From pv magazine 01/2022

Green hydrogen is the new cure-all of the energy transition; either a wonder drug or snake oil, depending on who you’re speaking to, and the potential use. Green hydrogen is a prospective zero-carbon solution for a wide variety of applications, including iron and steelmaking, ground transport, long-duration dispatchable power, fertilisers, and more.

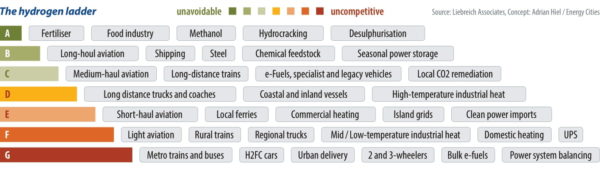

Cost, efficiency, and competing options for decarbonisation are key considerations for these uses. In some applications, the market is more mature compared to others where hydrogen may ultimately be the best solution but may take time to play out. Additionally, there are geographical distinctions in the applications for hydrogen, driven in large part by the policy choices of nations.

Thankfully, this is no longer a theoretical conversation. Electrolysers are being ordered and shipped, now.

Green steel

The application that has attracted the most attention in the last few years is steel. Inspired by the success of the Hybrit consortium’s production of fossil-free iron in northern Sweden, a new “green steel” industry is rapidly emerging. The H2 Green Steel consortium and Iberdrola have announced plans for a €2.3 billion (AU$3.7 billion) hydrogen-based iron plant in either Spain or Portugal.

Hybrit and other projects have shown that the process of using hydrogen as a “reducing” agent to separate the oxygen from iron in iron ore is eminently practical – if you have inexpensive renewable power and local ore. After all, demand is available, particularly among auto and truck makers. Mercedes Benz, Scania, and Volvo have all lined up to buy “green steel,” despite its higher cost.

Another consideration is that there isn’t another mature technology ready today to decarbonise primary steel production, and iron and steel making comprise 7% to 8% of global emissions. Boston Metals is championing the rival molten oxide electrolysis process, but it won’t even get to “semi-industrial validation” until this year or next. A pilot plant is even further away, and if its process does successfully emerge, it will have catching up to do. “We see hydrogen as being the lowest-cost way to produce net-zero steel globally by 2050,” explains Meredith Annex of BloombergNEF.

Annex says BloombergNEF is tracking 20 different green steel projects, including multiple phases. Many of these are pilot projects, however in the three full-scale commercial plants planned in Northern Sweden and the Iberian Peninsula, pv magazine has counted 2.4GW of electrolysers.

Including these plants, 19 of the 20 green steel projects being tracked by BloombergNEF are in Europe. But Europe is not the ultimate prize, as the continent has fallen in recent years to less than 10% of global steel production. A more telling sign is that China’s Hebei Iron and Steel is also building a hydrogen-based direct reduction project. “We do expect to see [green steel] projects in China,” notes Annex.

There remains a big question about what will happen with the world’s fleet of existing blast furnaces, which burn high purity coal to reduce the iron. Analysis by Agora Energiewende shows that 71% of global blast furnace capacity is scheduled for upgrades or replacement this century, and that this could be a good time for incumbents to move to hydrogen-based direct reduction.

If they don’t, others may take the opportunity. “Startups will push the incumbents towards this technology if they don’t already do it,” notes Abhinav Bhaskar, the product manager for hydrogen at consultancy Rystad Energy.

Power sector

Another area with significant demand for green hydrogen is the power sector, where it can provide the long-duration, dispatchable power needed in grids with high portions of renewable energy. “When it comes to long-duration storage, there really is no technology that could do the job better than hydrogen,” argues Gniewomir Flis, hydrogen expert at Agora Energiewende.

Modelling done by Tim Grejtak, senior innovation analyst at US utility ConEdison, confirms this. While Grejtak finds that novel battery technologies may be more cost effective for use cases of 100 hours or less, for longer durations H2 is the clear winner. “It’s going to come down to what the electricity markets favour,” notes Grejtak.

So far, the preference has been for hydrogen. As of July, BloombergNEF reported 14.8GW of projects to burn hydrogen to power turbines for the power sector. 43% of this capacity is in the United States, with significant demand in Canada, the United Kingdom and Europe.

But while turbine makers, including GE, offer some turbines that can run on 100% hydrogen today – and others that can handle mixes above 80% – most of these will initially use blends. “A lot of them are still figuring out what their schedules are for blending,” notes Annex. Additionally, it is not clear that this capacity will run on green hydrogen, as the US also plans to support “blue” hydrogen – hydrogen made from methane with carbon capture and storage – as well as “pink” hydrogen, made using electrolysis powered by nuclear energy.

And this solution may not be the best option in all cases. Both Grejtak and Flis note that conversion of existing gas plants to run on green hydrogen saves a lot of money compared to other long-duration storage options – if the circumstances are right.

“Making a gas asset H2 compatible is not just about replacing a burner in a turbine,” explains Flis. He notes that if geological storage in salt caverns for hydrogen is available – as it is at the Intermountain Power Plant in Utah – then converting a gas plant to run on hydrogen makes sense. But it may not if you need to install special tanks to store enough hydrogen for continual operation.

Both the United States and Europe have a lot of these caverns. However, Flis notes other less fortunate regions may be forced to utilise different solutions for flexible power and long-duration storage.

Refining and ammonia

Beyond steel and electricity generation, there are several “no-regrets” applications where green hydrogen could replace existing hydrogen production, most of which is from the steam methane reforming process. In 2020, oil refining was the largest source of hydrogen demand globally – and the sector with the largest number of green hydrogen projects tracked by BloombergNEF, at 23.

