Against the odds, Sydney-based battery company Gelion Technologies believes it’s found a way to manufacture its zinc-bromide solar batteries here in Australia.

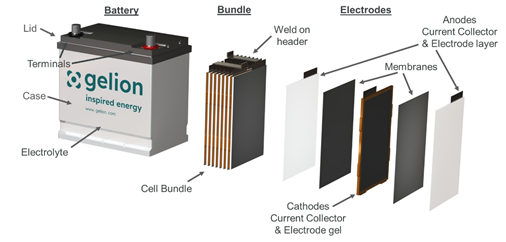

How? Well, put concisely, by completely overhauling its battery design. Gelion recently changed to a lead-acid format so it can leverage existing battery manufacturing capabilities and supply chains as the format’s traditional applications wane.

The first step on this new path, forged during the Covid-19 pandemic, is today’s announcement Gelion has formally entered into a partnership with one of Australia’s two lead-acid battery manufacturers, Battery Energy Power Solutions. The partnership will see Gelion’s redesigned and trademarked non-flow zinc-bromide (ZnBr2) ‘Endure’ batteries produced in Battery Energy’s facility in Fairfield, Sydney.

Gelion Technologies

Gelion’s rise and shift

University of Sydney chemistry professor, Thomas Maschmeyer, founded Gelion in 2015 to commercialise a significant discovery made during his research, for which he won the Prime Minister’s Prize for Innovation in 2020. But while Gelion’s innovative gel solution and subsequent bipolar batteries have indeed enjoyed success in the past years, Professor Maschmeyer said as the company moved toward commercialisation, it became clear its original design would struggle to be viable.

“As an academic, you think the best way… [is the] intellectually most elegant way. But that may not be the best at all from an engineering point of view, or from a commerce, financial, manufacturing point of view. So bringing it out of the lab and into real world manufacturing was a hugely informative journey for us,” Professor Maschmeyer told pv magazine Australia.

The basis of Gelion’s zinc-bromide innovation

In case the reader isn’t familiar with Gelion’s backstory and innovations, the breakthrough which launched Professor Maschmeyer into the battery creation space was his zinc-bromide battery gel. Traditionally, zinc-bromide chemistries have been implemented as flow batteries, which have operational and commercial challenges since they’re costly and complex to produce.

Professor Maschmeyer’s discovery moved Gelion away from flow arrangements, with the professor describing the gel as essentially a 3D flyscreen which holds liquid, permitting chemistry to happen inside it, and thereby allowing the transport of ions to be engineered.

Gelion Technologies

This makeup is quite novel, with only Gelion and U.S. company Eos playing in the non-flow zinc-bromide space – though there are a number of flow battery companies pursuing the chemistry, the most notable of which is Brisbane-based Redflow.

Professor Maschmeyer describes zinc-bromide chemistry as ideal for solar batteries as it’s relatively slow to charge. He’s glad other companies are playing in the space, positing lithium as the real competition – over which he says Gelion’s technology has significant advantages, particularly with regards to safety. Its electrolyte gel is a fire retardant, meaning its batteries can’t catch fire or explode. In fact, they can operate safely at temperatures up to 50°C and can be completely discharged to zero volts with no loss of function, making them “very abuse tolerant”.

Current designs of the individual Endure battery cells are between 200 to 300Wh currently. “This capacity is being fine-tuned as we finalise our production systems,” the company’s CEO Andrew Grimes said. “However, as the Gelion Endure battery is a scalable product, these individual cells are designed to work together to provide capacity ranging from the kilowatt-hour to megawatt-hour scale,” he added.

As it stands, its Endure battery has round-trip-efficiency of 90%, is non-toxic (bromide essentially being just a salty-solution) and the company claims it’s more than 95% recyclable.

These features were refined in Gelion’s initial bipolar format, but when the company began its deep design studies with a global parter (who it is yet to reveal) during the pandemic, it arrived at the conclusion the smartest way to commercialise the Endure battery would be to switch the design to a parallel plate lead-acid format.

Battery format switch

Two things preceded this decision. The first was the complexity of building new manufacturing capability, and second was the fact access to capital for such an endeavour is effectively hamstrung in Australia due to the Clean Energy Finance Corporation’s rules.

