Australian renewables developer Edify Energy and U.K.-based investor Octopus Group have deployed technology provider Fluence’s artificial intelligence-based Trading Platform to optimise the trading of the 333 MW Darlington Point Solar Farm in south-west New South Wales (NSW).

Darlington Point, jointly owned by Edify and Octopus, is the largest solar farm connected to the National Electricity Market (NEM), with an estimated 1,000,000 solar modules spread over 1,000 hectares and an output equivalent to powering about 115,000 Australian homes.

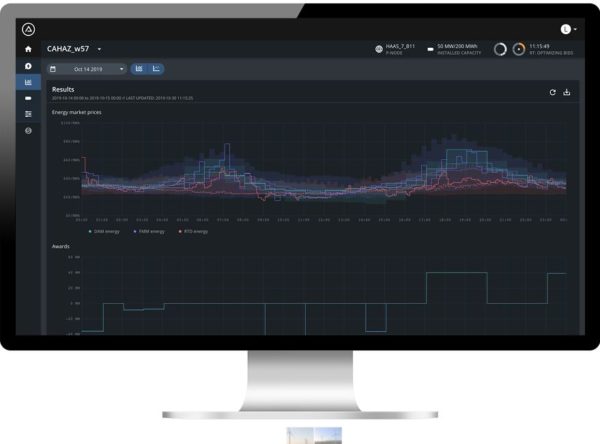

Octopus has confirmed U.S.-based technology provider Fluence’s AI-powered Trading Platform will be deployed to ensure the project maximises generation during favourable market conditions and responds to market price signals to avoid generation at times of over-supply and negative prices.

“We are always striving to find innovative solutions that will improve asset performance for our investors,” Octopus Australia managing director Sam Reynolds said.

“Solutions like this will help maximise revenue and investor returns by reducing price volatility, minimising costs and mitigating constraints.”

Darlington Point has a signed power purchase agreement (PPA) with Delta Electricity, the owner of the Vales Point coal-fired power station, for 150 MW or approximately 55% of its output.

A 100 MW/ 200 MWh lithium-ion battery project is also set to be constructed alongside the solar farm after the statre government earlier this year announced a $3.2 billion 10-year contract with Edify and Shell Energy.

Image: Edify

The Riverina Energy Storage System, to be built by early 2023 and operated by Edify, will provide critical dispatchable electricity prior to the closure of the Liddell Power Station.

Australia’s energy market is among the most complex in the world, with energy and ancillary services requiring assets to trade at five-minute intervals while integrating increasing amounts of variable renewable energy.

Renewable energy generation and battery asset operators in the NEM are having to deal with exposure to negative prices, physical grid constraints, frequency control ancillary services (FCAS) costs, and managing trading strategies.

Fluence chief digital officer Seyed Madaeni said automated bidding solutions are becoming a critical tool for asset owners in the NEM, where renewable energy assets need extremely accurate price forecasting capabilities to navigate “an increasingly volatile market”.

“The deployment of our AI-based trading platform at the largest solar farm in the NEM confirms that automated bidding tools are now firmly established as critical tools for operating renewable assets in the NEM,” he said.

“We’re excited to be supporting Octopus Investments and look forward to helping them navigate price volatility and constraints in an increasingly complex market.”

Image: Fluence

Fluence, the result of a joint venture between U.S. utility AES and global power giant Siemens, said its trading platform analyses thousands of variables to provide leading price forecasting and optimisation using proprietary machine learning algorithms.

The company claims it can increase revenue for standalone renewable energy assets by more than 10% and can increase revenue and operational efficiency for battery-based energy storage by 40-50%.

Fluence said the software-based trading platform is currently used to optimise about 1.5 GW of wind and solar energy assets bidding into the NEM.

The Australian Energy Market Operator (AEMO) has detailed that 30% of grid-scale solar and wind assets in the NEM had started using automated bidding solutions in the past two years.

Edify is among those developers who have embraced the technology, deploying an AI-backed trading platform at all of its projects to help navigate the increasing price volatility and maximize returns in the NEM.

The list of operational solar farms that the Australian developer manages and partly owns includes Daydream (180 MW), Hayman (60 MW), Whitsunday (69 MW), Hamilton (69 MW) and Gannawarra (60 MW).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.