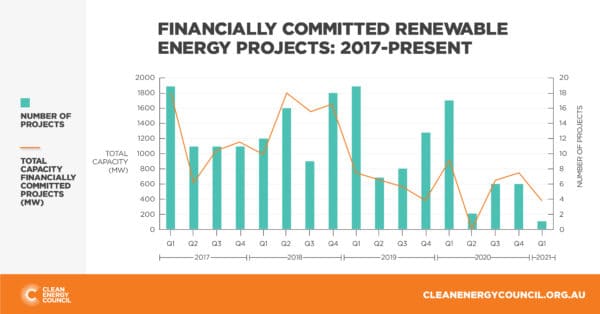

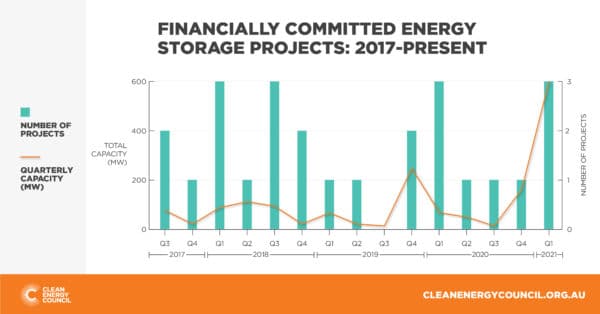

The Clean Energy Council last week put out alarming data concerning a shift in the investibility of large scale renewable energy projects in Australia. While battery storage has seen a 300% increase in the first quarter of 2021 compared with the last quarter of 2020; there has been a dramatic decline of investment in large-scale renewable projects, with financial commitments in large solar and wind farms falling to the lowest level seen in the past five years.

New England Solar farm near Uralla in New South Wales, was the only project to reach financial close in Q1 of 2021, and its 400 MW capacity is a 40% drop on capacity committed in the previous quarter and 30% lower than the 2020 quarterly average.

“Confidence for new investment in the sector is really in limbo at the moment,” said Clean Energy Council (CEC) Chief Executive, Kane Thornton, who cited projects experiencing “significant and often unanticipated delays through the grid connection process”; and government intervention in the energy market — as seen last week in the announcement of a new $600 million gas peaking plant to be built in Kurri Kurri — adding to “uncertainty for investors”.

Sally Torgoman, Infrastructure Lead Advisory for the energy practice at PwC, who provides commercial and legal advice to clients in the renewable energy field, agrees, saying grid risk must be factored into every stage of a renewable energy project.

She confirmed at a recent Smart Energy Summit that achieving grid connection for a large-scale development typically takes two to four years and costs upwards of $1 million; and that the risk posed by the grid continues into the operational phase of projects in the form of changing marginal loss factors (which measure energy likely to be lost between the point of generation and the point of demand — a reduction in revenue borne by the generator), the possibility of curtailment in response to grid instability and other possible requirements to mitigate problems with the grid.

How widespread are challenges posed by the grid?

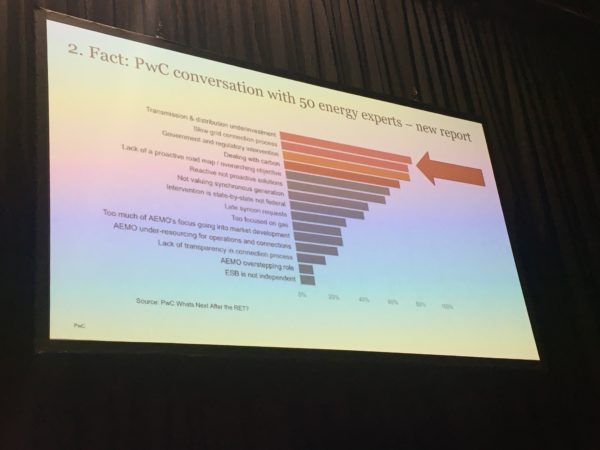

PwC recently surveyed 50 renewable energy experts in the Australian market to discover whether everyone was having the same problems.

Torgoman says, “It’s very rare that you run a survey and get 100% of participants saying the same thing, but 100% of the experts said that the number-one issue in the National Electricity Market [NEM] is underinvestment in transmission and distribution, followed by slow grid connection processes.”

Image: pv magazine

Speaking with pv magazine Australia today, Torgoman said investment was also likely to decline if there are no boundaries to the level of intervention the government might make in the market.

Recent Federal Government interventions have included investing taxpayer dollars in the development of Snowy 2.0, and more recently in development of a gas-peaking plant at Kurri Kurri on the Central Coast of New South Wales.

This despite this year’s research by the Clean Energy Council, which found that large-scale battery storage is superior — in reaction time, cost of operation, and emissions — to gas plants for delivering electricity peaking services

“In a market that’s really about managing supply and demand in a timely way, investors don’t know when the Government will plonk down another couple of hundred megawatts of assets to insure against closure of Liddell,” says Torgoman, “or whether it will allow the private sector to invest its own money to meet the approaching supply shortage.”

The market is awash with investor dollars seeking renewable projects

Monique Miller, Executive Director and Head of Solar and Dispatchable Renewables at the Clean Energy Finance Corporation, spoke after Torgoman at the Smart Energy Summit this month and said straight up, “Global investors are looking to double holdings in sustainable investments to 2025.”

Torgoman agrees that there’s “plenty of liquidity in the market and investors are very keen to invest in Environmental, Social and Governance (ESG) related projects, particularly in renewables.”

She and Thornton echo the voices of so many industry experts who say Australia has a tremendous opportunity to become the choice of renewables investors.

As Torgoman points out, “We desperately need new generation,” upwards of 40 GW of renewable energy simply to replace the output of retiring coal-fired power plants and meet electricity demand.

Big batteries still need renewable generation and grid connection

Investment in batteries also makes sense, she says, as they offer a number of benefits, including securing the stability of the grid, while allowing deferral of capital investment in major grid upgrades.

At this point in time, batteries also offer longer asset life than previously, and attractive pricing, such that the technology has come into commercial viability. Torgoman says, it’s become “good business to consider whether upgrading a power line or a substation can be dealt with more effectively with a battery.”

Image: Clean Energy Council

Battery energy storage also allows the time-shifting of excess renewable generation at certain times of day into low-generation, but high-demand periods, “but that actually means again that we have to remember the important role that transmission and grid connections play” she reminded Smart Energy Summit attendees.

“The grid is an unavoidable requirement,” Torgoman said.

Tips and strategies?

Among the remedies to the “financially and psychologically” painful problems of effectively quantifying risks the grid in its current state poses to investors, says Torgoman, is a more transparent process that helps investors and developers understand the limitations and accordingly cost them.

She says the current multi-faceted, multi-party process of grid connection, for example — which puts the onus on investors to understand grid capacity and complex modelling — could be greatly clarified.

She also says that some parts of the process are up for interpretation, and yet there is no third-party to which one can refer a grid connection decision made within AEMO, for review. The result is that investors end up “having this one-way conversation that becomes quite hard”.

The CEC’s Thornton says the reduction in financial commitment to clean energy generation is “a deeply disturbing trend.” Just as countries throughout the world are recognising the need to accelerate their investment in renewable energies, the brakes are being applied to “Australia’s promise as a renewable energy superpower”, he concludes.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

7 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.