“If you want to produce something in a factory here, you need to have a factory reference plant the same size or bigger that has been operating for two years and that allows you to have full emissions data of the factory. That means you can never build a new factory here for new technology because you’ve got to prove it somewhere and you can’t prove it here,” Professor Maschmeyer said.

Gelion Technologies

“If you can hook onto something that already exists, it’s much better,” he added, pointing out that lithium-ion factories largely came from the repurposing of CDs and DVDs factories when tape formats became obsolete. “That’s why it was possible to introduce it so quickly worldwide, because they didn’t have to build everything from scratch.”

“That’s exactly the concept behind us going for a lead-acid format.”

Taking Swedish battery developer Northvolt’s costings, the Gelion team discovered for them to retune an existing lead-acid battery factory for 1 GWh production capability would cost US$16 million (AU$21.7 million). To build a new lithium-ion factory with a 1 GWh capacity, on the other hand, would cost US$125 million (AU$170 million). A game-changing difference.

Hooking on

Lead-acid batteries are today about a $45 billion dollar industry, Professor Maschmeyer estimates. They are ubiquitous around the world, but increasingly under pressure, given electric vehicles (EVs) are quickly replacing petrol and diesel cars globally, for which lead-acid batteries are used. While telecom towers and trains still employ the lead-acid format, Professor Maschmeyer believes this will shift over time, freeing up even more capacity in these manufacturing plants.

“The assets are still there, so we can go in and give them a second life – go from a low-growth to a high-growth business with sunken costs already taken care of,” he said.

“That overcomes one of the main reasons, if not the main reason, for new battery technologies failing – and that is that they’ve got to build their own factories.”

Gelion Technologies

Test manufacturing in these facilities though, Gelion soon realised lead-acid factories worked quite differently to how its battery was designed. “We learned from that we could do things differently and interact much more productively. Rather than having to retune 80% of their line, we could retune 20% of their line [by changing our battery design]. And that makes, of course, a huge difference in cost, in risk, in timing, lead times,” Professor Maschmeyer said.

“And as we now have effectively a lead-acid format, we are using similar kind of membranes, similar kinds of carbons, similar kinds of housing, valves, the whole thing, so supply chains are already there,” he added. “Being able to hook onto existing supply lines, and diverting a little bit of that towards us and then only having a few bespoke pieces reduces the risk a lot and reduces the cost a lot.”

At the moment, Gelion is sourcing its zinc and bromide and other battery materials through existing supply chains, but its aim in future is to source most of its minerals from Australia. “We’ve got ingredients here, they are being mined and processed. So why not do some processing here for battery grade materials?”

Gelion’s Endure zinc-bromide batteries will be deployed in production trials next year ahead of anticipated commercial availability.

Gelion Technologies

Manufacturing model & costs

As you might have guessed, Gelion’s model going forward is not to manufacture its batteries in house, but rather to partner with facilities which have existing capabilities.

“We don’t intend ourself to become a battery manufacturing company. We are a tech developer to get it commercialisation, and we then license to partners,” Professor Maschmeyer said. “We are going overseas but we are also staying local with the same model.”

The company is targeting a commercial product cost of just $100 per kWh, which is highly competitive. Obviously, since cost is hugely dependent on volume, the company’s strategy is to tolerate a loss in its first few years while production scales up.

“We’ve factored that in, so what we will do is have a competitively priced product in the market and at very small scales it will be a lost leader, and as we establish marketshare, we will break even, and then as we get more marketshare, it goes cash flow positive,” Professor Maschmeyer said. He estimates the company should be able to break even and cover its costs by 2023 or 2024, if all goes according to plan.

Gelion is currently doing a capital raise, aiming to raise around $10 million. Given its last raise came in well oversubscribed at $13 million, the company is hopeful. After the raise concludes at the end of this month, the company will decide whether to stay private, or go public.

Gelion Technologies

Rollout horizons

Professor Maschmeyer and the Gelion team are buoyed by the fact Wood Mackenzie’s analysis has Australia representing 8% of the global energy storage investment market. Our island, he pointed out, rarely commands more than 1%, affording us an unusually strong position in the grid connected storage market, which Wood Mac says could be worth US$86 billion (AU$116 billion) globally by 2025.

