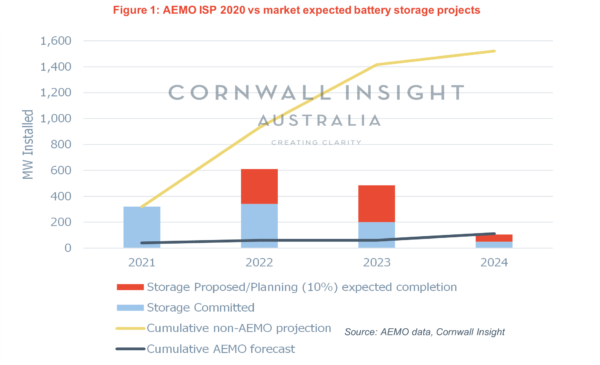

New research from Cornwall Insight Australia (CIA) projects that Australia has approximately 7 GW of battery storage projects currently in the pipeline. The vast majority of that 7 GW remains in the proposal phase, but CIA sees over 900 MW of battery energy storage at a stage of commitment or progress that will see delivery by 2024.

Thanks to Australia’s world-leading solar penetration and arcane grid, our great southern land is a hotbed for energy storage innovation and investment. Indeed, according to the Clean Energy Regulator’s (CER) latest modelling, rooftop solar capacity is rising at an exponential rate which could see it double in the next four years, capacity which can only penetrate the grid with the mass storage uptake at all levels.

CIA’s Principle Consultant, Ben Cerini, said that the projects highlight the strong pipeline of energy storage across the NEM, “despite the challenging economics and the continually developing value streams, which can be volatile. But as we have seen, those that move quickly will be rewarded and be in the best possible position to take advantage of new revenue streams when (not if) they arrive.”

Of course, South Australia’s (SA) Tesla Big Battery, Neoen’s Hornsdale Power Reserve, has been so wildly successful for both SA and Neoen that. the French renewables giant has already completed a 50% expansion of the project.

Neoen’s storage revenue jumped from €8.4m in the first half of 2019 to €24.6m (AU$40m) in the first half 2020 due to “an exceptional non-recurring event in Australia…the key factor behind this very hefty increase.” The exceptional non-recurring event was in fact a tornado in late January which pulled down the Heywood interconnector between SA and Victoria. SA was effectively isolated from the rest of the National Energy Market (NEM) for 18 days.

The battery’s success has encouraged Neoen to propose more large-scale energy storage projects, including the massive Goyder South Project – 1200 MW of wind, 600 MW of solar, and 900 MW of battery storage.

The success of the Hornsdale Power Reserve has not been overlooked by other states. The Australian Capital Territory (ACT) Government has promised a 250 MW of batteries. Meanwhile, New South Wales (NSW) and Victoria (VIC) have expanded their pubescent rivalry to the energy storage zone with both of Australia’s most populous states pursing multiple big battery projects, including the Wallgrove Grid Battery project in NSW, and Victoria’s 300 MW / 450 MWh Victoria Big Battery to be constructed on the outskirts of Geelong.

The Northern Territory (NT) is also getting in on the act, with a 30 MW battery proposed for the Darwin-Katherine grid, which is not to mention the possibility of a 100 MW battery project as part of the 10 GW SunCable project.

Of course, Australian energy giant AGL is also well and truly getting in on the act with its 850 MW large-scale battery storage goal by FY 2024. 500 MW of which AGL plans to build next to its soon-to-be-retired Liddell coal-fired power station in NSW. Along with a 250 MW battery project at SA’s Torrens Island Power Station, and a 200 MW battery at VIC’s Loy Yang coal-fired power station which was not taken into account by CIA.

Considering all of these projects have been quite seriously committed to in public, it might be that CIA’s projects are on the conservative side. Nevertheless, CIA’s figures show that the average capacity proposed battery project is around the 150 MW mark, the size of the expanded Tesla Big Battery.

To the dismay of NSW, VIC has the largest MW of proposed projects with more than 4 GW, which amounts to over 40% of recent peak demand. NSW currently only has 1.3 GW in the pipeline but it’s recently approved Roadmap will no doubt attract the big battery builders in to feed of the three in development Renewable Energy Zones (REZs).

Image: Cornwall Insight Australia

“The question then becomes,” says Cerini, “given the size of the storage pipeline and the recent commitment to delivery the largest battery in Australia at 300 MW. Do we already need to re-evaluate the amount of storage projected to be built in the NEM?”

The question is no doubt pertinent, CIA’s projections are put into perspective when it is assumed that only 10% of the projected storage is completed by 2024, totalling approximatley 1.5 GW, a capacity that is more than 13x the Australian Energy Market Operator’s (AEMO) forecast in its Integrated System Plan (ISP).

“To be fair,” continues Cerini, “the battery storage forecast by AEMO takes into consideration the reliability of the grid (i.e. the reduction of unserved energy). Therefore, it doesn’t consider the ability of system services contracts to be able to underpin investment in battery storage that allows batteries to then compete in energy and ancillary service markets.”

This is to say that it does not consider many of the services a big battery can provide. According to AEMO’s Q2 Energy Dynamics Report, despite a decline in FCAS was caused by a lack of network volatility, FCAS markets still contributed 88% of the Hornsdale Power Reserve’s revenue.

“More battery storage will deliver more system and ancillary services while also assisting during peak demand,” noted Cerini. “Underestimating the role of storage may have significant implications for future projects.”

Clearly, as the energy transition accelerates, forecasts and the resulting plans will have to think on their feet and be unprecedently flexible in scope. Considering gas was thought to be essential as a transition fuel in 2018 but by 2020 has been found to be unncessary, it is very difficult to know what the energy market will look like in 2022 let alone 2024. However, what we can say is that big batteries will be there.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.