On Friday the Australian Energy Market Operator (AEMO) released its latest Input, Assumptions and Scenarios Report (IASR) putting a likely new scaled-up solar scenario into play that would see Australia become a Hydrogen Superpower.

The IASR is about developing a range of plausible futures for growth in Australia’s energy demand, and how each would be met, thereby helping investors and policymakers make informed decisions on investment in generation, storage and transmission.

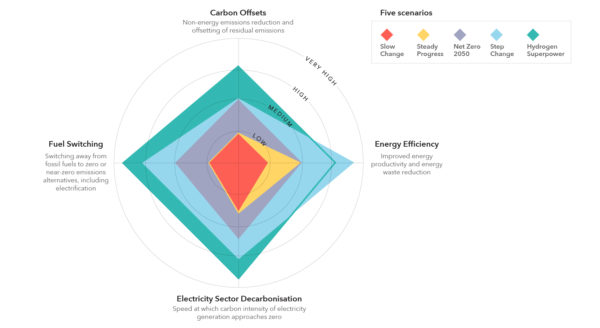

options broadly fall under four pillars of decarbonisation.

Image: AEMO

This year’s IASR was developed over a 10-month period of intense collaboration and consultation with industry participants, state and federal governments and consumer representatives.

In response to stakeholder requests for greater transparency and accuracy, it includes two new sections: a Transmission Cost Report and a Transmission Cost Database which outlines costs and risks and is accompanied by a cost estimation tool.

AEMO also received overwhelming demand from stakeholders, that the scenarios “reflect the observed rapid decarbonisation of the energy sector and pathways to achieve net-zero emissions across the economy,” said Alex Wonhas, AEMO’s Chief System Design Officer.

New scenarios to inspire investment

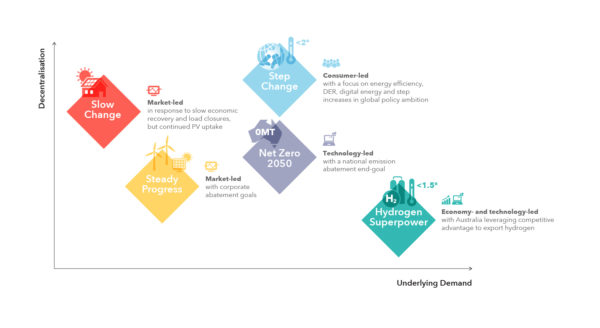

The observed uptick in momentum of the energy transition has led AEMO to add two central scenarios, that replace the single Central Scenario of the 2020 IASR.

The Steady Progress scenario maps out decarbonisation as driven by “existing government policy, corporate abatement goals and continued growth in PV uptake”, said Wonhas in a statement accompanying the report’s release.

The Net Zero scenario is based on accelerating technology-led emission abatement, driven by extensive research and development, and “progressive tightening” of emission targets by state and local governments and private enterprise to achieve net-zero by 2050.

Then there’s the new Hydrogen Superpower Scenario, which says Wonhas, emerged from the surge of government and business momentum to develop a renewable hydrogen export economy, and describes a power system needed to support that ambition.

Distributed PV forecasts revised upwards

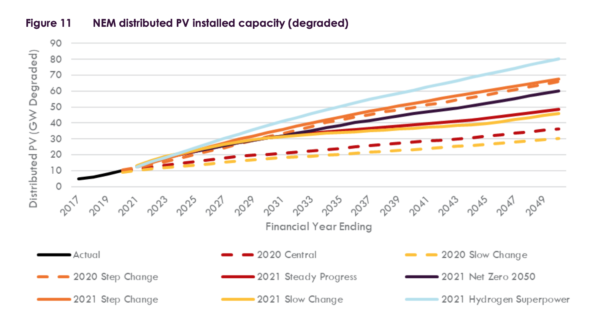

Each of the five refined or new scenarios sees a steady increase in distributed solar PV installation across the National Electricity Market (NEM) to 2050, and indeed a significant increase over forecasts made in the 2020 IASR.

The energy consumer response to COVID-19 — the “pandemic has seen household consumers redirecting discretionary income into assets that reduce their exposure to energy costs” — is part of growing consumer uptake of solar whatever the prevailing motivation to curb emissions.

Interestingly, the Hydrogen Superpower scenario shows the highest uptake in rooftop solar by households and businesses, with a forecast 50 GW installed by around 2035, and 80 GW by 2050, which in part may reflect a more enthusiastic, coordinated Zeitgeist under a scenario that strives to accelerate the postitive impacts of deploying renewables.

Even the relatively gloomy Slow Change scenario, which assumes a challenging economic environment in the wake of the COVID pandemic accompanied by greater risk of industrial load closures, sees consumers “proactively managing energy costs through continued investments in DER”, particularly PV. The 2021 IASR revises its 2035 forecast for DER under the Slow Change scenario up from 20 GW in 2020 to 35 GW; and by 2050 DER will have increased to around 47 GW (the 2020 IASR had it estimated at a mere 30 GW).

In the small-scale sector, AEMO also “assumes a rebound of energy consumption equal to 20% of the energy generated by the PV systems as lower future bills may change consumption behaviour or trigger investments in equipment that uses more electricity” (as opposed to, say, natural gas), says the report.

Solar generation writ large

With solar PV and wind generation continuing to provide the lowest cost generation of renewable energy, these energy sources feature in the High Variable Renewable Energy scenarios, Step Change and Hydrogen Superpower.

Step Change, however, is characterised as a “consumer-led change with focus on energy efficiency, DER, digitalisation and step increases in global emissions policy ambition”.

Relative to the Net Zero 2050 scenario, Step Change is driven by faster decarbonisation ambitions to achieve control of climate temperature increase; and supported by “rapidly falling costs for battery storage and VRE, which drive consumers’ actions and higher levels of electrification of other sectors”, says the report.

It adds, that “changes in building design, smart appliances, and digitalisation” will help consumers manage their energy use.

This scenario also assumes a limited amount of hydrogen production connected to the NEM, and that Australia’s hydrogen ambitions are likely realised off grid, without impacting investment in or operation of the NEM.

The Hydrogen Superpower fed from the NEM

Under the Hydrogen Superpower scenario, however, “Both domestic and export hydrogen demand are fuelled, at least in part, by NEM-connected electrolysis powered by additional VRE development,” envisages the IASR.

These capabilities will be driven by strong global impetus to tackle climate change and reduce emissions. AEMO posits that in this scenario, “as part of commensurate global action, Australia targets net zero emissions before 2050”.

An immense amount of considered research and data analysis is contained within the IASR, encompassing all aspects of integrated energy supply and demand, from the predicted charging behaviour around increasing numbers of battery electric vehicles under each scenario; to comparative locational costs envisaged for developing new generation; and the contribution and limits of generation within renewable energy zones (REZs).

The IASR’s 2021 iteration will inform AEMO’s 2021 Electricity Statement of Opportunities published later this year, its 2022 Gas Statement of Opportunities, scheduled for March, and AEMO’s updated 20-year outlook for the NEM — the 2022 Integrated System Plan, to be published mid next year.

Image: AEMO

Which scenario will we shoot for?

Mapping out scenarios, explains this IASR, “is an effective practice to manage investment and business risks when planning in highly uncertain environments, particularly through disruptive transitions”.

The future for solar PV looks bright under every scenario, however, the contribution that solar-rich Australia can make towards abating emissions and climate change, as opposed to simply reducing energy costs of local consumers varies vastly.

For the layperson, for governments, investors and industry, clearly articulated scenarios also clarify the characteristics of what to avoid at all costs, and what to shoot for.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.