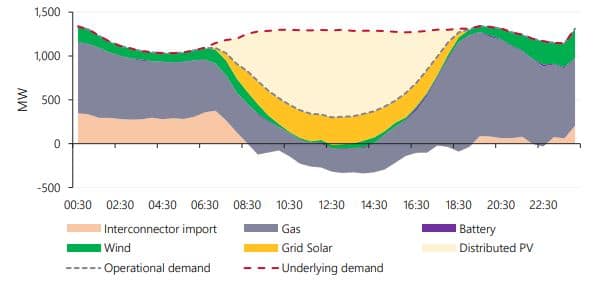

The Australian Energy Market Operator’s (AEMO), in its latest Quarterly Energy Dynamics report, confirmed that rooftop and utility scale solar satisfied 100% of South Australia’s electricity demand for more than an hour on October 11.

AEMO said the achievement is a world first for a jurisdiction of that size.

The milestone coincided with a new minimum demand record in the state of 300 MW, 158 MW down on the 2019 low.

South Australia wasn’t the only state to witness reductions in demand with AEMO confirming the average operational demand in the National Electricity Market (NEM) had reduced by 3% compared to Q4 2019, declining to its lowest quarterly average in 20 years.

AEMO’s chief member services officer, Violette Mouchaileh, said the record low operational demand, coupled with high wind and solar output had translated into record low emissions with a 7% decline on Q4 2019 levels.

“Electricity demand continues to reflect changing energy trends with new minimum demand records observed in Victoria, South Australia, and Western Australia,” she said.

“The downward operational demand trend, coupled with increasing renewable energy, which accounted for 24% of the generation mix in Q4 2020, resulted in significant displacement of thermal generation and the lowest NEM emissions on record.

“Similarly in WA, renewable energy contributed 35% of total generation in Q4 2020, which also led to a decline in average coal-fired generation and gas-powered generation compared to Q4 2019.”

AEMO said approximately 3 GW of distributed solar was installed nationwide in 2020, up about 50% on the previous record in 2019.

The increase drove record high distributed PV output, increasing by an average of 337 MW on 2019 levels. The largest increases in distributed PV output occurred in New South Wales, which saw a 124 MW increase on average, and Queensland (100 MW on average).

There were mixed results for electricity prices, with those in SA and Victoria continuing to fall while prices in Queensland and NSW climbed from Q3 2020 lows.

South Australia became the lowest-priced region for the first time since 2012 as its quarterly average price fell 57% to $29 per MWh, with negative prices accounting for $8.7 MWh of the reduction.

Western Australia also witnessed a price decrease with the quarterly average dropping to $41.66 MWh, a 13% decrease relative to Q3 2020 due largely to increased variable renewable energy (VRE) output in the Wholesale Electricity Market (WEM).

NSW’s quarterly average price of $64 MWh was at a significant premium to other regions, something AEMO attributed in part to record low coal-fired generation in the state.

The report confirms that the average black coal-fired generation decreased by 707 MW, reaching its lowest level since Q4 2014. The decline in generation occurred mainly in NSW which fell to its lowest quarterly average on record, a function of increased outages – including for unit upgrades – low operational demand, and displacement by VRE.

Average quarterly VRE output reached a record high of 3.4 GW, surpassing the previous record set in Q3 2020 by 306 MW. VRE accounted for 17% of the supply mix, up from 13.5% in Q4 2019.

Grid solar generation reached a record quarterly high of 1,018 MW on average, mainly due to new capacity entering the system.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.