Launched earlier this year, Wollongong-based startup Green Gravity is turning to the former cornerstone of Australia’s wealth, coal mining, to “evaporate” the final hurdle for a fully renewable electricity system. It is proposing to lift and release ultra heavy weights in legacy mine shafts, its reimagining of how the universal force of attraction, gravity, can be used to store renewable energy.

In all likelihood, this isn’t the first you’re hearing of gravitational energy storage, but Green Gravity’s founder and CEO Mark Swinnerton is adamant his company has distinct merits, many of which stem from the fact its concept is rooted in redeploying abandoned but very abundant infrastructure, lowering both the capital and environmental outlay of the projects.

Energy Vault

In recent weeks, Green Gravity completed its first formal capital raise from a range of private investors, which saw it secure $1.4 million “with plenty of surplus interest,” Swinnerton told pv magazine Australia.

“We are working toward a larger raise in a few months time when we firm up the capital cost for the demonstration plant,” Swinnerton said, adding that he has been engaging with bigger funds and received strong interest. (Energy Vault attracted investment from Leonardo DiCaprio, among other big names.)

Green Gravity’s new staff, which include Phil Moody, Origin’s former Chief of Transformation, have also began studies of the company’s supply chain and manufacturing footprint design. Something Swinnerton, who spent almost two decades at mining giant BHP, insists will be far more simple than other storage solutions with minimal inputs and low levels of processing.

“We don’t have to go and mine the lithium, or process it with new systems, we don’t have the recycle the chemicals because we don’t have any chemicals,” Swinnerton said.

“People ask sometimes, ‘why suddenly are you able to find something so simple and yet it’s an open market?’ and my answer is, ‘it’s really because it’s never been needed before.’”

“The only reason it’s needed now is because renewable penetration has increased past an inflection point where now all of a sudden natural hedging doesn’t work in the market, you need more storage assets.”

The technology proposition

Green Gravity’s technology is flexible in two keys ways, according to Swinnerton. “The first one is the power of the system is associated with how fast we move the weights through the mine shafts. Of course a motor can go at different speeds, therefore we can elect to change the duration and ratings of that dynamically, if we need to.”

“Which is unusual – most energy systems can’t change their duration dynamically,” Swinnerton said.

Mark Swinnerton

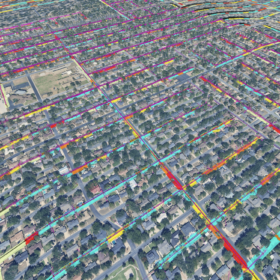

How the company plans to be do this is using advanced software and artificial intelligence (AI).

“What we’re going to be doing is move multiple objects around without being able to see them. So the AI is going to be able to help improve the responsiveness of the sensing systems, to be able to learn how to optimise the movement, and how to better respond to the needs of electricity grid in real time to be able to learn how to make our system match and support the grid,” Swinnerton said.

“We’re looking at models that can provide inertia potentially, we’re looking at models which can certainly play in the grid stability and the variety of frequency and voltage markets.”

“We’re also designed to have multiple durations and we think these deep mine shafts [which can be double the height of the Sydney tower in depth] have a real opportunity for mid or long duration storage.”

Green Gravity is ultimately seeking to bring a range of storage products to market. The first, Swinnerton said, will offer between two to three hours of duration, but he says there’s potential for shorter duration which focuses on grid support as well as a long duration model.

Reuse cutting capital cost

The second realm where Green Gravity can offer flexibility, Swinnerton says, comes back to the infrastructure it will be using. “Because we can use infrastructure that is already there, we can get a very low cost footprint.”

“We can attach the capacity in at similar unit costs to pumped hydro, but for a lot less capital.”

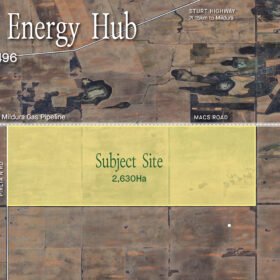

Image: ARENA

“So you don’t have to pay $700 million dollars like you do in some of the big pumped schemes. You just say, ‘well, we’ll pay $30 million’. You’ll get less energy, but you’ll get a similar unit cost outcome to the pumped hydro and there’s lots of them.”

That is to say, Green Gravity isn’t seeking to do one big project, but rather lots of littler ones – a model which lowers risks and affords greater financing flexibility.

‘If you look, there’s really sites everywhere’

Which brings us to another important facet of the proposition: Australia is littered with mine shafts. “Australia’s mining history was everywhere,” Swinnerton said.

The company has discovered at least 3 GWh of potential storage capacity from the 175 sites it has assessed and found to be suitable. “I can guarantee you unequivocally that there is more than that available – and that’s just in Australia.”

“There are many, many gigawatt hours that are up for grabs in the rest of the world that Australia should be looking at.”

Offering income streams for rehabilitation

Swinnerton thinks the Green Gravity’s concept will also offer legacy mine sites a valuable exchange, providing them with an income stream to fund their rehabilitation.

Again, this is a fairly straightforward concept: Green Gravity would come in and reuse the site’s shafts and possibly other infrastructure, providing mines which are no longer selling product with a constant trickle of cash to restore the sites. This would be especially useful for mine sites owned by government, for which taxpayers need to foot the rehab bill.

Promising climate

This weekend’s ‘greenslide’ election, coupled with the ongoing fight to secure battery materials has only boosted Green Gravity’s prospects, according to Swinnerton. “I think there is a real chance of an acceleration and am certainly keen to engage with the incoming government around this point,” he said.

The company is also in the final stages of settling a significant operating partnership, with an announcement anticipated in the coming weeks.

Image: Facebook

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I’d love to see this stuff work, but the basic physics worries me.

For hydro, to get 1 kWh of electricity you need 1,000 l of water to drop 400m.

Same applies to solid weights.

So you need a 1,000 tonne weight dropping 400m for a 1 MWh gravity battery, or less weight for a longer drop

The article mentions 3GWh potential

Which would be 3,000 of these suckers.

Something seems a bit overblown to me ????