Back to Gelion specifically, the company has two rollout horizons it plans to target successively. The first horizon is smaller projects, 10 kWh to 1 MWh, which includes stand alone systems, mining, irrigation, and pumping applications.

It then plans to move to 10 MWh+ installations. “Then once we have the capacity to produce a few hundred megawatt hours, we can go into supporting solar farms or wind farms etcetera,” which, Professor Maschmeyer said, is horizon two. It’s aiming to reach that vista towards the end of 2023.

Image: University of Sydney

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It seems time for Gelion to reveal the achieved energy density or at least compare their product to LFP and sodium batteries from CATL, Faradion and Natron.

What is the storage efficiency? i.e. kwh out/kwh in.

The achieved (or achievable) energy density compared with Li Ion will be the sink or swim factor.

So energy density is certainly important for some Battery Use cases I don’t believe it solely defines wether as a solution its good or bad…

Sure if comparing Electric Vehicles then density is probably prime. However for Off Grid or Hybrid Grid connect House Battery situations who, from an end user perspective, really cares if a ZnBr system is 100KG heavier than a LiIon based solution? Especially if in 10 years time your 100Kg heavier system is still capable of producing 100% of its rated output? If the LiIon system is only producing 60% of its rated power at the 10 year such that the average is 80% across its useful life then to compare like for like in terms of useful capacity then is the achieved LiIon energy density really needs to be discounted by 25% to allow for the degradation you’ll see over its useful life.

For me for a house based battery connected to a hybrid inverter that allows discharge to 100% of rated capacity is far more desirable than a Lithium chemistry system that is rated at 13kwhrs but in reality only delivers 10.5kwhr on day 1 of its useful life……

Looks like the zinc-bromine chemistry produces cell voltage up to 1.83 volts and floats towards 1.3 volts under discharge, and energy density is about 120 WH/KG. (google research) LoL!

Hi everyone,

So I sought some clarification from Gelion about the battery’s density. Here is what Gelion CEO Andrew Grimes said:

“Current designs of individual battery cells are about 200 to 300 watt-hours. This capacity is being fine-tuned as we finalise our production systems. However, as the Gelion Endure battery is a scalable product, these individual cells are designed to work together to provide capacity ranging from the kilowatt-hour to megawatt-hour scale.

“Our goal is to build Gelion Endure battery systems capable of supporting large infrastructure projects, including solar and wind farms, that need capacity in the hundreds of megawatt hours.”

I’m interested in 10 kw battery have Large space under house would not consider any other technology sitting there would be interested in power company putting it there distributed power less power losses I have 6.6kw of Solar easily upgraded to probably 20 kw with 5 kw connect already in place 1 mtr high racks perfect easily mass produced Vic government rebates available etc Vic interest free loans available why not you have the right technology for safe distributed systems

Hi John, you may not be able to install a battery under your house according to draft legislation which would require residential energy storage systems to be stored on the exterior of a house, for good reason. I’d say do some research into that before you buy.

Does the gel ion battery allow for quick discharge as required when using an induction cooktop

I assume a typo when in the article it quotes $100 per kilowatt hour

Be interested in pricing for 10 and 20 kWh battery for use in off grid to compare against lithium ion batteries

Hi Bernard,

I can’t answer precisely your query on induction cooktops, but I can confirm the company is indeed targeting $100 per kwh. The Endure batteries aren’t on the market quite yet though, so we’ll have to wait a little longer to confirm if the company manages to pull off that ambitious aim which would make them cheaper than many lithium ion competitors.

Quote “ is non-toxic (bromide essentially being just a salty-solution)”. Bromide is a poison. If you imbibe it, it can lead to serious neurological effects. Although not as poisonous as Sodium Cyanide or Potassium Cyanide, it’s wise to remember they are “just salts” as well.

Hi John, thanks for your comment! I don’t think anyone at Gelion or elsewhere is suggesting bromide is non-toxic for human consumption but rather non-toxic in terms of environmental impacts and if humans encounter the substance – which for many battery chemistries is certainly not the case.