Fluence Energy has revealed it has secured approximately 1.5 GW of new wind, solar and battery energy storage contracts for its AI-powered Trading Platform in Australia in just six months as renewable energy asset owners confront the challenges of operating them profitably in today’s dynamic electricity market.

Matt Penfold, Fluence’s commercial – digital vice president, described Australia’s National Electricity Market (NEM) as one of the most complex energy markets in the world, with energy and ancillary services requiring assets to trade at five-minute intervals while integrating ever-higher amounts of variable renewable energy penetration.

“As the number of grid-scale wind and solar farms has increased in recent years, so have the challenges of operating them profitably in a more dynamic wholesale electricity market,” Penfold told pv magazine.

“In addition, batteries have additional capabilities and complexities of operation that also need to be factored into trading strategies.”

Penfold said renewables and battery asset operators are having to deal with exposure to negative prices, physical grid constraints, frequency control ancillary services (FCAS) costs, and managing trading strategies.

He said the challenges of today’s fast-moving market means a growing number of asset operators are adopting software-based bidding tools to help them participate in the market more actively and respond more dynamically to the NEM’s price signals.

Data provided by the Australian Energy Market Operator (AEMO) shows that 30% of grid-scale solar and wind assets had started using automated bidding solutions in the past two years to optimize performance and reduce exposure to negative pricing.

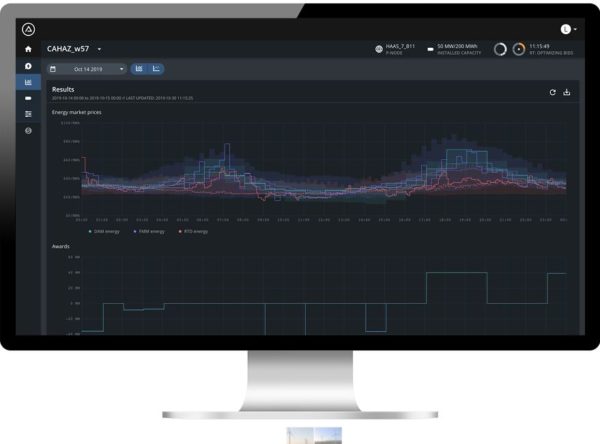

Image: Fluence

Seyed Madaeni, chief digital officer at Fluence, said the rapid uptake shows significant appetite for this type of software to boost the value of renewable energy assets and/or utility-scale batteries.

“Trading renewables and energy storage in merchant markets is now so complex that it requires AI-based software to manage decision-making,” he said.

“Sophisticated bidding and optimization software not only provides powerful tools to complement trading desk operations and increase asset revenue, but also supports greater efficiency at the grid level by improving the operation and dispatch of renewable and storage assets.”

United States-headquartered Fluence acquired Advanced Microgrid Solutions’ (AMS) software and digital intelligence platform in October as part of push to assist its utility, developer and commercial and industrial customers optimize their energy storage and renewable assets.

In the six months since it acquired AMS, Fluence’s Trading Platform has been selected to help manage 1.5 GW of wind and solar projects in Australia, including projects by Spark Renewables and BJCE.

It is being used to manage approximately 18% of the NEM’s grid-scale wind and solar assets, or 60% of those asset owners who are already using software for bidding.

Among the projects utilizing Fluence’s Trading Platform is Tilt Renewables’ 100 MW Snowtown 1 wind farm in South Australia.

Image: Fluence

Edify Energy has also adopted the Trading Platform to help manage a portfolio of five solar farms totalling 438 MWp, including the 180 MWp Daydream Solar Farm in Queensland and the 69 MWp Hamilton and 60 MWp Gannawarra solar farms in Victoria.

Fluence said its Trading Platform utilizes artificial intelligence to analyse thousands of variables to forecast market prices and anticipate grid conditions that are likely to cause negative prices. The platform provides the asset owner with optimal economic bids, which tell the grid operator the prices at which the asset is willing to continue generating. The company said the resulting market-compliant bids can increase revenue for wind and solar asset owners by up to 10% over a 12-month period.

“Fluence’s AI-powered Trading Platform provides better forecasting so that solar and wind operators know when to ramp down, reducing losses from negative pricing events and making renewable energy more competitive and lucrative,” Penfold said.

“We have created proprietary, probabilistic price forecasts that have consistently proven more accurate than the only publicly available alternative, the pre-dispatch price projections provided by AEMO.”

Fluence said its Trading Platform can integrate with battery energy storage systems from any original equipment manufacturer or technology provider, as well as a range of renewable energy assets, including wind and solar.

“This flexibility enables Fluence to provide more value to a broader set of customers, optimizing portfolios of diverse assets and accelerating the adoption of renewables and energy storage, either separately or together,” Penfold said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.