The AGL takeover saga continues, though the solo Mike Cannon-Brookes is this time approaching from a new angle. With his investment firm Grok Ventures now AGL’s largest single shareholder, Cannon-Brookes is seeking to block the company demerger at the upcoming shareholder meeting on June 15.

The demerger is cornerstone of AGL’s new corporate strategy, so stopping it could seriously disrupt Australia’s largest “gentailer” and presumably put Cannon-Brookes’ vision of a complete takeover for the purposed of decarbonisation once again on the table.

Grok Ventures has now launched a website Keep it together Australia to “actively encourage” AGL shareholders to also block the demerger which it says will threaten the company’s transition, noting AGL’s emissions alone are more than those from Sweden, New Zealand or Portugal.

Image: Greenpeace

Given Cannon-Brookes now owns almost half of the 25% stake needed to derail the demerger, it appears the play is well within the realms of possibility.

It is made all the more feasible given in September last year, 55% of AGL shareholders voted for the company to adopt Paris-aligned climate targets in what was reportedly the largest ever contested resolution in Australian corporate history.

AGL has been slow to transition and its stock price has reflected the growing disquiet, having lost 73% of its value over the past five years. No institutional investors held more than a 4% stake in AGL until yesterday.

How we got here

In February, Mike Cannon-Brookes and then partner Brookfield Asset Management, a Canadian investment giant, put in a bid to takeover AGL. Their stated plan was to take control of the 185-year-old company, close its substantial coal fleet and replace it with billions of dollars worth of renewables by 2030.

Cannon-Brookes claimed it would be the world’s largest single decarbonisation project – a staggering call, but one backed up by Tim Buckley, director of Climate Energy Finance, who previously told pv magazine the play would cumulatively avoid 289 million tonnes of CO2 emissions.

AGL promptly rejected the takeover bid, as well as a subsequent bid made by the duo in March. Following the rejection, Cannon-Brookes and Brookfield announced it would be “pens down” – though both alluded to continued interest.

Plan to foil ‘destructive’ demerger

This brings us back to today’s news of Cannon-Brookes’ campaign to foil the AGL demerger, which he has repeatedly labelled as “value destructive.”

On the new website, Grok Ventures spells out the three primary reasons why the demerger is a bad strategy. The first is that it will destroy shareholder value, primarily because AGL would no longer hold unified control of the generation and distribution assets, making decarbonisation trickier.

Secondly, Grok Ventures said Accel Energy, the proposed name for the future ‘demerged’ coal carry asset, will not be a viable, standalone public company. This view is widely shared among analysts pv magazine Australia has spoken to, with Buckley likening the plan to cutting the Titanic in half in the hopes one side would float. Moreover, it is believed the company would struggle to pay for the remediation of its polluted sites, as the tide of finance has rapidly turned against fossil companies.

Finally, the letter says the demerger would be “globally irresponsible” as it will “entrench a position that is inconsistent with limiting climate change.”

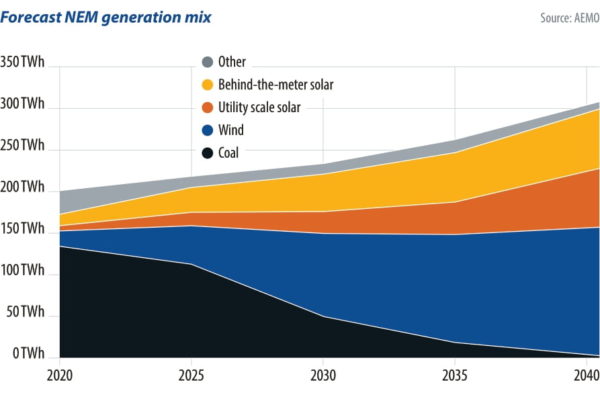

AGL is Australia’s largest polluter, and generates around 20% of the electricity traded in Australia’s National Electricity Market, primarily from coal. The company also supplies almost one-third of the country’s households – the main reason, it has been suggested, Cannon-Brookes is so eager to takeover the company.

The news comes just hours after AGL announced a failure at one of the units at its Loy Yang A coal power station in Victoria could cost it around $73 million. The failure has led the company to downgrade its profit expectations, with the unit potentially remaining offline for months.

“Sweating old coal plants which are expensive to run, and increasingly breakdown like we’re seeing today with Loy Yang A is not economical or responsible. It makes no sense…or cents,” Cannon-Brookes said in a statement.

AGL is also currently in the process of shutting down one of its other major coal stations, Liddell in New South Wales, in line with a plan made some years ago by the company’s dramatically ousted boss Andy Vesey.

Image: AGL Energy

This news will no doubt generate much attention in the fortnight before Australians head to the polls in the culmination of an election campaign where energy and climate policy were among the hottest issues.

This political turmoil comes on the backdrop of massive electricity cost increases in the eastern states which have seen wholesale prices in the NEM increased 141% in the past year – and 67% in the last three months. While the price hikes are largely to do with the deterioration of coal, it has reflected badly on the renewable energy sector with mass media often pointing to the energy transition as the price spike culprit.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.