From pv magazine Global.

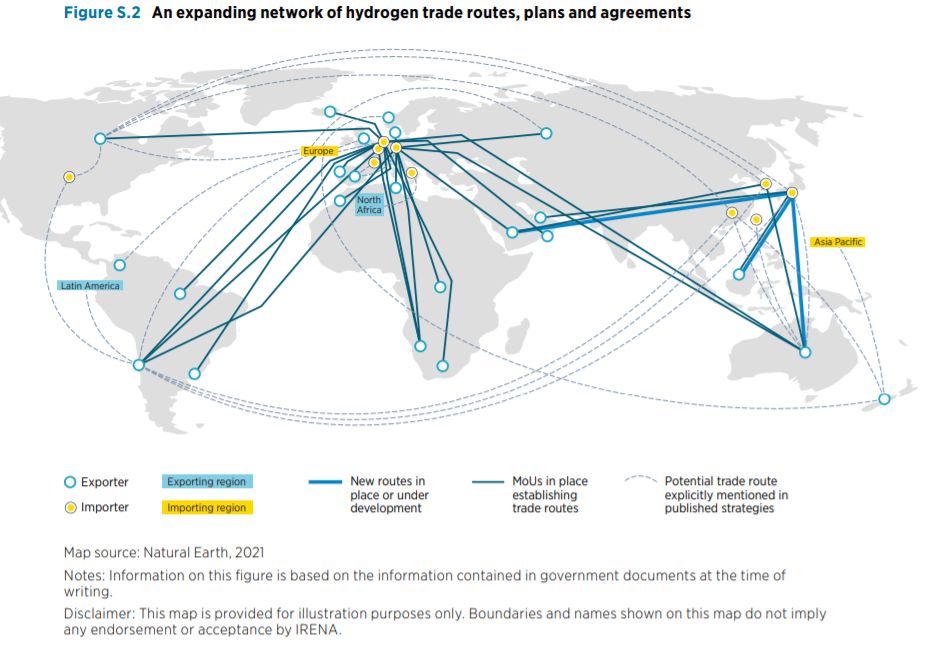

Rapid growth of the global hydrogen economy can bring significant geoeconomic and geopolitical shifts disrupting global trade and bilateral energy relations, according to the International Renewable Energy Agency (IRENA). Already today, over 30 countries and regions are planning for active commerce heralding a considerable growth in cross-border hydrogen trade.

The agency estimates that over 30% of hydrogen could be traded across borders by 2050, a higher share than natural gas today. According to its latest analysis Geopolitics of the Energy Transformation: The Hydrogen Factor, hydrogen is set to change the geography of energy trade and regionalise energy relations, with the emergence of new centres of geopolitical influence built on the production and use of hydrogen, as traditional oil and gas trade declines.

Net energy importers such as Chile, Morocco, and Namibia are emerging as green hydrogen exporters while fossil fuel exporters, such as Australia, Oman, Saudi Arabia, and the UAE, are increasingly considering clean hydrogen to diversify their economies. Some countries that expect to be importers are already deploying dedicated hydrogen diplomacy such as Japan and Germany.

“As more players and new classes of net importers and exporters emerge on the world stage, hydrogen trade is unlikely to become weaponised and cartelised, in contrast to the geopolitical influence of oil and gas,” IRENA says. However, the hydrogen business will be more competitive and less lucrative than oil and gas.

According to IRENA, hydrogen is set to cover up to 12% of global energy use by 2050, driven by the climate urgency and countries’ commitments to net zero. “Hydrogen is clearly riding on the renewable energy revolution with green hydrogen emerging as a game changer for achieving climate neutrality without compromising industrial growth and social development,” says Francesco La Camera, director-general of IRENA. “But hydrogen is not a new oil. And the transition is not a fuel replacement but a shift to a new system with political, technical, environmental, and economic disruptions.”

In terms of the supply-demand ratio, the technical potential for hydrogen production significantly exceeds the estimated global demand. Therefore, realising the potential of regions like Africa, the Americas, the Middle East, and Oceania could limit the risk of export concentration, but many countries will need technology transfers, infrastructure, and investment at scale, IRENA says.

The report sees the 2020s as a big race for technology leadership, as costs are likely to fall sharply with learning and scaling-up of needed infrastructure. But demand is expected to only take off in the mid-2030s. By that time, green hydrogen will cost-compete with fossil-fuel hydrogen globally, according to IRENA, and this is poised to happen even earlier in countries like China, Brazil, and India. Green hydrogen was already affordable in Europe during the 2021 spike in natural gas prices.

Further, the manufacturing of equipment like electrolysers and fuel cells could drive business in the coming years. In fact, estimates point to a $50-60 billion market potential for electrolysers and a $21-25 billion market for fuel cells by the middle of the century. China, Japan and Europe have already developed a head start in the production, IRENA notes, but innovation and emerging technologies will shape the current manufacturing landscape further.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

First it was getting Oil from “far away” because it was available in a few places only…

Now “Foreign Trade Addicts” want to replace Oil Tankers with Hydrogen produced from Solar Energy (??) … or we going to continue with our pollution addiction and make it from Fossil/Polluting Fuels all over again… ???

If Hydrogen is “Green” from Solar Energy… this makes NO SENSE .. as Solar Energy is available ALL OVER THE GLOBE in abundance …. and Hydrogen can then be made “locally”… what is the need to ship (the dangerous and explosive) Hydrogen at all… Would you ship Oil to Saudi Arabia where it is in abundance… ???