BloombergNEF’s Annex attributes much of this to corporate emissions reductions goals, with EU regulations anticipated under the REDII program. And while the United States is contemplating a tax credit in the Build Back Better legislation before the Senate, she sees slower progress in this market. “European players have stronger targets,” explains Annex. “US players are still catching up.”

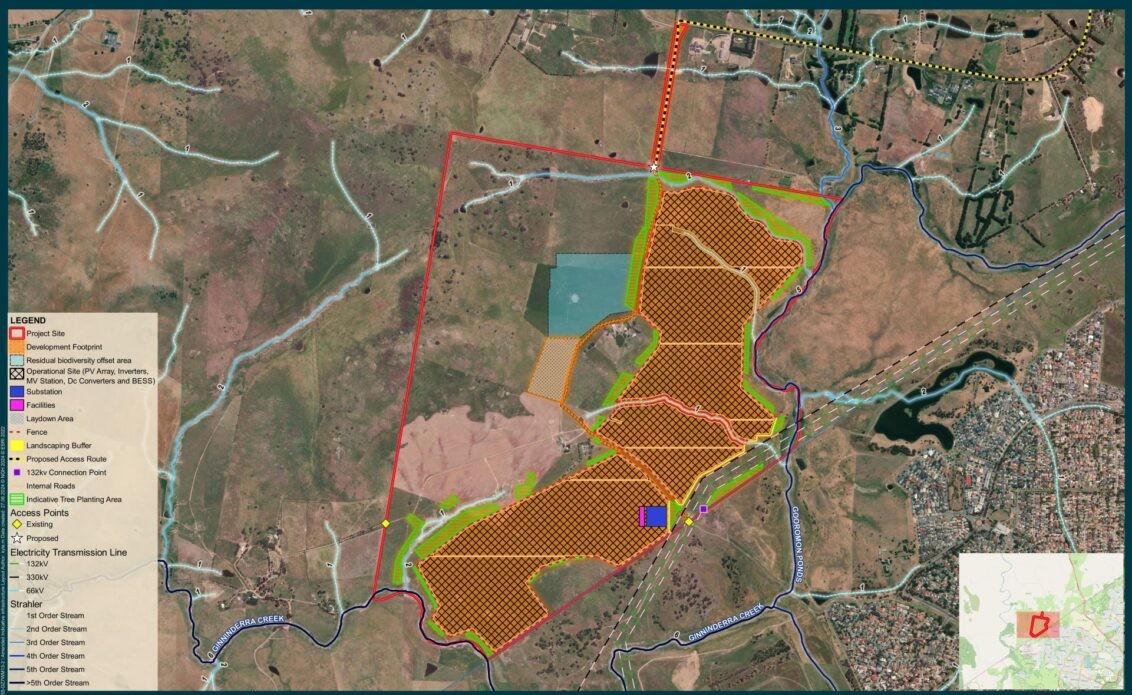

Meanwhile, ammonia is the second-largest source of current demand for hydrogen and has the second-largest number of green hydrogen projects underway. This includes three massive projects that Norwegian fertiliser maker Yara is planning with partners in Norway, the Netherlands, and Australia.

And while fertiliser is currently the largest source of ammonia demand, there is the promise that ammonia can be a carrier for green hydrogen. Already Japan has begun importing ammonia made with “blue” hydrogen from Saudi Arabia to co-fire in coal power plants. The potential for demand from not only these uses but also as a fuel for shipping has led to large “green ammonia” projects to be announced in Australia, Chile, Ireland, Saudi Arabia, and Spain.

In fact, BNEF’s Annex notes that most of the ammonia projects that are being announced are for export, not for on-site fertilizer production. She adds that green ammonia for export “is happening earlier than we thought it was going to.”

Options, dead ends

There are multiple promising emerging applications for hydrogen. Notably, batteries aren’t practical for long-distance shipping and aviation. The net-zero pathways for the global shipping industry are focused on using either methanol or ammonia as fuel, either of which would be derived from carbon-free hydrogen production. In aviation, a recent deal between Alaska Airlines and ZeroAvia suggests that commercial hydrogen-powered aircraft could be transporting passengers as soon as 2024.

Other applications are more dubious. While gas utilities have widely promoted blending of H2 in their gas networks, heat pumps use energy inputs much more efficiently; a report by Energy Transitions Commission estimates a 5x efficiency gain.

Another more questionable application is personal vehicles. While makers of fuel cell electric vehicles (FCEV) promote the superior range and claim other technical advantages, they have clearly lost out to battery electric vehicles (BEV) in the market. Currently there are more than 100 BEVs on the road globally for every FCEV. As time goes on, the bar for FCEV to catch up gets higher and higher. There may be more potential for FCEV in heavy trucks and other long-distance road transport.

There are strong reasons for governments to take an active role in prioritising specific uses of hydrogen in support programs. Electrolysers will consume an enormous amount of power as the world decarbonises steel, ammonia, shipping, and potentially portions of transport. Global economies may be hard pressed to put enough renewables online to both rapidly decarbonise and supply hydrogen.

Many analysts and advocates see this coming and are pushing for hydrogen to be used where it is most needed and most efficient, and not towards use cases where electricity can serve better.

However, as hydrogen is emerging as the new darling of the oil and gas industry, there is a real danger that these less useful applications will be prioritised. This is particularly a risk in nations where the oil and gas industry holds substantial political power, such as the United States.

Author: Christian Roselund

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

All very sensible; however, I like the idea of electrolytic reduction of iron ore to produce steel. This is similar to aluminum production and makes more sense than producing hydrogen to chemically reduce iron ore.