From pv magazine Brazil

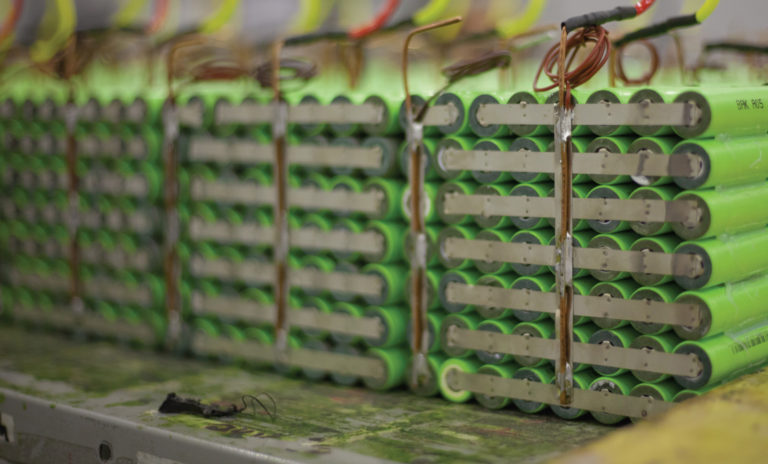

Brazil-based Energy Source is betting on two new business models to boost its revenue in 2021: storage services with reused batteries and the recycling of batteries that have already completed their second life cycles, including the recovery of metals such as cobalt.

The company expects to conclude a financing round by October that will support its “battery-as-a-service” (BaaS) model. The expectation is to raise BRL 12 million ($2.3 million) from existing partners and investors.

“The manufacture of new batteries from batteries that have already gone through a first life cycle started in 2017, and the recycling of batteries at the end of the second cycle began in December 2020,” Energy Source CEO David Noronha told pv magazine.

Up until this year, Energy Source had mainly been selling its products through a partnership with Brazil’s largest PV product distributor, Aldo Solar, which also sells and distributes reused batteries. The idea now is to expand the relationship with end customers, in order to sell the batteries but also to sell storage services, which could include battery replacement. So far, the company has traded 6.5 MWh of second-life batteries and 1.4 MWh of new batteries. The expectation is to reach 10 MWh per month, on average, from 2022.

The company aims to serve the energy backup market, off-grid systems, and hybrid energy systems.

“The investment round is also to make this new commercial model for the company viable,” said Noronha.

To also serve the energy management market, the company has developed a battery monitoring system that can be integrated with technologies other than lithium, including lead-acid batteries.

The software is part of the BaaS model and enables end-to-end monitoring, maintenance, failure prevention, and battery behaviour prediction functions.

“In the end, what we intend is to guarantee the delivery of the contracted energy, that it is available when needed,” said Noronha.

Energy Source is also ramping up its recycling line for batteries that have already passed through their second life cycle at its plant in São João da Boa Vista, in the state of Sao Paulo. It began running a pilot line in December 2020.

So far this year, the recycling plant has already processed 50 tons of batteries. By the end of the year, there will be 300 tons.

“(They) are no longer discarded and are returning to the market as metals used by the industry, such as cobalt and nickel,” said Noronha.

The process, which is carbon neutral, is designed to appeal to people and companies that are interested in the proper disposal of batteries. Automakers Renault and BMW are already Energy Source partners.

The recycling of batteries and the recovery of metals is conducted in two stages, both without associated emissions, as they do not involve the burning of materials. The first stage is carried out at the Energy Source plant itself. It is an electrochemical-mechanical process that produces the so-called “black mass,” which consists of large amounts of lithium, manganese, cobalt and nickel metals. The black mass is then sent to InCasa, a company based in Joinville, which is also located in Sao Paulo, for the second stage. This phase involves the separation and refinement of metals through a hydrometallurgical process. Under this recycling model, the company becomes eligible to issue carbon credits.

This year, it started a certification process led by ACV Brasil, with completion scheduled by 2022. The estimate of preliminary studies is that each ton recycled is equivalent to 5 tons of carbon credits.

“One of our main goals currently has been to capture the batteries,” said Noronha. The batteries collected by Energy Source mainly come from electronics, as well as products such as phones, drones, electric vehicles, electric bicycles, and electric scooters.

The recycled batteries are mainly traded with waste managers, but also with equipment manufacturers. Noronha said partnerships with disposal companies can be designed in different ways.

“Among other variables, it depends on the composition of the batteries, the amount of lithium, iron, phosphate. Batteries with higher concentrations of cobalt tend to be worth more,” he added.

Author: Livia Neves

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.