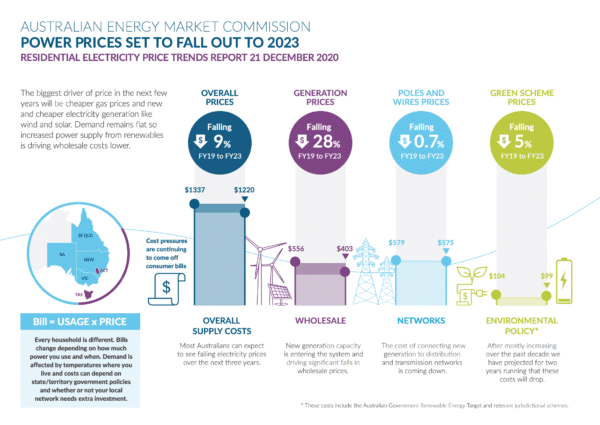

More than 4.2 GW of renewable capacity entering the National Electricity Market (NEM) over the coming three years and forecast lower gas prices will drive down electricity prices for east-coast residents by an average of about 9% or $120 per household out to 2023, despite a slight rise in costs predicted when the Liddell coal-fired plant closes in early 2023, according to the Australian Energy Market Commission’s (AEMC) annual Residential Electricity Price Trends 2020 report released this morning.

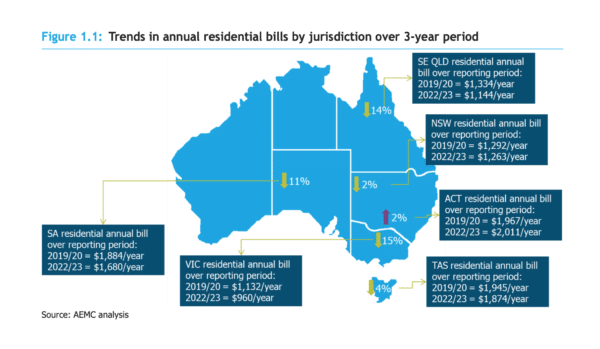

Figures vary among jurisdictions, with the ACT calculated to experience a slight rise of 2% or $45 (an annual average increase of 0.7%) over the period, and South East Queensland set to be twisting by the pool pump with air-con blasting through open doors as it enjoys the biggest drop of around 14% or $190 per household (an annual average decrease of 5%).

What’s wrong with that picture? Of course individual household bills will still be influenced by energy use and the energy offer they’ve signed up to.

Image: AEMC

Sarah McNamara, the Australian Energy Council’s Chief Executive, representing the majority of electricity and gas providers in Australia, said the report, “reinforces that the market is competitive with committed new generation continuing to push down wholesale prices even without recently announced government plans to underwrite more capacity.”

As this morning’s AEMC statement accompanying the report points out, actual price movements will be influenced by how retailers continue to compete, as well as by “the dynamics of wholesale spot and contract markets, the outcomes of future network regulatory decisions, and changes in policy and legislation”.

The impact of government policy and the signals it provides to investors is still key, and the forecast decline in gas prices is no validation of the Federal Government’s so-called gas-led recovery from Covid-19, as many in-depth analyses have already attested.

The report is, however, a high-five to the dogged persistence of the renewables industry in building generation, despite the Federal Government’s hands-off-the-wheel approach to driving transition.

More renewables set to further slash prices

The AEMC has added up a committed project capacity over the coming three years of 1,667 MW of solar and 2,580 MW of wind generation, but its calculations do not include the potential positive effects of the NSW Government’s recently announced Electricity Infrastructure Roadmap, which aims to underwrite 12 GW of renewable energy in the state by 2030, or the Victorian Government’s November budget commitment to developing six renewable energy zones and thereby boost its progress toward the state being 50% powered by renewables by 2030.

“We conducted our analysis before those announcements were made and so our numbers do not reflect the impact those developments could have on prices,” said AEMC Chief Executive Benn Barr.

He said the outcome for 2023 prices may well be different — that is, the NEM might not see a tightening of demand around the closure of Liddell, if still greater renewable generation begins to have a timely effect due to these state initiatives.

“In any case, the overall figures show that prices in 2023 will still be lower than they are today,” added Barr.

Factors beyond pure capacity

Continued investment in low-cost renewable generation is enmeshed in the three main drivers of household electricity bills, which are trending as follows:

Wholesale costs are expected to fall by about $150 per household between FY19/20 and FY22/23 as more generation capacity enters the system and gas prices remain low.

Network costs are forecast to fall by about $4 by FY22/23. This is made up of a $13 increase in transmission costs, offset by a $17 decline in distribution and metering costs.

Environmental costs (that is, the cost of the Large-scale Renewable Energy Target (LRET) and the Small-scale Renewable Energy Scheme (SRES)) are expected drop by $5 over the three years as Large-scale Generation Certificates (LGCs) reduce in cost as more renewable energy generation comes online. These costs have mostly increased over the past decade, but “they have now been projected to drop for two years running”, said the AEMC in a statement.

In New South Wales and South Australia, the states where prices are forecast to be driven down by an influx of planned solar PV development, prices are forecast to fall over the three-year period by $30 (an annual average decrease of 0.8%) and $200 (an annual average decrease of 3.7%), respectively.

Victoria’s forecast bill reduction of 15% (an annual average decrease of 5.3%) is credited to an increase in committed wind power.

The Northern Territory and Western Australia are not included in the 2020 analysis, because the NT’s reporting of wholesale prices does not take account of new generators entering the market, and could therefore be considered misleading; and WA’s electricity prices are set by the state government as part of its annual budget process.

For those states reported on, “It’s great to see prices falling,” said Barr, “because at the AEMC, what drives us is how to keep the lights on and costs down in a decarbonising power system.”

Image: AEMC

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.