The Clean Energy Finance Corporation’s (CEFC) study into the competitiveness of renewable hydrogen across 25 Australian industry sectors found it is nearing cost competitiveness for heavy trucking, buses and remote power, with the potential to become commercially viable across other sectors of transportation as early as 2030.

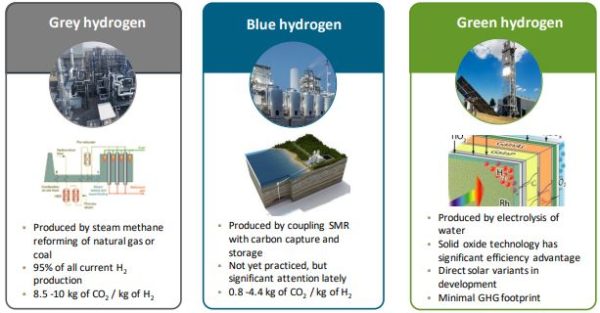

CEFC hydrogen lead Rupert Maloney, speaking at the Australia Hydrogen Conference in Sydney on Wednesday, said he expects the price of hydrogen produced using renewable energy sources such as solar or wind power, to be comparable with that of blue hydrogen (fossil-fuel sourced with carbon capture) between 2025 and 2030, but closer to 2030.

Maloney expects the price of green hydrogen to not come into line with that of grey hydrogen (produced by steam methane reforming of natural gas or coal) until 2045 while the study indicates the forecast costs for low-carbon hydrogen will not achieve cost parity with natural gas before 2050.

This led Maloney to the conclusion that the economics of replacing natural gas with hydrogen would be “challenging,” though he also acknowledged the figures and modelling CEFC used were “relatively conservative.”

“We are not a grant-giving entity, we’re investors,” Maloney said of the CEFC’s financial role.

The report says farm gate production cost of green hydrogen is currently forecast at $3.88 per kilogram. That is predicted to drop to $2.81/kg by 2030, still above the forecast production costs for blue hydrogen ($2.80/kg) and grey hydrogen ($2.29/kg). It is predicted the price for green hydrogen will decline to $2.09/kg towards 2050, undercutting blue ($2.80/kg) and grey alternatives ($2.29/kg).

Andrew Horvath, chairman of Australian hydrogen research and development company, Star Scientific, was surprised by the projections, telling pv magazine the CEFC numbers are “too conservative.”

“Technology has a momentum, and their numbers don’t account for that,” he said.

Former Australian prime minister Malcolm Turnbull, who spoke at the conference as well, also had more ambitious forecasts for cost curve reductions of green hydrogen, predicting a steeper drop in price over the next decades.

Image: CEFC

Turnbull told the audience at the Australia Hydrogen Conference that green hydrogen is the only hydrogen Australia should be focusing on.

The Australian Hydrogen Market Study, prepared by global energy analysts Advisian for the CEFC, examines the competitiveness of renewable hydrogen compared with existing energy technologies in the Australian landscape in particular. The 105-page study cumulates over six months of work, Maloney told the conference.

CEFC chief executive officer Ian Learmonth said large-scale development of green hydrogen will be critical in driving down installation and commissioning costs, similar to the development experienced by Australia’s large-scale renewable energy sector.

“There is enormous excitement around the potential to create green hydrogen to deliver a cleaner and more enduring energy source. As with any new technology, costs will decline over time,” he said.

“The purpose of this analysis is to give industry participants and investors an understanding of the potential economics for the uses of hydrogen in the Australian context, including potential early adopters.

“Our experience in developing the solar and wind sectors shows that prices decline rapidly as a new industry reaches scale and technical proficiency. It is encouraging to see a similar trajectory for the exciting hydrogen sector.”

The study found the key factors effecting the production cost of green hydrogen are the cost of renewable power; electrolyser costs; and intermittency of power supply.

Image: AGIG

The study anticipates that current electrolyser capital costs of around $1.1 million per MW would decline to around $500,000 per MW by 2050.

Advisian said there could be further upside to these forward cost curves, with several market commentators and manufacturers forecasting a more aggressive reduction in capital costs over a shorter timeframe.

The continued decline in solar and wind generation costs also shapes as a key to lower hydrogen production costs with the cost declines in large-scale solar developments in Australia providing a comparable model.

Advisian said the competitiveness of hydrogen could be further accelerated as a result of other market factors, including the levelised costs of hydrogen being lower than forecast; oil, gas and coal prices being higher than forecast and the willingness of energy users to pay a premium for a clean energy alternative as part of their broad emissions commitments.

The CEFC said that there is also great potential for Australia to play a part in a globally traded hydrogen market.

“There are opportunities for Australia to play a leading role in the developing a hydrogen economy,” Maloney said.

“Our high quality and low-cost renewable resources provide a comparative advantage which will be a key driver in achieving competitive hydrogen production costs.

“We have a proud history and strong reputation for exporting energy to the world, including as one of the world’s largest exporters of LNG. This same skilled workforce can be used to develop and ultimately export new energy vectors such as green hydrogen.”

Australia’s current hydrogen production is about 650 kilo-tonnes per annum (ktpa) and virtually all of this hydrogen is made using natural gas steam methane reforming (NG SMR) and is immediately consumed by the associated ammonia synthesis (~65%) and crude oil refining (~35%) plant.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.