have really material, large decreases in MLFs. Over the years those risks have only gotten worse.”

Medium-scale projects, on the other hand, “deliver the same rewards and returns, but you avoid many of the risks”. Pearson says a 5 MW solar farm can, for example, be fully permitted within four months, and “commissioning takes half a day compared to up to 18 months for larger projects”.

Although Terregra began with a merchant model of electricity sales, Solarion energy output is now at least 50% firmly contracted to provide stable returns, and Pearson anticipates that the remaining merchant component “will provide some attractive upside”.

Investors can also expect to receive a final distribution of 5% of invested capital at the end of the target investment term, subject to the Fund’s realised exit strategy.

The sprinkling of small-scale solar

Of the five solar farms Solarion currently has under development, SA U1, U3, U4 and U5 are all located around the city of Murray Bridge in South Australia, while SA U2 (formerly known as Moyhall Solar Farm) is expected to break ground at its site near the state’s south-eastern town of Naracoorte in the first quarter of 2021.

Solarion Renewable Fund has calculated that each of its medium-scale assets will generate enough electricity to power 2,885 households per annum, and save around 11.5 million kilograms of CO2 emissions each year, compared to the equivalent coal generation.

This creates an attractive proposition, says Pearson, for institutional investors, family offices and high-net-worth individuals looking to increase the ESG (Environmental, Social and Governance) component of their portfolios and positively impact the environment and regional communities.

The fund website points out that the compact project footprint of medium-scale projects is more likely than larger-scale projects to engender community support, and a relatively small project such as Mobilong still created more than 50 jobs during its construction.

At the time of Mobilong’s commissioning, Pearson said it had been, “pleasing to see so many high-quality local businesses involved in the project. This will continue during the operation phase with local tradespeople already contracted to provide maintenance services for the next few years.”

Niche marketing and the Solarion ecosystem

Minimum initial investment in the Solarion Renewables Fund is $100,000 which can then be increased by increments of $50,000.

Solarion will hold a minimum of 5% equity in each of the projects in the fund, with the intention of firmly aligning the fund-manager’s interests with those of investors: “It means we’ll all want the best for the projects, the best outcomes and the best returns”, says Pearson.

Construction of the first five solar farms, and possibly others planned throughout Australia will be carried out by Solarion Renewables, an affiliated engineering, procurement and construction (EPC) entity, to enable economies of scale in repeating Solarion’s model for small-scale development.

He says that in bringing investors to smaller solar projects, he hopes Solarion can shift the market focus a little, “proving that these projects have economies of scale, really good returns and a much lower risk profile”.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.