Australian tech billionaire Mike Cannon-Brookes’ firm Grok Ventures has become the single largest shareholder in AGL after this week settling an 11.28% stake in the public company worth $650 million with financial services company JP Morgan. The trade gives Cannon-Brookes, who is waging a public campaign to stop the demerger, voting rights over the shares ahead of a scheduled June 15 vote.

Cannon-Brookes had gained the initial stake in AGL earlier this month after Grok Ventures, the private investment company he owns with wife Annie, had failed in an earlier $3.8 billion takeover attempt with Canadian investment firm Brookfield Asset Management.

The initial stake was in a derivative that meant the shareholders of the borrowed stock could “recall” it at short notice. Grok said in a statement it had instructed JP Morgan to carry out a series of trades on Tuesday to “simplify” its interest in AGL by converting them into physical shares. Grok now owns the shares.

“Grok has now invested approximately $650 million to build its relevant interest of 11.28% in AGL shares, with close to $600 million funded with cash and the remainder with debt,” a Grok spokesperson said.

“Only 1.21% remains subject to JPM’s right to recall shares under stock borrow arrangements in certain circumstances. At this point in time, JPM has not recalled any shares.

“Grok is confident that they will be able to vote the full 11.28% at the relevant time, against the demerger.”

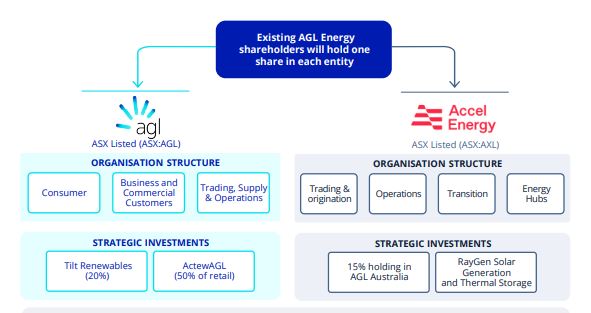

AGL is planning to split into two separate entities – green energy retailer AGL Australia and generator Accel Energy which will control the existing coal-fired assets, including the Loy Yang A power station in Victoria, and the Liddell and Bayswater power stations in New South Wales.

AGL said moving forward as two independently listed companies would give the retail business and the generator business the individual freedom to pursue their own agendas, and the board remains committed to delivering on the proposed demerger which will be put to a shareholder vote next month.

Cannon-Brookes wrote to all 150,000 AGL shareholders on Monday, labelling AGL’s plan “flawed” and said he would vote his shares against the demerger.

The tech billionaire said the merger proposal “confirms the board’s lack of leadership and a strategy that misses one of Australia’s biggest economic opportunities, decarbonisation”.

“We believe this is a deeply flawed plan that will deliver a terrible outcome for AGL shareholders, workers, customers, Australian taxpayers and the planet,” he wrote.

Image: Atlassian

To go ahead, AGL’s plan requires approval from 75% of the votes cast. With Cannon-Brookes holding 11.28% of the shares, only a further 14% would need to oppose the split in order for the demerger plan to be blocked.

Cannon-Brooks’ stance appears to have already attracted the support of some, including Australian pension fund HESTA, which owns a 0.36% stake in AGL.

HESTA has indicated it is “unlikely to support” the demerger unless AGL sets a clear strategy to invest in renewables and storage and “strong commitments” to close coal-fired power plants earlier than currently proposed.

AGL announced it February it would bring forward the planned closure of the Bayswater black coal plant to “no later than 2033” and Loy Yang A power station in Victoria to 2045. The Liddell power plant is scheduled to close in April 2023.

The shareholder’s vote on AGL’s proposed demerger is scheduled for June 15.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.